Research & Whitepapers

Interest Rate Hikes and Small-Cap Stock Returns

Interest Rate Hikes and Small-Cap Stock Returns

Regardless of the macro factor influences, investors are always concerned about future returns. One of those concerns is the impact on stock prices once the Federal Reserve starts raising short-term interest rates. While we certainly agree that many recessions happen after the Fed raises rates too much, it may interest investors how small-cap returns perform.

While exact dates and periods of past tapering actions or interpretations of “Fed speak” can’t be measured precisely, we can look at past periods of interest rate hikes and their impact on small-cap equity returns. From this data, investors may gain some historic context to enhance their perspective regarding Fed actions and stock returns.

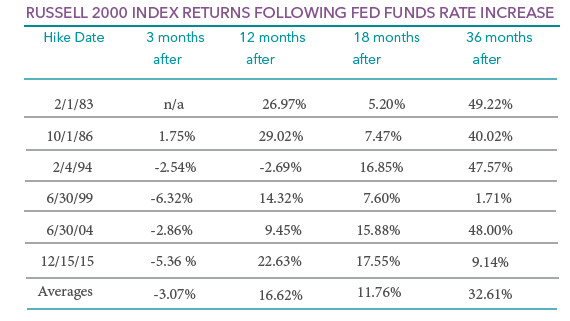

The previous six times the Federal Reserve embarked on raising interest rates and the performance of small returns are listed below:

During the each of the last six instances, small-cap returns have provided positive average returns during the 12, 18 and 36-month periods following Fed tightening. Notably, small-cap stocks generally performed very strongly for the first twelve months following a rate hike, followed by a pull back during the ensuring six-month period. This indicates that, historically, if there is a time for concern regarding small-cap returns in relation to Fed actions, that time is typically twelve months following a rate hike. Lastly, it could be argued that the 12 to 18-month period could be a buying opportunity too. The 36-month return after an initial rate is remarkably strong.