Uncategorized

Marin Independent Journal Trader’s Magazine – February, 2013

Portfolio Manager Michael Corbett is interviewed in this article as a shareholder of Hennessy Advisors following the announcement of an acquisition, which nearly tripled the assets under Hennessy’s management. Asked about the acquisition, Corbett said, “”By combining forces, (FBR and Hennessy Advisors) can generate some synergy and bring down costs.”

To read, visit marinij.com.

Trader’s Magazine – January, 2013

Director of Research/Equity Analyst George Metrou is interviewed in the article “Building Blocks for Building Block Trades.” In it, he describes Perritt’s “old fashioned” trading process of using a network of 40-to-45 brokers across the country who have established a relationship of trust with the team.

To read “Building Blocks for Building Block Trades,” visit Trade Magazine’s website.

InvestingDaily.com – February, 2013

The Perritt MicroCap Opportunities Fund is mentioned in this article devoted to explaining the potential benefits inherent in a space known for scarce information and limited liquidity. A detailed description of the team’s investment process is also included in the piece.

To read “Micro-Caps: Tiny Companies, Powerful Gains,” visit InvestingDaily.com.

Investment Advisor – June 2012

Investment Advisor Magazine features Michael Corbett, Portfolio Manager of the Perritt Funds, in the article “Managing Through the Micro-Cap Mania.” Corbett discusses why small-cap volatility doesn’t faze the investment team at Perritt Capital Management. Asked about volatility, Corbett notes that, “The possibility of shareholder value is significant because of how strong the balance sheets are.”

Both Perritt Funds are discussed in detail, including mention that “The Ultra MicroCap Fund has the lowest average market cap [for the companies which it invests] of any mutual fund out there,” according to Morningstar.com.

To read “Managing Through the Micro-Cap Mania,” visit Investment Advisor’s website.

Crain’s Chicago Business – December, 2012

George Metrou, Director of Research of the Perritt Funds, discusses John B. Sanfilippo & Son’s in the article “Does Fisher Nuts Have the Recipe to Win This War?” When asked about John B. Sanfilippo & Son’s success at increasing market share and diversifying its product line for it’s Fisher Nuts brand, George states: “We’re very happy with what the company has been doing. We decided to maintain our position because we saw them make a push to grab market share and diversify the product line.”

To read “Does Fisher Nuts Have the Recipe to Win This War?”, visit Crain’s Chicago Business’ website.

Crain’s Chicago Business – December, 2012

George Metrou, Director of Research of the Perritt Funds, discusses John B. Sanfilippo & Son’s in the article “Does Fisher Nuts Have the Recipe to Win This War?” Asked about John B. Sanfilippo & Son’s success at increasing market share and diversifying its product line for it’s Fisher Nuts brand, George states, “We’re very happy with what the company has been doing. We decided to maintain our position because we saw them make a push to grab market share and diversify the product line.”

To view “Does Fisher Nuts Have the Recipe to Win This War?” visit Crain’s Chicago Business.

Investment Advisor – June 2012

Investment Advisor Magazine features Michael Corbett, Portfolio Manager of the Perritt Funds, in the article “Managing Through the Micro-Cap Mania.” Corbett discusses why small-cap volatility doesn’t faze the investment team at Perritt Capital Management. Asked about volatility, Corbett notes that, “The possibility of shareholder value is significant because of how strong the balance sheets are.”

Both Perritt Funds are discussed in detail, including mention that “The Ultra MicroCap Fund has the lowest average market cap [for the companies which it invests] of any mutual fund out there,” according to Morningstar.com.

To view “Managing Through the Micro-Cap Mania” visit Investment Advisor Magazine.

Perritt Capital Management Launches New Website and Brand

Click here to read a press release regarding the firm’s launching of our new website and brand.

Perritt Emerging Opportunities Fund Changes Name to Perritt Ultra MicroCap Fund

Click here to read a press release regarding the name change of the Perritt Emerging Opportunities Fund.

Change in Majority Control of the Advisor to The Perritt Funds

Click here for important information regarding an agreement to transfer majority control of Perritt Capital Management from founder Dr. Gerald Perritt to Portfolio Manager Michael Corbett.

Manager Commentary, 2nd Quarter 2013

“I Get No Respect!” Until Lately….

Q: What Has Been The Cause Of The Outsized Returns Seen In Several Individual Small Company Names?

A: As Rodney Dangerfield might say: Respect. We understand that micro-cap is an inefficient asset class containing many misunderstood companies and select our individual stocks with great care. When companies are misunderstood by investors, you can find them priced to return many multiples of your initial purchase should the investment pan out. Patience is part of the micro-cap discipline, as it can take many years for a story to play out and for a company to finally get recognition. Lately we have seen several once misunderstood micro-cap stocks finally gaining respect, which has contributed to our strong performance of late. Two recent examples show that our investments in these stocks increased by 500% and here we outline their progress from highly misunderstood to highly respected and potentially overbought.

Addus HomeCare (ADUS) – Addus provides assisted living and skilled home nursing services. You can rarely explain a misunderstood stock with a single concept because if it was that simple it would not be misunderstood. There are four intertwined parts to the Addus story and why investors had no confidence the company could succeed:

- A large portion of Addus’ business was linked with the State of Illinois, and there was a perception that the state would never pay the bills.

- Addus operated a nursing home business which had very low margins. Management was able to divest this business at a nice multiple, improved the company’s balance sheet and financial strength.

- Because of the two issues above, investors did not believe that Addus could deploy capital to buy other business, which they subsequently were in fact able to.

- Addus was plagued by operating inefficiencies which no one believed they could improve.

- Again management proved doubters wrong as it fixed these issues and increased profitably.

From the beginning Addus was a broken IPO, as the stock went public at $9.00 and immediately missed expectations, dropping to $3.00-$4.00 right out of the gate. We sat down with the entire management team, it was twelve people in their offices which may have set a new record, and we listened to them pounding the table about how they would fix the four issues above and practically beg for institutional sponsorship. We became one of the only institutional investors in Addus and were rewarded when the stock finally received the market’s respect and increased 500% from our initial purchase.

“We have seen several once misunderstood micro-cap stocks finally gaining respect, which has contributed to our strong performance of late.”

Virtus Investment Partners (VRTS)* is an asset management firm which uses a model of sub-advisors, each with a distinct specialty and brand. Like Addus, Virtus came to the market as a highly misunderstood company, in this instance in a reverse merger. The company was valued at $100 million despite having $20 billion under management. We were intrigued because at this level the market said Virtus was worth 0.5% of AUM versus 1.5%-2.5% norm for the industry. Doing our homework we found that another $10 billion AUM was soon to come onto the balance sheet as contracts expired. So a company that was already undervalued was in reality vastly undervalued as AUM was in fact $30 billion and not $20 billion. Investors woke up and finally gave Virtus its respect over the past year, as our initial investment increased by over 500%.

Q: Does The Volatility In The Bond Market Have An Impact On Smaller Companies?

A: As many investors know, intermediate-and long-term long bond prices declined significantly over the past several months as interest rates began to rise. The reason for the rise in interest rates is related to expectations regarding Federal Reserve policy. The only reason the Fed would taper or shift toward a higher interest rate policy is because the economy is improving. Thisshould bode well for smaller companies that are more economically sensitive. We recently completed a historical analysis of this relationship in a research paper you can find on our website: Take Away The Punch Bowl, Small Cap Stocks May Keep Drinking, Rate Hikes and Small Cap Stock Returns.

Q: Do You See Any Change In Correlation Among Small And Micro-Cap Stocks?*

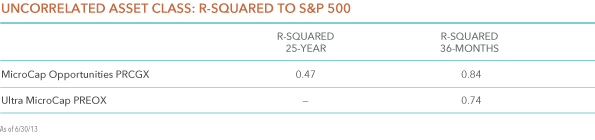

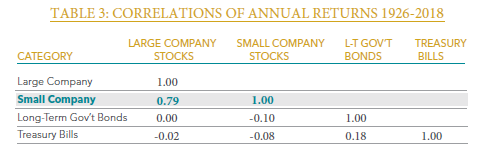

A: Over the life of our MicroCap Funds, the portfolios have experienced lower correlation to the overall stock market. The Perritt MicroCap Opportunity Fund’s R-squared measurement is 0.47 versus the S&P 500 Index over the twenty-five year life of the Fund. However, during the 2007 to 2011 timeframe, correlation increased significantly. We have noticed that correlation has starting to normalize toward a lower level over the past year. This is a positive because individual companies are once again starting to march to the beat of their own drummer, which implies fundamentals are working through to stock prices.

Performance as of 6/30/13*

The Perritt MicroCap Opportunity Fund’s R-squared measurement is 0.47 versus the S&P 500 Index over the twenty-five year life of the Fund.

Attribution Analysis

Click here for standardized fund performance.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-800-331-8936. The funds impose a 2% redemption fee for shares held less than 90 days. Performance data quoted does not reflect the redemption fee. If reflected, total return would be reduced.

Micro Cap Opportunities Fund (PRCGX)

- The MicroCap Opportunities Fund gained 4.72% in the second quarter, outperforming the Russell 2000 Index (3.08%) but lagging the Russell MicroCap Index (5.10%). Year to date the Fund’s 19.54% return is higher than both indexes.

- Stock selection contributed to all of the positive returns relative to the indexes. Stock selection added 5.02% versus the Russell 2000 Index and 4.12% versus the Russell MicroCap Index. Stock selection in six of the Fund’s eight equity sectors added to relative outperformance.

- Stock selection was most pronounced in the health care, financials and consumer discretionary sectors.

- We continue to stress that our investors monitor the high level of exposure to financials in the Indexes. Financials now account for nearly 30% of the Russell MicroCap Index. Our underweight to financials added to the funds relative performance in the second quarter as financial names, notably REITS, struggled.

- Our biggest winners drove the returns, as the top five holdings provided 2.1% of portfolio return during the quarter. In aggregate, top five holdings have returned 118.3% year to date.

Ultra MicroCap Fund (PREOX)

- The Ultra MicroCap Fund gained 5.91% in the second quarter, versus 5.10% for the Russell Micro Cap Index.

- We always stress the difficulty of comparing this fund to a benchmark as it invests in companies far below the traditional radar, as demonstrated by its average market capitalization of just $59 Million (the lowest of all 8,012 equity Funds, according to Morningstar as of 7/26/13).

- Strong stock selection was concentrated in our top names, as the top five holdings contributed 3.5% to performance. Stock selection in five of the Fund’s eight equity sectors added to relative outperformance.

Manager Commentary, 1st Quarter 2013

Celebrating 25 Years

On April 11th, the Perritt MicroCap Opportunities Fund attained a 25-year track record. We are proud to be among a limited group of mutual fund managers – not to mention one of the only micro-cap managers – to have achieved such an established record of experience. We believe that we can keep improving if we make sure to always learn from our past experience. Departing from our typical commentary format, below is a look at select quotes over past three years and several outcomes which we can study to understand the strengths of our own analysis.

“I have not seen this degree of opportunities in both their range and depth over my twenty year career. Because of the damage to the confidence in our markets and in our economy, we believe that the recovery could last for many years and the rewards could be very impressive.”

—Manager Commentary, 3/31/2009

Results speak for themselves*, and we believe shareholders of the Perritt Funds have been rewarded considerably since the market bottom in March 2009. Equally impressive is the level of passion we witnessed from certain entrepreneurs and business owners who never seemed in doubt of their companies’ potential even during dire economic times. We may have learned more about human and investor psychology during this period than at any other time in our 25 years.

“We believe that the conditions facing the management teams of acquiring companies and those of companies targeted for pur-chase have created an environment for acquisition activity in the microcap universe where ‘the stars are aligned.”

—Manager Commentary, 3/31/2010

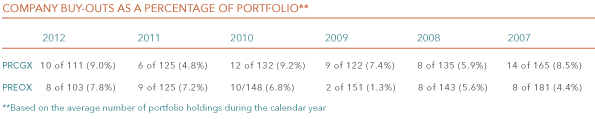

Merger & Acquisition (M&A) activity continues to be a major characteristic of micro-cap investing. Our outlook was initially accurate before M&A activity declined overall in 2011. Buy-out activity returned in 2012 due in part to anticipated changes in the tax code. Today we believe that we are in an environment where private equity firms and shareholder activists are hungry to get deals done.

“While short term periods where our investment style may be out of favor can be difficult, these periods have often provided us with the greatest opportunities”

—Manager Commentary, 6/30/2011

We added to our positions in a select group of securities during the summer of 2011 including Sanfilippo John B & Sons (JBSS), Midas (MDS), Global Cash Access (GCA) and Ruldolph Technologies (RTEC). Each of these companies were trading at very attractive valuations due partly to indiscriminate selling during the period. Our conviction was rewarded as each of the positions at least doubled since the investment.

The number one difference that we detect in the management teams between now and 2008-09 is what we describe as their ‘Cash Attitude.’ Simply put, management teams are no longer trying to survive, they are creating new ways to thrive.”

—Manager Commentary, 12/31/2010

A great example of Cash Attitude is Landec (LNDC), which used their excess cash and even new debt to make several strong accretive acquisitions. Landec, which has a legacy business of food packaging and distribution to grocery stores on the West Coast, has now partnered with food growers to build an expansive new greenhouse which produces many of the very foods the company packages. We recently visited the new Santa Monica, CA facility and were blown away by its size and scope; the site includes 64 acres of greenhouses, or 3 million sq. feet, equivalent to the size of fifty football fields. The market has loved Landec’s transactions as the stock has more than doubled since management’s announcement that they were using cash to invest in the business. You can hear more about our opinion of Landec in our interview with TheStreet.com on 2/1/13 (thestreet.com/video/11829793/bet-big-on-century-casinos landec.html – copy and paste link in your web browser to view).

“Investors who wish to participate in improvements in the U.S. economy may wish to look to small/micro-caps with more domestically-driven revenue sources as they seek to take advantage of U.S. improvements.”

—Manager Commentary, 3/31/2012

We are of the opinion there is no better way to get domestic revenue exposure than through a small, regional bank. Bank of the Internet (BOFI) is a distinct, niche company in that it provides banking and financial services online and without any brick and mortar locations. BOFI was a strong contributor to the performance both Funds, climbing 92% last year and another 29% in the first quarter of 2013. While it is true that the world is getting “flat” or more global, a significant portionof micro-cap revenue has continued to be domestically-based, which has been a benefit for investors in the current environment.

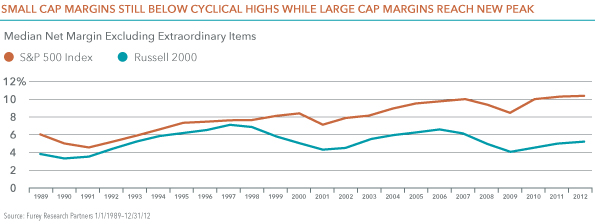

“It seems to be a common belief that margin expansion is at its peak. However, this is not always true in the types of small, niche businesses that possess more nimble pricing power than their larger, more diversified peers .”

—Manager Commentary, 6/30/2012

Corporate profits have been at record highs*, prompting many investors to wonder if decreasing margins pose an imminent risk to equity inventors. While this might be true for The S&P 500, we caution investors to realize that margin levels for small companies are nowhere near as elevated as what is seen in large cap companies, as seen in the chart on page one. Small companies are more likely to invest into growing their businesses, which has the potential to keep margins low. If a “margin-bubble” does in fact exist, we don’t see this risk among small cap companies.

Attribution Analysis

Click here for standardized fund performance.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-800-331-8936. The funds impose a 2% redemption fee for shares held less than 90 days. Performance data quoted does not reflect the redemption fee. If reflected, total return would be reduced.

MicroCap Opportunities Fund (PRCGX)

- The MicroCap Opportunities Fund gained 14.15% in the first quarter, outperforming both the Russell 2000 Index (12.39%) and the Russell MicroCap Index (12.58%)

- Stock selection contributed to all of the positive returns relative to the indexes. Stock selection added 4.97% verses the Russell 2000 Index and 6.90% versus the Russell MicroCap Index. Stock selection in six of the Fund’s eight equity sectors added to relative outperformance.

- Continuing last ear’s trends, stock selection was most pronounced in the Health Care and Financials sectors. Strong selection in these sectors more than made up for a relative underweight versus the index, which detracted from performance.

- In aggregate, investments in the Health Care sector returned 39.60% in large part due to a strong performance oftop-10 holding Addus HomeCare (ADUS), which was up 84.53% during the quarter.

- We continkue to stress that our investors monitor the high level of exposure to Financials in the Indexes. Financials now account for nearly 30% of the Russell MicroCap Index, a level that we don’t believe is sustainable over the long term.

Ultra MicroCap Fund (PREOX)

- The Ultra MicroCap Fund gained 12.16% in the first quarter, versus 12.58% for the Russell MicroCap Index.

- We always stress the difficulty of comparing this fund to a benchmark as it invests in companies far below the traditional radar, as demonstrated by its median market capitalization of just $57 Million (the lowest of all 8,130 equity Funds, according to Morningstar as of 4/18/13).

- Overall stock selection was strong, contributing 4.64% to relative performance. Stock selection by industry was mixed, as selection in four equity sectors added to relative performance while selection in four sectors detracted.

- In the sectors where we did experience dpositive stock selection, the magnitude was significant.Our selection in the Financials and Health Care industries accounted for 6.03% of relative out performeance, due to strong returns in several individual names.

- The primary reason why our positive stock selection did not translate into outperformance was a bombination of a large underweight in Financials, which continued its strong run, and poor returns in the Consumer Discretionary sector.

Manager Commentary, 4th Quarter 2012

Where’s the Breadth?

A Closer Analysis of a Strong Year for MicroCap

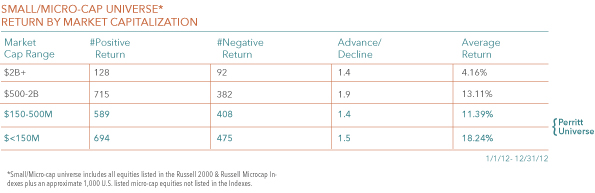

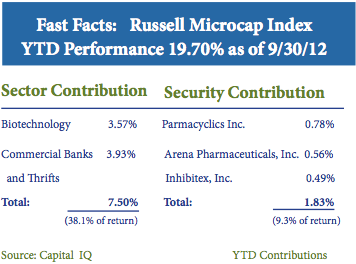

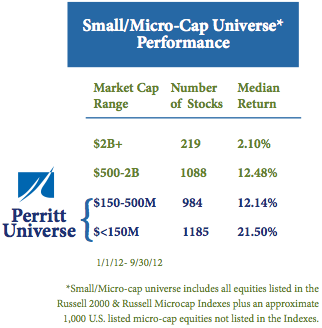

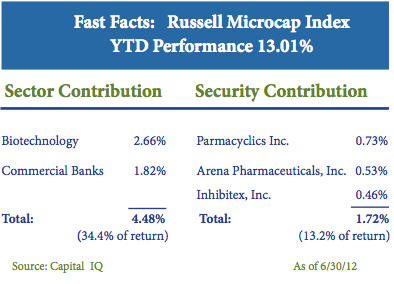

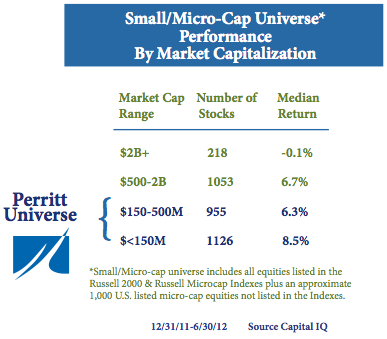

The year 2012 is now in the history books, and while returns in the small/micro-cap space were certainly a pleasurable read, we are also reminded of the old advice “don’t judge a book by its cover.” Despite our strong returns over the past year for both of The Perritt Funds, we believe that more opportunity may exist in our space. Valuations appear attractive, small businesses are growing, and an analysis of underlying index returns reveals how the small/micro-cap universe has not had the kind of broad-based run that has historically provided the best return environment for active managers. The 2012 return of the Russell Microcap Index was concentrated in a small number of sectors and securities, as we detailed in our last commentary. At year end, more than 35% of the Index’s return was due to the contribution of just two sectors: Biotechnology and Commercial Banks/Thrifts. The trend that a relatively small number of companies are driving the returns of the small/microcap space is more pronounced as you go down the market-cap scale. As shown in the table below, when we look beyond the Index and take a close analysis of our proprietary small cap universe, the advance/decline ratio was 1.5 or lower among companies with a market capitalization of $500 million and under. Historically, during a robust and healthy advance for micro-cap equities, this number has generally been much higher.

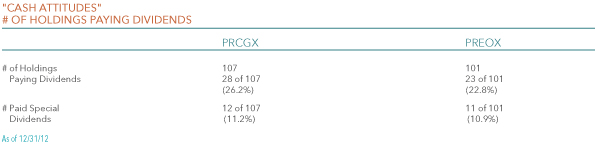

If we are to see the kind of improved breadth among micro-cap companies associated with a healthy advance, what will spark the investor confidence needed to get us there? One potential answer is the continued improvement of Cash Attitudes among management teams. We saw very healthy use of cash by companies in our portfolios at the end of 2012, although not in the way we predicted. More than 10% of companies in each of our Funds paid a special dividend at the end of last year.*

“…The small/micro-cap universe has yet to have the kind of broad-based run that has historically provided the best return environment for active managers.”

In fact, the Perritt MicroCap Opportunities Fund received 150% more dividend income during the last two months of the year than during the first ten months, primarily due to special dividends. Management teams decided to pay special dividends in large part because of the imminent tax increase on dividends (most of the companies we invest in have high insider ownership). Dividend payouts were also related to high levels of cash on balancesheets, which is a result of our process of investing in financially sound small companies.

The unparalleled payout of special dividends we saw last year is a shareholder-friendly action that we believe should bring positives to the capital structure of many micro-cap companies we invest in. First and foremost, small companies continue to improve their top and bottom lines. However, the excess cash held by many of the companies in our portfolio has driven down returns on equity, negatively affecting the P/E ratio investors are willing to pay. For example, RCM Technologies (RCM) is a company we own which has been in the $5.00-6.00 range while having $2.50 in cash per share. In December, RCM paid a special dividend of $1.00 per share, equal to one-sixth of its stock price, which will also increase the company’s ROE by a similar amount. With a lower shareholder equity number, the company’s future growth will show a greater improvement in ROE with less cash on hand. In the case of many micro-cap companies which fly so far under the traditional Wall Street radar, these kinds of actions can be the catalyst which sparks interest in the underlying business quality which has in fact been there all along.

We can’t finish without a mention that the Russell 2000 Index has reached a new all time high and a discussion of what this might mean for small/micro-cap investors. In our view this is again related to the issue of breadth. That the Russell 2000 Index hasreached new highs despite the fact that returns have been concentrated in a small number of names indicates that there may be opportunity for a more broad-based advance. Having avoided the ‘fiscal cliff ’ and with tax changes now settled, many management teams that we have met with are saying that uncertainly is declining, allowing them to better plan and execute their growth strategy. Smaller company stocks tend to demonstrate serial correlation, meaning that strong performance has historically been followed by periods of similarly strong performance. We will outline serial correlation in a new research paper later in the first quarter.

“The unparalleled payout of special dividends we saw last year is a shareholder-friendly action that will bring positives to the capital structure of many micro-cap companies we invest in.”

Attribution Analysis

Click here for standardized fund performance.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-800-331-8936. The funds impose a 2% redemption fee for shares held less than 90 days. Performance data quoted does not reflect the redemption fee. If reflected, total return would be reduced.

MicroCap Opportunities Fund (PRCGX)

- The MicroCap Opportunities Fund gained 2.78% versus 1.85% for Russell 2000 Index and 0.04% for the Russell MicroCap Index during the fourth quarter. For the year the Fund returned 16.87% versus 16.35% and 19.74% for the Indexes, respectively.

- Stock selection was strong for the year, contributing 5.82% to relative returns versus the Russell 2000 Index and 4.12% versus the Russell MicroCap Index. Six of the Fund’s nine equity sectors added to relative performance (one sector, Telecom, had no impact).

- Stock selection was most pronounced in the Health Care and Financials sectors. Returns in the Health Care sector were driven by a nearly 100% return in top 5 holding BioScrip (BIOS). Financials returns were strong across the board, with over 75% of Financials holdings contributing to absolute returns.

- Despite the fact that Financials names we did invest in worked well, overall strength in the Financial sector overall detracted from our relative performance due to our significant underweight relative to the Index. Nearly 30% of the Russell MicroCap Index is now allocated to Financials. As discussed previously, more than 35% of the return of the Russell Microcap Index was concentrated in a small number of Biotech, Regional and Thrift Banking and stocks.

Ultra MicroCap Fund (PREOX)

- The Ultra MicroCap Fund gained 1.91% versus 0.04% for the Russell MicroCap Index during the second quarter. The Fund returned 11.79% for the year versus 19.70% for the Index.

- We always stress the difficulty of comparing this fund to a benchmark as it invests in companies far below the traditional radar, as demonstrated by its median market capitalization of just $50 Million (the lowest of all 8,163 equity Funds, accord-ing to Morningstar as of 1/28/12)

- Overall stock selection was positive, contributing 3.45% to relative performance for the year. The best performing investment was John B Sanfilippo & Son’s (JBSS), maker of Fisher Nuts. After trading at 0.1 times sales and 0.5 times book value earlier in the year JBSS began to gain traction after price increases took hold and margins expanded. We continue to be long term investors in JBSS and remain confident in this management team.

-

Stock selection gains were outweighed by negative contribution from holdings in the Technology and Materials sectors, both in terms of stock selection and sector allocation. Our relative overweight in Technology companies demonstrates our conviction in the strong upside opportunities currently found in more cyclical industries, especially in the sub-$50 million market cap range.

Manager Commentary, 3rd Quarter 2012

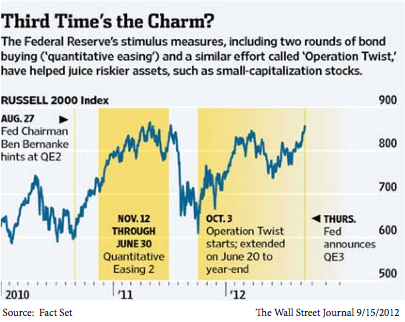

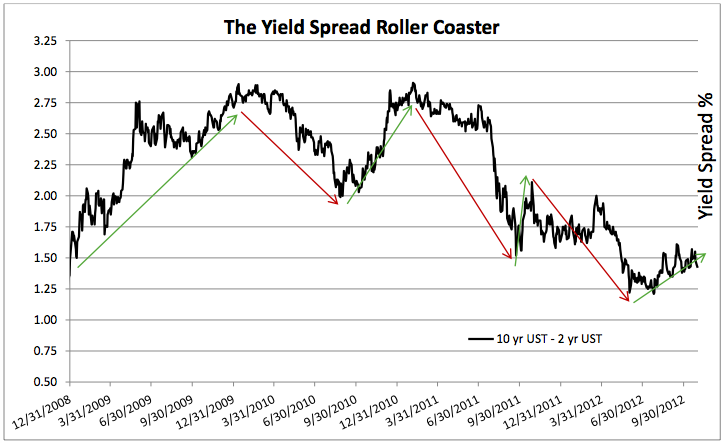

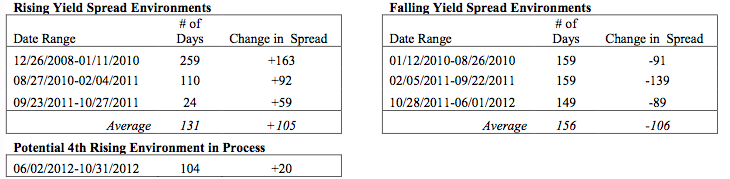

Q: How Might the Most Recent QE Announcement Affect Micro-cap Equities?

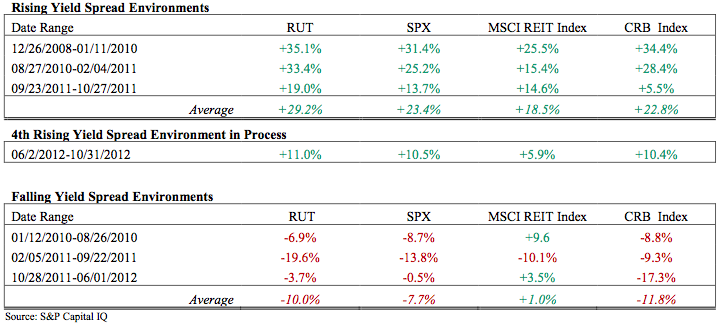

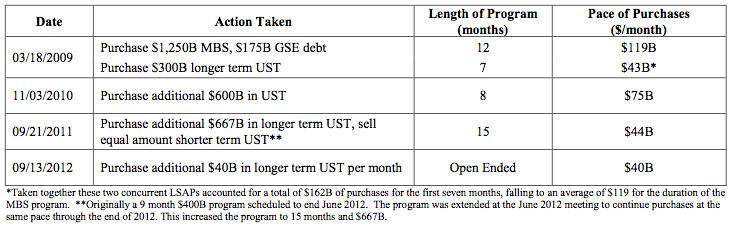

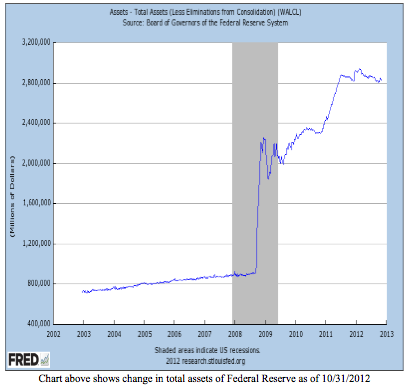

A: As most investors know, part of the underlying goal of continued QE is to push investors toward “riskier assets.” Measured by this metric, Bernanke has been somewhat successful despite the fact that investor assets have continued to pour into U.S. Treasuries. As seen in the table below, QE corresponds closely with positive returns for the Russell 2000 index. While QE continues it is reasonable to believe that this trend might persist, indicating a strong environment for small- and micro-cap companies.

An analysis of how small and micro-cap stocks respond to the rise and fall of inflation expectations provides us added valuable insight. These market-determined expectations have perhaps played a large role in investor behavior during the new, post-crisis/zero rate environment. We will be publishing a white paper early next month, Observations of Inflation Expectations’ Effect on Risk Assets in the Post-Crisis Period, analyzing the distinct periods of rising and falling inflation expectations over the past four years. We have found that since reaching the zero bound for interest rates the old ways of viewing inflation’s effect on stock prices has been turned upside down. In summary, higher inflation expectations have been good for risk assets generally and for small- and micro-cap stocks in particular. We believe that advisors and shareholders should continue to monitor investor expectations of inflation closely when measuring opportunity in the small and micro-cap sector. We certainly recommend all of our clients take a look at the white paper when it is released and we encourage your thoughts and feedback.

We will be publishing a white paper, Observations of Inflation Expectations Effect on Risk Assets inthe Post-Crisis Period, which demonstrates that since reaching the zero bound for interest rates, the old ways of viewing inflation’s effect on stock prices has been turned upside down.

Q: With Financials And Biotech Continuing To Drive Index Returns, Why Do You Remain Confident In Cyclical Companies?

A: As we detailed in our previous commentary, the return of the Russell Microcap Index has been concentrated in a small number of Biotech, Regional and Thrift Banking stocks. This trend continued in the third quarter, as can be seen in the table below. Despite this, we are significantly underweight the Financials and Healthcare sectors be- cause of our strong conviction that the greatest upside opportunity in the micro-cap space can currently be found in cyclical companies.

“We believe that the low upside offered by financials is far less compelling than the earnings-power opportunities we see in cyclical companies today.”

To take a closer look at the level of upside potential found in typical cyclical company in our portfolio we point to Integrated Silicon Solutions (ISSI). This company produces semi-conductors for high-margin, customizable electronics products. Annual revenue is $265 million, the firm holds $100 million in cash with no debt on the balance sheet, and the market capitalization is $248 as of 9/30/12. Like many cyclical investments in the small- and micro-cap space, investors have shown no interest in business growth and fundamentals and have failed to do their homework to understand the story. ISSI has been lumped in with more commoditized chip manufactures despite its move towards high margin, more customized products and applications, a classic example of the baby being thrown out with the bath water. What we believe investors will eventually realize is the fact that ISSI trades at a P/E of 6.2 after netting out cash. To demonstrate the potential upside, ISSI would be priced in the mid $20 range based on forward earnings of $1.00, a 19.8% ROE and cash on the balance sheet.

Attribution Analysis

Click here for standardized fund performance.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-800-331-8936. The funds impose a 2% redemption fee for shares held less than 90 days. Performance data quoted does not reflect the redemption fee. If reflected, total return would be reduced.

- The MicroCap Opportunities Fund gained 3.99% versus 5.25% for Russell 2000 Index and 5.92% for the Russell MicroCap Index during the second quarter. YTD the fund is up 13.70% versus 14.23% and 19.70% for the Indexes, respectively.

- Strength in both the Financial and Healthcare sectors detracted from our relative performance due to our significant underweight to those two industries as discussed previously. Nearly 40% of the return of the Russell Microcap Index YTD has been concentrated in a small number of Biotech, Regional and Thrift Banking and stocks

- Stock selection in total attributed 4.63% to relative returns versus the Russell 2000 Index YTD and 4.45% for the quarter. Relative to the Russell Microcap Index selection attributed 1.21% YTD and 2.5% for the quarter. Seven of the Fund’s nine equity sectors attributed positive stock selection, including strong selection in both the Financials and Healthcare sectors which were in fact the top two sector contributors based on stock selection.

- The Ultra MicroCap Fund gained 0.96% versus 5.92% for the Russell MicroCap Index during the second quarter. YTD the fund is up 9.70% versus 19.70% for the Index.

- We stress again the difficulty of contrasting this fund to a benchmark as it invests in companies far below the traditional radar, as demonstrated by its average market capitalization of just $50.6 Million (the lowest of all 8,145 domestic equity Funds, according to Morningstar as of 10/23/12)

- Like the MicroCap Opportunities Fund, the Ultra MicroCap Fund’s overweight to cyclical industries such as technology and energy detracted from relative performance.

- Relative performance impact was mixed as five of the Funds ten equity sectors contributed positively to performance. However, negative contributions from Energy, Healthcare and Materials outweighed gains achieved elsewhere.

Manager Commentary, 2nd Quarter 2012

Opportunity Now: Reasons For Small Company Optimism

Our clients understand that micro-cap equity is an asset class where active managers can provide great value. The lack of traditional Wall Street Analyst coverage leads to price inefficiencies and potential trading advantages that don’t always exist in the more closely-followed sectors. Yet as of the end of June, from what we have seen, active management in the micro-cap space appears to have lagged. As seen, micro-cap benchmark returns have been concentrated in a small number of Biotech and Regional Banking firms where many active managers (including ourselves) don’t observe compelling tradeoff between risk and reward.

In times like today, it is sometimes too easy to become swallowed by negative news and prevailing pessimism about the economy. Yet we consider ourselves fortunate to have the ability to meet with 3-5 management teams of small companies every week inside our offices. The perspectives we have gained from these on-the-ground entrepreneurs is often much different from what you read in the headlines. Here we pass along some of the opportunities we are uncovering during our analysis and meetings with company management. If you read closely you will find that in the Small/Micro-cap universe the facts counter many common misperceptions. ”

Micro-cap benchmark returns have been concentrated in a small number of Biotech and Regional Banking firms where many active managers (including ourselves) don’t observe a compelling trade-off between risk and reward”

High Margin Levels Unsustainable

Opportunity: Pricing Power Lets Many Small Companies Continue Margin Expansion

It seems to be a common belief that margin expansion is at its peak. However, this is not always true in the types of small, niche businesses that possess more nimble pricing power than their larger, more diversified peers. The decline of input costs related to falling commodity prices is another often overlooked part of the peak margin story. For example, John B. San Filippo & Son (JBSS) (maker of Fisher Nuts) consistently raised prices during a recent cycle where raw nut prices were steadily increasing. Roughly speaking, in a typical period where JBSS’s revenue was growing at 5%, prices were increasing by 10% while sales were down 5%. Knowing that this is a cyclical business, we were pleased when our investment thesis was proven correct and positive sales growth returned. Today, JBSS’s business is growing and nut prices are beginning to come down. Yet those higher prices the company set will be sticky, helping to potentially increase margins. Despite increasing over 100% this year, we continue to believe JBSS has upside potential; even after the substantial increase in share price JBSS is still trading below book value*.

“We applaud the many companies in our portfolio who are driving capital allocation in the right direction.”

Attribution Analysis

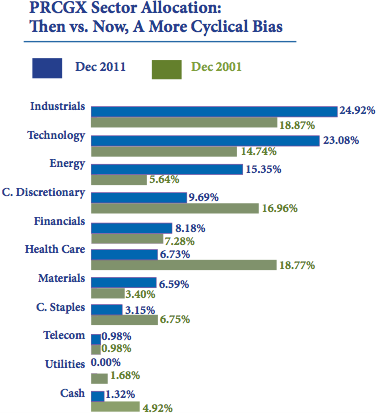

As discussed earlier, much of the micro-cap Index performance this year has been driven by concentrated returns in a small number of Biotech and Regional Banking firms. In our MicroCap Opportunities Fund, Healthcare (which includes Biotechnology) was the largest sector detractor from performance, contributing -1.50% to relative performance. In addition, our portfolios are currently invested with a cyclical bias in energy, technology, and industrial companies. This is wholly a result of our bottom-up analysis and our conviction that the greatest upside opportunity in micro-cap space can currently be found in cyclical companies. However, more cyclical investments have suffered due to a general flight to liquidity most of this year. Along with the aforementioned Healthcare sector, three of the top four sector detractors to performance were in fact Energy, Technology, and Industrials.

Stock selection has had a greater positive impact on the Ultra MicroCap Funds’ performance than seen in the MicroCap Opportunities Fund this year. This is not surprisingly considering we are investing in companies which are so far off the traditional radar; the current median market capitalization is approximately $50 million. One of our top performing holdings, U.S. Home Systems (USHS), provides customized kitchen and bathroom remodeling for Home Depot customers. USHS increased nearly threefold in a matter of two months on what was essentially market speculation about the recovery in U.S. housing. This type of “irrational buying” demonstrates the potential upside of investing in less liquid securities that many investors may overlook when focusing only on the risk to the downside of investing in micro-cap companies. Having experienced this type of short- term investor behavior many times before, we reduced our position by half before the stock returned to more normalized prices. USHS’s business is still growing and at today’s more modest price we believe that future earnings could equal a P/E in the mid single-digits.

Manager Commentary, 1st Quarter 2012

Three Years Later: Investor Sentiment Still Timid

You would not believe that investor confidence has returned if you only paid attention to the headlines. News of troubles in the Eurozone, a potentially slowing Chinese economy and partisan bickering in the U.S. have all contributed to a very pessimistic attitude among equity investors. Yet stock prices tell a much brighter story, as seen in the performance table below. Our MicroCap Funds have returned nearly 30% annually over the last three years since the market lows and overall equity markets, as measured by the S&P 500 Index, have approximately doubled during the same period. What investors fail to realize is that equity markets have typically climbed a “wall of worry” and that in terms of stock prices the headwinds in the news today are largely a thing of the past. We remain confident in the future of small/micro-cap equities based on our conversations with management teams, who are much more optimistic than headlines might have you believe. Companies are reporting strong corporate profits, cash flows are rising, and management teams are strategically deploying cash by increasing dividends, buying back shares, or making accretive acquisitions. In fact, this “cash attitude” thesis we have spoken about previously was confirmed by the world’s largest company, Apple (AAPL), which recently declared a dividend and outlined other plans to deploy cash.

“Companies are reporting strong corporate profits, cash flows are rising, and management teams are strategically deploying cash by increasing dividends, buying back shares, or making accretive acquisitions.”

Click here for standardized fund performance.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-800-331-8936. The funds impose a 2% redemption fee for shares held less than 90 days. Performance data quoted does not reflect the redemption fee. If reflected, total return would be reduced.

According to the Investment Company Institute, investors have placed nearly one trillion dollars (net) into bond funds while taking nearly five hundred billion dollars out of domestic equity funds during the past six years. This massive flow from equity funds into bond funds is not surprising given that investors have experienced volatile equity markets with little return (specifically in large-cap equities) during the past ten years*.

The flows are not only from individual investors but also institutional investors such as pension funds. In fact, according to pension consulting firm Millman, assets into equities dropped to 38% in 2011 from 44% in 2010; while fixed income climbed to nearly 42% from 36% in the same time period. It may get even worse. Neil Schloss, VP and Treasurer of Ford Motors (F) was quoted at a recent conference saying, “we’re about 45% bonds today and over time we will move to a target of about 80% bonds.”

Equity markets have performed well despite a relentless outflow of cash due to several reasons including strong corporate profits, the fact that companies are purchasing back their own shares and the simple law of supply and demand. While the “demand” for equities is declining as seen in the patterns of inflows and outflows, the “supply” has actually decreased at the same time. The number of stocks publicly traded and the amount of shares available to investors has significantly declined over the past ten years. According to The Frank Russell Company, the number of investable stocks has declined by 40% since 1999. In 1999 there were nearly 6,000 domestic companies listed on major exchanges, as compared to just 3,566 today. If investors return to equity markets in any magnitude, a simple law of economics would suggest that the shrinking supply of companies to invest in could have a strong impact on rising prices.

How is your portfolio is positioned today compared to ten years ago?

We build portfolios from the bottom up based on a fundamental analysis of financial statements and in-person meetings with company management teams, so we do not make macro calls. However, a look at how our portfolios are structured does provide an understanding of where we are finding the most attractive valuations.

There is a greater allocation to cyclical companies in our portfolios today as compared to ten years ago. As you can see in the accompanying table*, just 10% of our portfolios are invested in defensive sectors such as consumer staples, health care, utilities or cash. Ten years ago this number was over 30%. This demonstrates our outlook that the business cycle is on the mend and that more economically sensitive small companies are beginning to thrive. While our cyclical bias detracted from performance somewhat in 2011, the top three sector contributors to performance in 2012 are technology, energy and industrials.

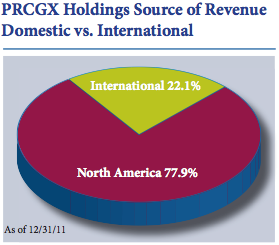

Sales of U.S. small/microcap companies are generally less global than that of large companies. According to Standard & Poor’s most recent analysis*, S&P 500 companies posted 46.3% of their sales from outside of the United States in 2010. By contrast, over three-quarters of revenues for companies in the Perritt MicroCap opportunities Fund were from North America. While some international economies appear to be faltering – notably the Eurozone where unemployment hit a 15 year high in February – there has been visible strength in the U.S. economy according to major indicators. The February University of Michigan consumer confidence and Institute of Supply Management service index reached their highest point in one year, the initial jobless claims 4 week average is at its lowest point since March 2008, and vehicle sales recorded the best month since May 2008 (excluding the cash for clunkers month of August 2009). Investors who wish to participate in im- provements in the U.S. economy may wish to look to small/micro-caps with more domestically-driven revenue sources as they seek to take advantage of U.S. improvements.

“Investors who wish to participate in improvements in the U.S. economy may wish to look to small/micro-caps with more domestically-driven revenue sources as they seek to take advantage of U.S. improvements.”

While some international economies appear to be faltering – notably the Eurozone where unemployment hit a 15 year high in February – there has been visible strength in the U.S. economy according to major indicators. The February University of Michigan consumer confidence and Institute of Supply Management service index reached their highest point in one year, the initial jobless claims 4 week average is at its lowest point since March 2008, and vehicle sales recorded the best month since May 2008 (excluding the cash for clunkers month of August 2009). Investors who wish to participate in improvements in the U.S. economy may wish to look to small/micro-caps with more domestically-driven revenue sources as they seek to take advantage of U.S. improvements. First quarter outperformance for the MicroCap Opportunities Fund was largely a result of stock selection and our cyclical bias. The top sector contributors included Technology (added 4.2% to performance), Energy (2.9%) and Industrials (2.9%). Because the microcap space is so vast, the active returns investors can earn are much more likely to come from stock selection as opposed to sector bets. That said, microcap stocks in sectors which the market is favoring can experience the catalyst which transforms them from an unknown to a Wall Street darling in an instant. For example, Global Cash Access (GCA), one of our top performing holdings, increased over 75% for the quarter after finally being recognized by analysts on Wall Street. Recent trading volume in GCA is four or five times greater than when we first began purchasing it. Despite the 75% increase in price, as of 3/31/12 the stock traded at only ten times earnings today, demonstrating how undervalued it was before other investors caught on. As we often like to do once volume picks up and price increases rapidly, we have reduced our risk by taking some profits off the table.

All of the outperformance by the Emerging Opportunities fund during the first quarter was due to stock selection. This is often the case when investing in companies with a median market capitalization of approximately $60 million which are so far off the traditional radar. We had some of our best success investing in technology stocks, which contributed 4.2% to the Fund’s performance as a sector. One of our top performing holdings, Innodata (INOD), is a business specializing in e-reader and e-book technology. The company helped Amazon develop the Kindle and has now been brought on to help Apple develop the e-reading technology in the iPad. INOD has no analyst coverage despite earning over $100 million in revenue and a healthy backlog of clients.

Manager Commentary, 4th Quarter 2011

Cash Value

What CEO’s of Small Businesses Are Doing Now to Enhance Shareholder Value

Don’t let headline market returns fool you; in the small and micro-cap space, shareholder value is being enhanced. Increased uncertainty and a rush to liquidity led to a disappointing year for micro-cap investors in 2011. However, the noise that is driving investor behavior such as political inaction and partisan bickering is short-term in nature. We are much more interested in analyzing the attitudes of the CEO’s of small businesses that we speak to in our offices every day. These attitudes reflect the true nature of long-term trends in our economy.

The number one difference that we detect in the management teams between now and 2008-09 is what we describe as their “Cash Attitude.” Simply put, management teams are no longer trying to survive, they are creating new ways to thrive. A few years ago, the top concern for most management teams was ensuring that they had enough cash in the bank to survive a difficult recession. Today, management teams are utilizing their cash and balance sheets to expand their businesses and enhance shareholder value in a variety of ways.

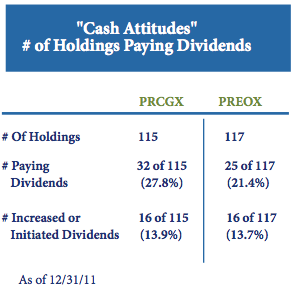

As you know, shareholder value comes in many forms. In addition to bottom-line growth, companies can increase shareholder value by initiating or increasing cash dividends. As can be seen in the accompanying table, nearly one-third of the holdings in the MicroCap Opportunities Fund pay a dividend and nearly 15% increased or initiated a dividend in 2011. Another way companies can enhance shareholder value is by buying back their own company’s stock. Although you’re not as likely to hear about it in the media, small-cap companies are often better positioned than their large-cap peers to buy-back their own shares. There are several companies within our portfolios that continue to buy back their own shares at levels they consider undervalued. For example, AEP Industries (AEPI) repurchased approximately $20 million worth of its shares in a privately negotiated deal in June of last year (nearly 15% of the company’s market cap at that time). We were pleased that management acted on their conviction that the company’s share-price did not accurately reflect shareholder value.

“Simply put, management teams are no longer trying to survive, they are creating new ways to thrive”

Finally, shareholder value can be enhanced by acquiring other companies. With ultra-low interest rates and depressed stock prices, it can make greater economic sense to buy a company rather than build it. Lately, we have seen management teams acquire companies that are not only synergistic but are also imm ediately accretive to their current business. For example, Glo-becomm System (GCOM) acquired Comm Source, Inc. in April 2011. Using cash to buy a profitable company that is delivering current earnings was immediately accretive to Globecomm’s financials.

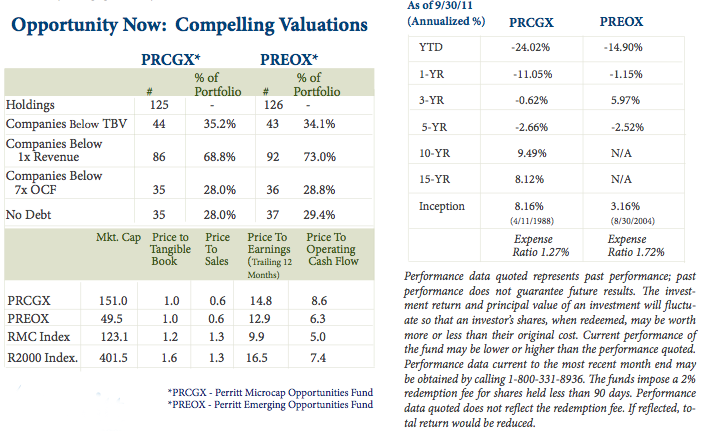

Valuations

Regarding valuations, the small/microcap universe is attractively priced based on several characteristics, as seen in the accompanying table*. The most talked-about measure, the price-to-earnings ratio, appears the least attractive. However, we en- courage investors to take a closer look at price-to-sales and price-to-book value, which are very compelling. We believe these two characteristics indicate that there is substantial cash flow and/or earnings power that can soon reach the bottom line.

Despite a contraction in valuation multiples, micro-cap equities have been growing cash flows, book values and overall shareholder value over the past few years. Perhaps more importantly, the “cash attitudes” of management teams indicate that there is a robust period of growth underway for well-run micro-cap companies currently being unrecognized by the market. As is often the case, micro-cap stock prices have been slow to respond due in part to their under-followed and under-researched nature. We believe this is a short term phenomenon and that shareholder value will ultimately be recognized with higher stock prices.

In 2011, sector allocation contributed more to The MicroCap Opportunities Fund’s under performance than stock selection. Nearly half of the Fund’s under performance was due to our significant overweight to the Energy and Industrials sectors relative to the benchmark. As we have noted before, much of the under performance in more cyclical sectors was due to a general flight to liquidity as investors abandoned micro-cap stocks during the year. Selling was often focused on the more volatile Energy, Industrials and Technology spaces, and on our lower market caps names in particular.

Regarding stock selection, our largest detractor during the year was within the consumer discretionary segment (Furniture Brands (FBN), Kimball International (KBALB) and CPI Corp (CPY) are examples). We are confident that, over time, investors will realize that these undiscovered companies are in fact trading at very attractive levels relative to their strong underlying fundamentals. Some recovery has already been realized in 2011: although CPY is no longer in the portfolio, FBN and KBALB are up 18% and 23%, respectively, this year (as of 1/25/12). It is important to note that individual stock selection within the energy sector contributed more positive return to the portfolio than did our selection within any other industry. This demonstrates the high level of opportunity that exists in the Energy space, despite the fact that many Energy names struggled to find recognition in 2011. In the micro-cap space, the best Energy opportunities tend to be found in service companies. Two of the portfolio’s top five contributors in 2011 were energy related companies: TGC Industries (TGE) and Newpark Resources (NR).

Under performance in Technology and Consumer Discretionary sectors detracted from The Emerging Opportunities Fund’s relative return in 2011. With a median market capitalization of just $50 Million, the investments in the Perritt Emerging Opportunities’ portfolio tend to be off the radar for traditional Wall Street analysts, helping these companies to move independently of the market. According to Morningstar, the Fund’s r-squared of 66.32 vs. the S&P 500 Index is the lowest of over 8,000 long-only U.S. Mutual Funds, as of 1/25/12.

Manager Commentary, 3rd Quarter 2011

Numbers Don’t Lie: A Disappointing Quarter, Compelling Opportunity?

If we believe that numbers don’t lie, then our words shouldn’t either: we are disappointed with our recent performance. Yet cold, hard numbers can teach us a lot, especially in an environment being dominated by emotion. In this commentary we will keep the words short and focus on the data. What can it tell us about the recent downturn? And where is the opportunity?

The extreme volatility in the microcap space was caused by a rush to liquidity by investors of all kinds. Fearful investors shunned the stocks that were less likely to be able to provide them with short term cash and they placed a premium valuation on more liquid, defensive names. The result was that poor performance has been most pronounced in the lower marketcap stocks, as seen in the adjacent table. Because we invest primarily in the sub-$500 million market cap range, the companies that we invest in were adversely affected.

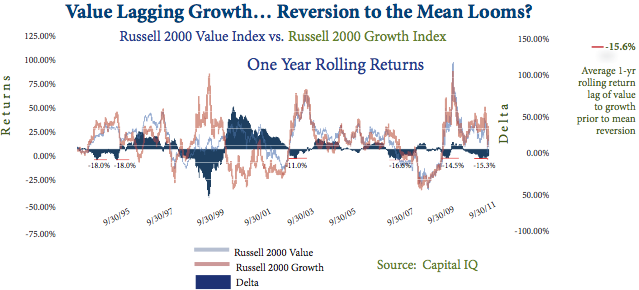

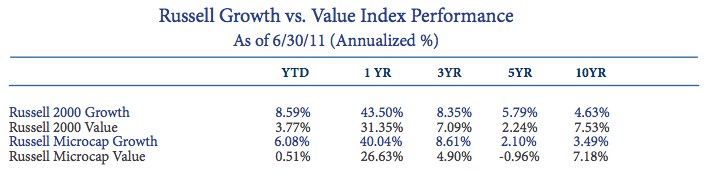

Value stocks have lagged growth stocks in the small-cap space this year, although this trend has been slightly reversing. In the past twenty years, The Russell 2000 Value Index has lagged the Russell 2000 Growth Index in seven distinct periods outside of the Technology Boom of the late 90’s, which can be viewed as somewhat of an anomaly. In each of the seven periods, the Value Index lagged the Growth Index by an average of 15.6% on a one-year basis before a predicable reversion to the mean occurred. In April of this year, the one-year return of the Value index lagged the Growth Index by 15.8%. As expected, since that time small-cap value stocks have outperformed. We tend to invest with an emphasis on solid fundamentals and clean balance sheets and we prefer to not pay for a price-to-earnings growth (PEG) ratio of over 1.0 for a growing company. Because of this, the relative outperformance of growth stocks has hurt our portfolio on a year-to-date and one-year basis, although it is encouraging that this trend is slightly reversing as might be expected.

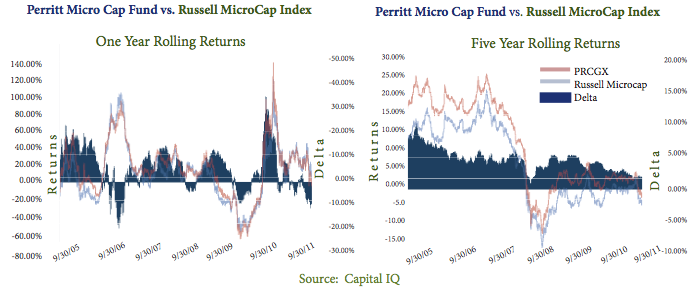

Short Term Volatility… Long Term Track Record

We know that the best way to measure performance is over a full market cycle. Despite being disappointed with our recent short-term performance, we do remember that we have been here before. We are confident about the future because our five-year rolling returns (shown below)* confirm that our shareholders have profited relative to the Index despite short term volatility.

Our twenty years of experience investing over multiple market cycles has taught us that it is difficult – if not impossible – to predict the moment when a short-term trend in under-performance of a market segment or a skilled manager reverses itself. However, portfolio valuations have often provided a good forecast. Many of the stocks in our portfolio have been a victim of indiscriminate selling regardless of balance sheet fundamentals or business performance. We hope that the valuation data and examples that follow will give you an insight into the earnings power and upside opportunity in our portfolios that are currently being ignored by Wall Street.

During the third quarter both the sector allocation and the stock selection hurt the performance of the Microcap Opportunities Fund. Much of the under performance was due to our significant underweight in Financials relative to the benchmark*.

The Fund has historically been significantly underweight in Financials and we expect that trend will continue as the number of high-quality financial companies in the micro-cap space is limited. However, despite our large underweight to the sector, we have lately increased our allocation to Financials as we have seen several attractively priced and compelling opportunities in the sector lately, mainly in asset managers and some regional banks.

Year-to-date, over half of the MicroCap Opportunities Fund’s relative under performance was due to our selection in the Technology sector. As explained in the beginning of this commentary, much of this had to do with a general flight to liquidity as investors abandoned micro-cap stocks. There was a large amount of selling focused on the more volatile Technology space, and on our lower market caps names in particular. We remain convinced about the long-term prospects of many micro-cap companies in the technology space because the strength of balance sheets in relation to stock prices is as attractive as we have seen in many years.

Stock selection was the reason that The Emerging Opportunities Fund outperformed its benchmark in the quarter as well as on a year-to-date basis. The Fund was driven by outperformance in stocks of nearly every sector. Selection was particularly strong in the Health Care sector, aided by the buy-out of two companies (American Medical Alert Corp. and Allied Healthcare International) at a significant return. Whether lucky or good, we are well-aware the kinds of “nano-cap” companies we invest in do march to the beat of their own drum and that making short-term comparisons to a benchmark can be something of a ridiculous exercise. As our clients know, we have good reason to believe this Fund is a truly distinctive offering which gives investors exposure to the very smallest of the small companies.

Manager Commentary, 2nd Quarter 2011

“Risk On, Risk Off”

The Misunderstanding of Business Risk And Why Inefficiency Reigns in the Micro-Cap Space

You don’t need your boutique and “undiscovered” micro-cap manager to tell you this, because you are probably hearing it everywhere. What we can tell you is that in the past six months the stock prices of some of the companies in our portfolio have suffered as a result. We feel these movements are short term in nature and do not greatly interfere with our 3 to 5 year investment outlook.

What we have seen is that investors are currently dismissing a number of micro-cap stocks as “risky” without having a complete understanding of the underlying businesses, and this has led to more pricing inefficiencies in the micro-cap space today.

As our shareholders know, we look for undiscovered companies that are not followed by Wall Street analysts. Stocks get ignored by Wall Street for a long list of reasons that includes a market capitalization that is deemed too small, a stock that is considered a “fallen angel,” or the fact that a company simply has no history or expectation of profitability. One area where we are finding what in our opinion are undiscovered and misunderstood companies today is what we call “cross-over stories.”

A cross-over story is a company that has a cash cow business and is using those profits to feed another business that has accelerating growth rates.

Click here for standardized fund performance.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-800-331-8936. The funds impose a 2% redemption fee for shares held less than 90 days. Performance data quoted does not reflect the redemption fee. If reflected, total return would be reduced.

A quick look at the financial statements or an automated screen of a cross-over story may give you a false impression of the underlying business. The cash cow portion of the business may be stagnant or have declining margins. Analysis focused on this portion of business may justify a lower valuation, and in the current environment may lead an investor to deem the business as “risky.” This misunderstanding of risk is precisely where we believe that the opportunity arises.

We seek to understand a company based on the entire picture because we make the effort to dig deeper and to meet with company management. Our analysis is often focused on the cross-over portion of the business, because our experience leads us to believe that this overlooked segment should drive earnings over the next 3 to 5 years. For example:

Rentrak (RENT)

Rentrak has been in the business of supplying VHS and DVDs to Mom & Pop video stores across the country for more than a decade. However, the rise of streaming video and other video-delivery options has caused this business to decline. Aware of this trend, Rentrak management diversified their business into demographic data tracking. Rentrak is now the leading provider of real-time audience data to marketing businesses. Rentrak’s crossover story is that its video-supplying business is feeding the higher growth rate and higher margin data-tracking business. We see this data-tracking segment becoming the majority of the company’s business in the future, a fact that we believe is being missed by Wall Street.

- Rentrak has been stuck in the range of approximately $100 million in revenue for multiple years.

- Revenue from the legacy business decreased in excess of 30%

- New data tracking revenue has grown from zero to in excess of $30 million.

- Margins in the data tracking business significantly higher than legacy business.

- As the company crosses over to the higher growth and higher margin data tracking business, earnings should accelerate to several dollars a share, equating to a single-digit P/E.

Landec(LNDC)

Landec has a legacy business of food packaging and distri-bution to grocery stores on the west coast. The company has developed a new line of business based on technology that extends the shelf-life of food, mainly bananas and avocados. Landec’s crossover story is that its food distribution business is feeding what could soon be a multi-million dollar recurring business with higher margins. This high growth/high margin business is being overlooked because it currently represents less than 20% of the firm’s business. However, we believe that the Breathway® segment could soon provide a major portion Landec’s overall revenue, possibly making the stock deeply undervalued to future earnings.

- Landec’s transition into the new business leads us to believe that the company can potentially possess an earnings power of $1.00, which equals a P/E in the single-digits.

“As our shareholders know, when a misunderstood company has received recognition historically the upside has been fast and significant”

Investors’ current aversion to risk has led to a significant amount of pricing inefficiencies in the micro-cap space and within our own Portfolios. In the short term this has affected performance, but we continue to have a strong conviction in our portfolios. As our shareholders know, when a misunderstood company has received recognition historically the upside has been fast and significant.

A crucial issue in determining when an under followed investment may gain recognition is the catalyst. This is something that we cannot be sure of. It could be growth rates that help micro-cap stocks gain the Street’s attention – small company growth rates could be 1.5-2 times the growth rates of larger companies, potentially helping small companies get into favor. But we just don’t know. Ultimately we are long term investors and we will continue to look for pricing inefficiencies in the micro-cap space, a task which has been getting a bit easier of late.

Small-Cap Market Overview

As we noted in our last commentary, larger market-cap names have been out-performing this year. This trend continued into the second quarter, with the largest names in the Russell 2000 Index providing a median return of 8.8%, as compared to -7.4% and -2.8% for companies under $150 MM and in the $150-$500 MM range, respectively, which is where we tend to invest.

This year the market has also favored growth over value, as the Russell Microcap Growth Index has provided investors with a 6.08% return YTD as compared to 0.51% for the Russell Microcap Value Index.

We invest with a long-term horizon because we understand the cyclical nature of the market. While short term periods where our investment style may be out of favor can be difficult, these periods have often provided us with the greatest opportunities, as described in this commentary. We believe that the true measure of a manager is over the full market cycle, and in our opinion our Portfolios are well-positioned to achieve another profitable run.

Manager Commentary, 1st Quarter 2011

Q: Despite a lack of coverage in mainstream media, the Russell 2000 recently hit a new all time high. What is your outlook?

A: The Russell 2000 hit a new all time high on April 27, 2011, closing at 858.31, above the mark of 855.77 set on July 13, 2007. Both the S&P 500 Index and the Dow Jones Industrial Average still have yet to fully recover from the bear market of 2008-09. The Russell 2000 Index’s continued climb relative to the broader markets has prompted us to take a closer look at what has been driving the Index’s recent performance, and to understand what this might mean for investors.

Despite the recent leadership by the Russell 2000 Index, a closer look at market internals leads us to believe that we are actually in the middle of a small-cap correction.

The Russell 2000 Index’s return has been driven by a small number of larger market-cap names. For the period of 12/21/10-4/12/11, the median return for companies with a market capitalization above $2 billion was 8.1%, as compared to just 1.1% for companies in the $150 million to $500 million market-cap range. Because the Russell 2000 Index is market-cap weighted, the stronger performance among larger names had an even greater effect on the Index’s overall return. Investors should be aware that the Russell 2000 Index will be rebalanced on June 24, 2011, as is performed annually. At that time, many of the larger stocks that have been driving the Index’s performance will be rotated out of the index in favor of smaller names. The correction can be observed in many of the true micro-cap names within the Russell 2000 Index that have in fact declined in price. In our opinion, much of these declines can be attributed to investors’ decisions to take profits, as many of the smallest names in the Index provided some of the strongest returns coming out of the down market.

Average Annualized Performance % as of 3/31/11*

Q: The MicroCap Opportunities Fund was up 6.27% for the quarter, yet the Fund saw its P/E ratios decline. How do you explain this apparent anomaly?

A: We believe that our ability to lower the P/E ratios in the portfolios during a strong period of positive returns demonstrates that we are still able to find value within our universe of micro-cap names. We are able to find value because of improving business fundamentals and the relative lagging performance of smaller names within the Russell 2000 Index, as discussed previously.

The decline in P/E ratios is two-fold: we rotated out of several more expensive names into more modestly priced equities and we also saw a broad increase in company earnings

The most interesting part of the decline in P/E ratios is that on a weighted average basis this trend is amplified. As you can see in the table below, the weighted average P/E ratio of the Fund declined significantly within the last quarter. This demonstrates that we have focused portfolio assets among more value-oriented equities. For example, in the MicroCap Opportunities Fund we recently sold Vasco Data Security (VDSI), a company trading at 40x earnings, and purchased two companies, Global Cash Access (GCA) and Intersections (INTX), which are both trading close to 10x earnings.

Russell 2000 Index Performance by Market Capitalization 12/31/10-4/12/11*

Q: What trends are you discovering regarding dividends within the small company universe?

A: Smaller companies are certainly not known to pay out a significant amount of dividends. However, lately more small companies are both initiating dividends as well as increasing dividends. In The Microcap Opportunities Fund there are 28 companies that pay out dividends. Eight of these have actually increased their dividends over the quarter. In The Emerging Opportunities Fund 16 companies pay out dividends. Five of these sixteen have recently increased dividends. Companies are also taking other actions in deploying their cash such as buying other businesses or buying back their own stock. Each of these trends has been significant in our portfolio and in the small-cap market as a whole. In our opinion, the fact that companies are finally using their cash instead of holding onto it demonstrates that they are no longer afraid of near-term problems with the overall economy. This gives us confidence that management teams should continue to take actions that will ultimately increase shareholder value.

Median and Dollar Weighted P/E ratios 12/31/10-3/31/11*

Lynn Burmeister, IACCP®

Matthew Brackmann, CFA®

Dianne Click

David Maglich

Interest Rate Hikes and Small-Cap Stock Returns

Interest Rate Hikes and Small-Cap Stock Returns

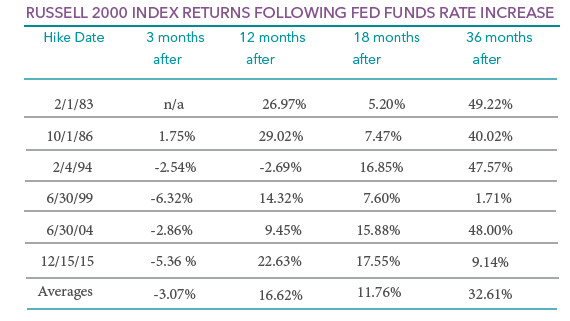

Regardless of the macro factor influences, investors are always concerned about future returns. One of those concerns is the impact on stock prices once the Federal Reserve starts raising short-term interest rates. While we certainly agree that many recessions happen after the Fed raises rates too much, it may interest investors how small-cap returns perform.

While exact dates and periods of past tapering actions or interpretations of “Fed speak” can’t be measured precisely, we can look at past periods of interest rate hikes and their impact on small-cap equity returns. From this data, investors may gain some historic context to enhance their perspective regarding Fed actions and stock returns.

The previous six times the Federal Reserve embarked on raising interest rates and the performance of small returns are listed below:

During the each of the last six instances, small-cap returns have provided positive average returns during the 12, 18 and 36-month periods following Fed tightening. Notably, small-cap stocks generally performed very strongly for the first twelve months following a rate hike, followed by a pull back during the ensuring six-month period. This indicates that, historically, if there is a time for concern regarding small-cap returns in relation to Fed actions, that time is typically twelve months following a rate hike. Lastly, it could be argued that the 12 to 18-month period could be a buying opportunity too. The 36-month return after an initial rate is remarkably strong.

The Micro-Cap Advantage: How MicroCap Equities Have Helped Enhance Return and Lower Correlation in Client Portfolios

The Micro-Cap Advantage

Ever since stock markets were created, investors have been devising schemes to enable them to beat the market’s average return. Some invest in large companies, some invest in small companies, and others ignore company size and invest in companies of any size as long as they have potential to produce market-topping returns. Some investors buy-and-hold while others trade frenetically. Some invest in high multiple growth stocks while others prefer to shop among companies whose stocks have recently been beaten down. Then there are the technical analysts and those who analyze only economic fundamentals. Some investors assemble portfolios from “the top down” while others prefer a “bottom up” approach.

Academics have long admonished investors for spending so much time trying to predict the future. They point to the plethora of studies that indicate the stock market is a reasonably efficient mechanism. In an efficient market, the best guess at tomorrow’s stock price is today’s price. The existence of numerous buyers and sellers and the near instantaneous flow of new information cause securities to be priced according to their inherent risk. Most academics will tell you the only way to produce market-topping long-term investment returns is to build and maintain a highly diversified portfolio that contains more systematic risk than the stock market as a whole. In short, what investors ultimately get from their equity portfolios is paid for by the risks they take.

The Small Firm Effect

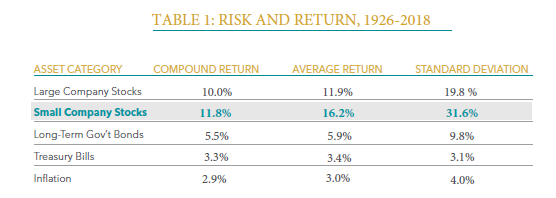

The first formidable crack in the so-called efficient market theory appeared in the late 1970s when a University of Chicago doctoral student discovered a strategy that has produced superior investment returns for more than 80 years. Superior meaning that this strategy has historically produced greater returns than dictated by portfolio risk. This strategy has come to be known as “the small firm effect.”

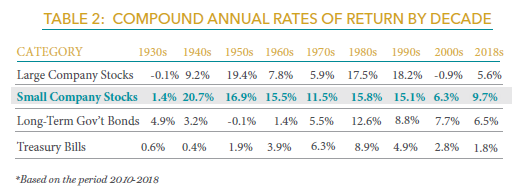

Simply put, the small firm effect is the tendency of the common stocks of small firms to outperform the common stocks of large firms given the same level of risk. In an efficient market, the expected rate of return from any portfolio is directly related to its non-diversifiable risk. The greater the level of non-diversifiable risk, the greater the expected rate of return. Contemporary research, however, indicates that this has not been the case for well-diversified portfolios consisting of small firm common stocks.

The small firm effect was first measured in 1978 by Rolf Banz while completing his doctoral dissertation at the University of Chicago. Banz ranked NYSE-listed stocks by market capitalization and formed five portfolios containing the largest to smallest stocks listed on the Exchange. These portfolios were held for five years and then the stocks were re-ranked and new portfolios were formed. He repeated the process throughout the period 1925 through 1975. Next, he measured the monthly returns of each portfolio and applied a least squares regression analysis to those returns to obtain each portfolio’s beta (measure of relative systematic risk) and alpha (the portfolio’s average monthly risk-adjusted return). He expected portfolios with larger amounts of systematic risk to produce larger investment returns than portfolios with smaller amounts of systematic risk. What he found was a return anomaly that has yet to be fully explained.