From the desk of...

What’s Next?

Director of Research

Remember when Fed Chairman Powell promised to kill inflation a month ago? Inflation is as prominent as ever. We knew prices were going up at the grocery store and it costs more to fill a tank of gas, but now wages are increasing, rents are skyrocketing, and of course mortgage rates are up. The recent .75-point increase is the Fed’s third such hike, boosting borrowing costs at the fastest pace in decades.

What should we expect next?

- We believe the Fed will keep raising rates until it restrains the economy and consumer spending decreases. The thought is that we will likely see rates at 4.4% to 4.6% by the end of the year. Fed Chairman Powell is a big believer that the mistake policymakers repeatedly made in the 1970s was allowing inflation to become more firmly entrenched.

- Higher rates will affect everything you do – credit card rates are the highest since 1996, mortgage rates the highest since 2008 and auto loans the highest since 2012. Consumers with credit card debt will spend an estimated additional $5.3 billion on interest.

- On the plus side, savings rates are up. Top-yielding online savings account rates are as high as 2.5%. However, they may not increase as much or as fast as you would expect.

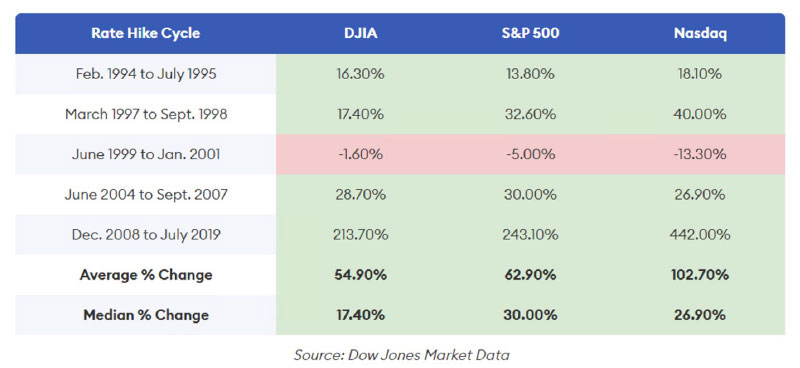

- The stock market has been declining in anticipation of this move by the Fed. During the five most recent rate hike cycles, the three leading stock market indexes only declined during one rate hike cycle. The period of 2008-2019 was an exceptional period due to the Housing Bubble.

Past performance does not guarantee future results. Index performance is not illustrative of fund performance. One cannot invest directly in an index. For fund performance please visit www.perrittmutualfunds.com.