From the desk of…

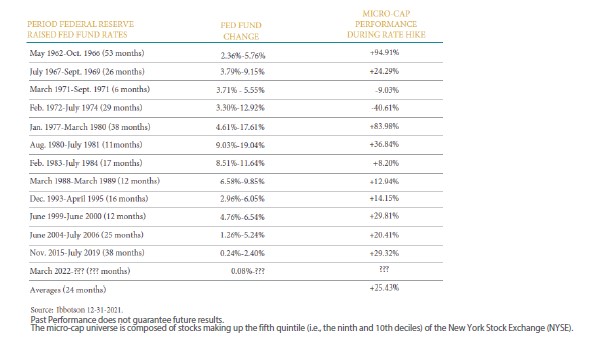

Remember when Fed Chairman Powell promised to kill inflation a month ago? Inflation is as prominent as ever.

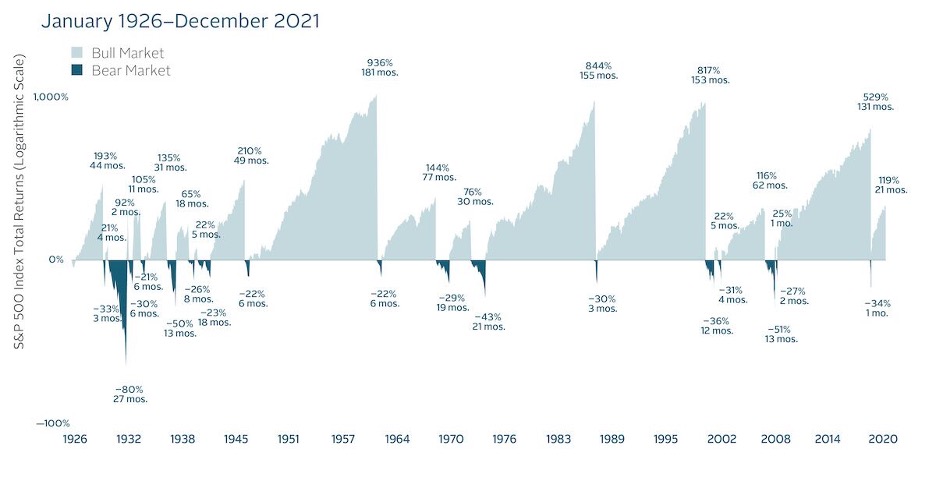

The stock market “officially” became a bear market this week, defined as a 20% decline in the S&P 500 Index.

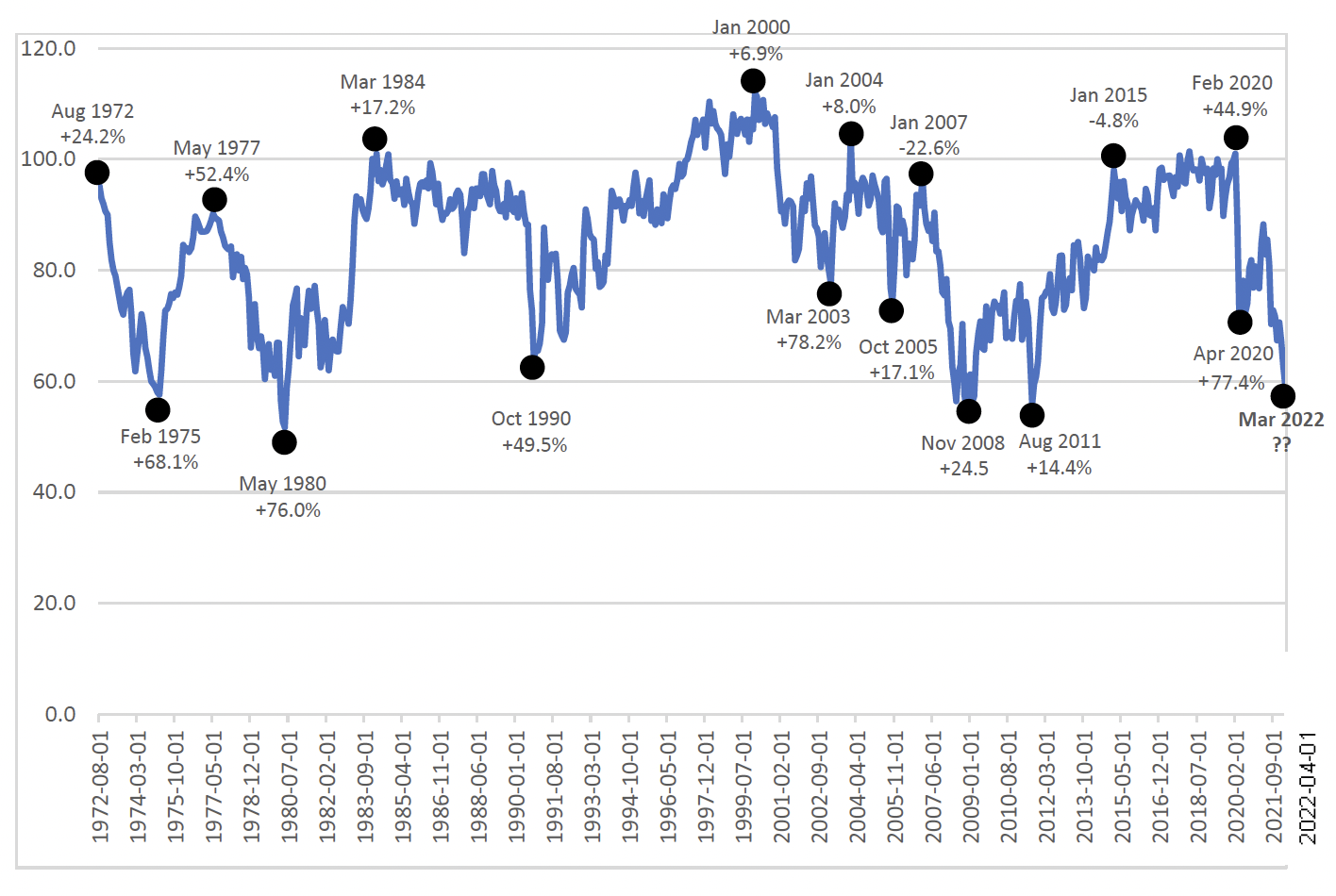

As the old adage says, a picture is worth a thousand words. The chart below shows how strong microcap performance can be in times following extremes in consumer sentiment.

Over the past 12 to 18 months, the Fed has explained that the inflation we have been experiencing is short-term and transitory.

While each of the domestic indexes have clearly entered bear market territory, the average stock has experienced a far greater decline.