Manager Commentary-Archive

Manager Commentary, 1st Quarter 2014

History Doesn’t Repeat, It Rhymes

How Strong are the Future Prospects of Small Companies?

While today’s P/E’s do present some challenge, valuations are not the only factor which drive small-cap returns . In 2013 small-cap stocks were called too expensive by many, yet The Russell Microcap Index led the market with a 45.62% return. This should be a reminder that valuations reflect past earnings. Looking at the past may show us if a market is pricey or inexpensive, but it can’t predict the direction or size of future returns. Returns are determined by current price and future prospects. This is the question we analyze in meetings with management teams daily: how strong are the future prospects of small companies?

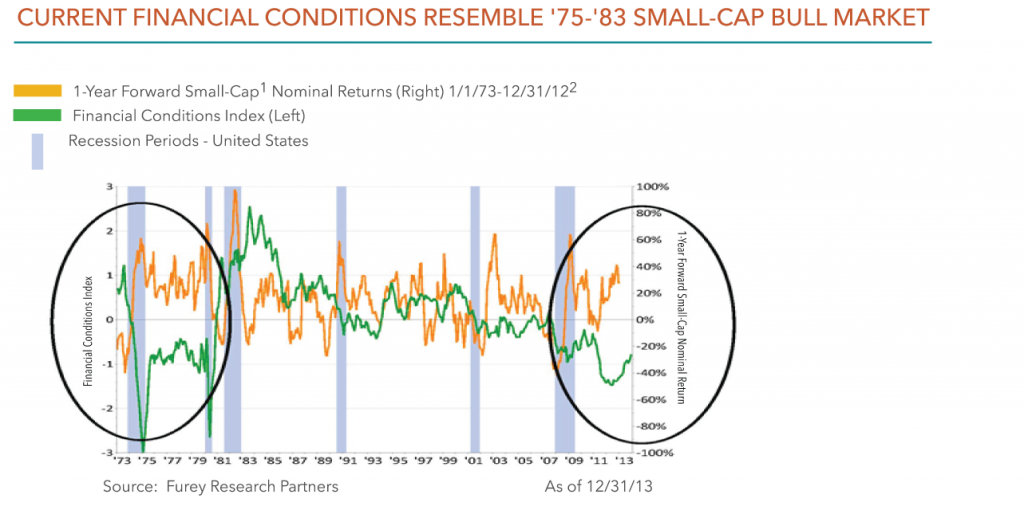

No two market cycles are alike, but as we often say: history doesn’t repeat, it rhymes. Prior market cycles can be linked to the present by studying financial conditions. Do financial conditions – interest rates, liquidity, economic trends – promote strong future prospects and earnings power?

Looking at financial conditions, our current environment most closely resembles the period of ‘75-’82, a phenomenal bull market for small-cap stocks. As seen in the table below from Furey Research Partners, financial conditions are historically a good indicator of future small-cap returns (The Financial Conditions Index represents the level of real interest rates, 10-year yields and the trade weighted dollar). Investors may be surprised to learn that the current small-cap bull market lags the ‘75-‘82 run significantly. Between 1/1/75 and 12/31/82, small cap stocks1 returned 1,419.43% (35.3% annualized). Notably, during this period small cap stocks continued to rise in spite of interest rate increases, a historical lesson that might calm fears that small-caps can’t perform in rising rate environments.

21-yr Forward Small-cap nominal returns represent the total return for the period beginning at any point on the chart and ending one year later. For example, the 1-yr forward small-cap nominal return on 12/31/02 represents the 60.70% return of small-cap stocks between 12/31/02-12/31/03.

In our view, the highly simulative Fed policies (which may continue for years, even after rates begin to rise) create an environment that has historically justified higher P/E’s. We build our portfolios from the bottom-up seeking to uncover individual opportunities. As we discussed in our last research paper, the micro-cap asset class is vast, enabling active managers the opportunity to find stocks with much different valuations than the “headline” P/E of the market index. Based on our individual company analysis, along with current financial conditions, we are confident in the future prospects of small companies.

One Door is Closed, Another is Open: Launch of Low Priced Stock Fund

In order to keep our commitment to investing in the smallest companies available on public exchanges, we have begun the process of soft-closing The Perritt Ultra MicroCap Fund (PREOX). We have talked openly about the capacity constraints of the Fund. Although the current asset levels are not pushing us to our absolute limit, we are confident that starting the process of a soft-close now is in the best interest of our shareholders. Financial advisors and retirement plans with clients in the Fund prior to the closure will be able to continue investing in the Fund for existing as well as new clients. Call Mark Oberrotman at 800-331-8936 for more information on how this might affect you specifically.

We have launched The Perritt Low Priced Stock Fund (PLOWX) to take our proven (since 1987) investment process in micro-cap stocks and add small-cap stocks to broaden our opportunities.

The Fund will invest in micro-cap and small-cap stocks priced under $15 per share and $3 billion market capitalization when purchased, providing plenty of room to move. We will follow the same investment and stock selection process and research team that has been part of our firm’s twenty-five years of experience investing in smaller companies. Our Low Price approach should fit in its niche as it is one of just three Low Priced Stock Mutual Funds available to investors.

Our investment process utilizes a bottom-up approach, favoring fundamentally sound companies with modest valuation multiples relative to long-term growth prospects. The Low Priced Stock Fund investable universe includes 2,119 stocks as of 2/28/14. Steps in our investment process include:

- Companies are first subjected to a nine-point evaluation — based on balance sheets, cash flow statements and income statements — that we believe demonstrates whether a company is acting in the interests of its shareholders.

- For companies whose fundamentals look favorable based on the nine-point evaluation, the next step is to assess its broader business prospects. The focus of this step is to identify growing, niche companies with innovative products and/or services and the potential to build franchises and brand.

The co-portfolio managers of the Perritt Low Priced Stock Fund are Michael Corbett, our Chief Investment Officer (with the firm since 1990), who is joined by portfolio manager, Brian Gillespie who has been working side-by-side with Mr. Corbett since 2005. Michael has served as Portfolio Manager for the MicroCap Opportunities Fund (PRCGX) since 1999 and the Ultra MicroCap Fund (PREOX) since 2004.

Click here for standardized fund performance.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling (800) 331-8936. The funds impose a 2% exchange and redemption fee for shares held 90 days or less. Performance data quoted does not reflect the redemption or exchange fee. If reflected, total return would be reduced.

Meet the Team – Mark Oberrotman, Executive Director of Client Relations

Mark’s professional career covers an interesting spectrum of experience. He joined Perritt Capital in 2004 and has more than twenty-five years of experience in the investment industry.

As a graduate of the University of Illinois with a degree in Mechanical Engineering he started right out the gate into the engineering world with an old line Fortune 500 company, Continental Can. Mark started his financial services career with Thomson McKinnon Securities as a stock broker working with high net worth individuals. An early experience of the 1987 market crash opened his eyes to how the market works as well as gave him plenty of stories (which we are tired of but please ask him to share).

In the early days if you didn’t have connections you built your business by going door to door, making cold calls, or both, which Mark did until eventually managing as much as $50 million. Mark’s experience managing clients and his own book of business has helped him connect with Advisors with whom he is often found coaching on life and business strategy along with the merits of small/micro-cap-company investing.

Mark met Perritt Capital owner and Portfolio Manager Michael Corbett more than fifteen years ago after discussing small company names as a sell-side broker. At Perritt you will find Mark opening up distribution agreements, creating marketing materials and tending to the needs of clients.

Mark enjoys international and outdoor travel and has recently visited Istanbul, Australia, Galapagos Islands, Europe as well as national parks like Yosemite, Tetons and Yelllowstone.

The information provided herein represents the opinion of Perritt Capital Management and is not intended to be a forecast of future events, a guarantee of future results, nor investment advice.