Research & Whitepapers

View a historical analysis of how micro-cap equity returns are distributed over time. (2017)

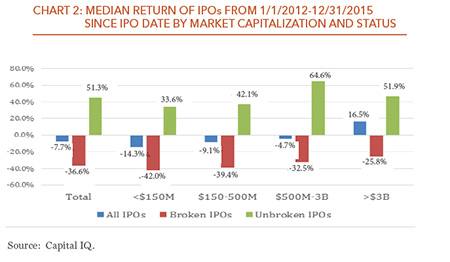

With the proper approach and analysis, IPOs represent a sound investment. Looking at IPOs by market capitalization and industry segment helps to narrow and focus the decision about whether a given IPO makes sense. (2016)

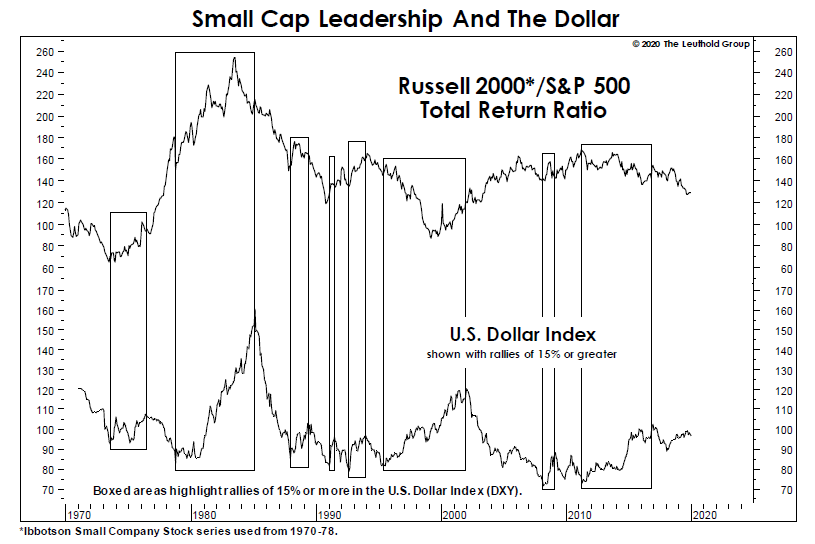

With a continued run of a strong dollar, will money begin flowing back into Small-Cap stocks? We look at the reasons why this may just happen. (2015)

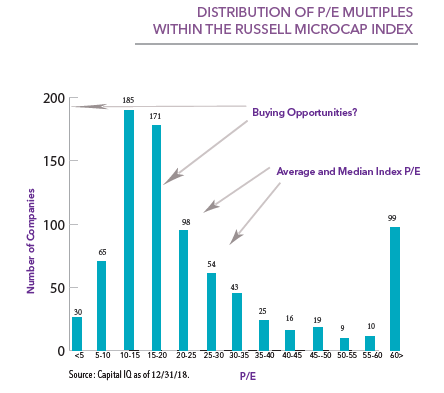

Evidence that an accurate assessment of valuation for the micro-cap asset class requires a deeper analysis of the index (2013)

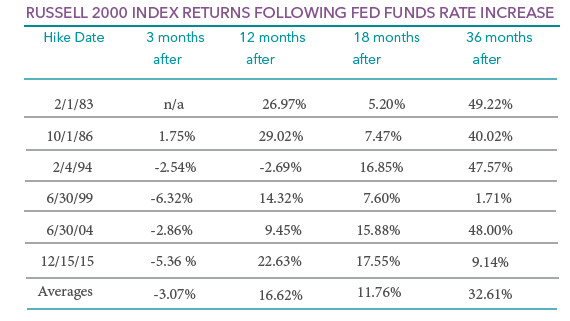

Learn how small cap stocks have performed following previous hikes in interest rates. (2013)

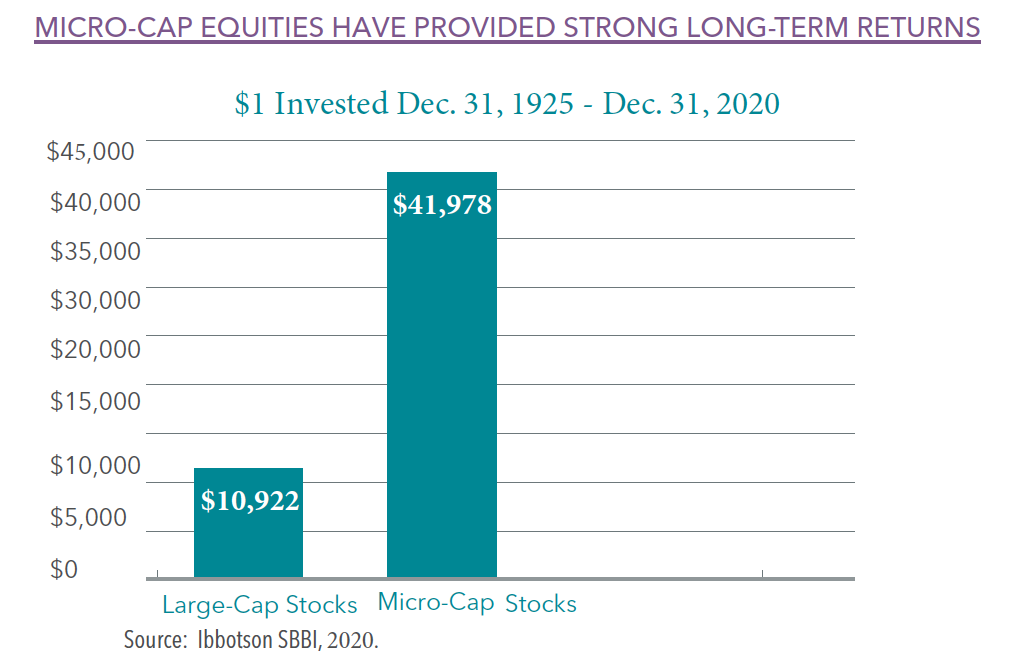

Perritt Capital Management Founder Dr. Gerald W. Perritt’s white paper on The Micro-Cap Advantage. (2013)

An analysis of how higher inflation expectations have affected risk-assets in the new, zero-bound interest rate environment. (2013)