Marvelous Microcaps

Pure Cycle Corporation (PCYO)

INTRO:

At Perritt Capital Management, we take focused positions in companies where we have a high conviction in their success; companies that are out of the mainstream of small cap investing. To highlight our process, we are pleased to present the newest installment in our ongoing series “Marvelous Microcaps – Big Ideas on Small Companies.” This series profiles companies that we believe have a niche in their existing markets or are launching a product that could disrupt their marketplace.

THE COMPANY:

Pure Cycle Corporation (PCYO) designs, constructs, operates and maintains water and wastewater systems in the Denver metropolitan area. It has two divisions, Wholesale Water and Wastewater Services and Land Development. The company owns 29,000+ acre-feet of water rights providing industrial and oil and gas customers with water. They own 930 acres of land called Sky Ranch which they are currently developing. This development will have around 3,200 residential units and 2 million square feet of commercial, retail, and industrial uses. They recently started a Single-family home rental division which is benefiting from immediate asset appreciation and positive cash flows.

WHY WE OWN: THE PERRITT ADVANTAGE

Pure Cycle is not an easy company to understand and that is where the Perritt Advantage comes in. PCYO takes their water sources, treats it, stores it, and distributes it to their customers. The customers are in the planned development of Sky Ranch. PCYO gets connection charges for each home, around $32,000, and then they charge a consumption fee. They have a closed loop system of use and reuse. Water is also sold to oil and gas customers. Each rig can drill as many as 25 to 30 wells a year. The more wells – the more water sold. The newest division is the single-family rental with 4 homes rented and 10 under construction. They estimate they will eventually have 50 rental homes generating $880,000 in cash flow from operations.

In summary PCYO has very valuable low-cost basis legacy assets both in water and land. As they continue to grow the company, they will do small tuck-in acquisitions. Financial results will continue to be lumpy based on the oil and gas industry and housing sales. Their assets are solid and irreplaceable.

Quipt Home Medical Corp. (QIPT)

INTRO:

At Perritt Capital Management, we take focused positions in companies where we have a high conviction in their success; companies that are out of the mainstream of small cap investing. To highlight our process, we are pleased to present the newest installment in our ongoing series “Marvelous Microcaps – Big Ideas on Small Companies.” This series profiles companies that we believe have a niche in their existing markets or are launching a product that could disrupt their marketplace.

THE COMPANY:

Quipt Home Medical Corp. (QIPT) is a provider of durable medical equipment, respiratory aids, and medical equipment and supplies for in-home use throughout the U.S.A. The company offers a wide range of products that address chronic health issues including cardiovascular and pulmonary diseases, sleep apnea, and other chronic health issues.

They offer a wide range of products including bariatric equipment, bathroom safety products, mobility products, CPAP machines, and hospital beds. They are the fifth largest provider of home medical equipment in the country, utilizing a network of 32,500 referring physicians to serve 270,000 plus patients. The company estimates they will make 690,000 plus deliveries in 2023 increasing from 516,328 in 2022. 79.7% of their revenue is from their respiratory product mix.

They currently have 115 locations in twenty-six states, with over 1,000 employees. They have a solid presence in the Southwest and Midwest regions of the country and are pursuing a series of strategic acquisitions to expand their footprint and increase their market penetration throughout the country.

They primarily offer equipment for lease which gives the company a strong recurring revenue stream. Based on their current projections for the next year, they estimate 82% of their revenue stream to be recurring, with the other 18% being made up of sales. 82% of their revenue is from Medicare, Medicaid, and private insurance programs with the other 18% made up of private payers.

WHY WE OWN: THE PERRITT ADVANTAGE

We made an investment in Quipt Medical in both funds due to both strong organic growth opportunities due to a favorable patient demographics as well as the company’s own internal growth initiatives via a strategic roll-up strategy.

On a macro level, Quipt is well positioned for growth due to demographic trends for the U.S. over the next several years. Per the company’s presentation, 10,000 Americans turning 65 every day and that segment of the population is expected to grow from 56 million in 2020 to 73 million in 2030. The aging population will require more at home health care. Additionally, they estimate that 31.7% of the population suffers from two or more chronic conditions, with that number expected to grow from 157 million in 2020 to 171 million in 2030. Many of these conditions are undiagnosed and represent unserved markets. Within respiratory conditions, the company estimates there are twenty-four million Americans suffering from undiagnosed sleep apnea. They also estimate there are 16 million patients suffering from COPD (Chronic Obstructive Pulmonary Disease) and they target market with higher rates of COPD patients for market expansion opportunities given their product mix.

The company has also been executing on a roll-up strategy, making 18 acquisitions since 2018. These acquisitions have brought in an additional $148 million in annualized revenues and account for much of the growth the company has experienced since that time. The market for home medical equipment leasing companies is highly fragmented, with most of the players being small private companies. Quipt targets companies with a focus on respiratory products and has certain margin requirements that weed out distressed candidates. They are dually focused on expanding their geographic footprint and infilling their markets with a more favorable mix of offerings, insurance contracts, and payor mixes.

So far, the combination of these organic growth trends and strategic growth initiatives has paid off for Quipt. For their fiscal year 2022 (their fiscal year ending in September, 2022) they saw revenues increase by 36.6% from $102.4 million to $139.9 million with similar growth in EBITDA going from $20.8 million to $32.03. For their fiscal year 2023 analyst estimates are for $223.26 million in revenue, or a 56% growth rate and EBITDA of $55 million, or a 76% growth rate. If the company meets these growth targets, we believe that will represent evidence of both leverage in their business model and continued success in their acquisition program.

Biomerica, Inc.: A health diagnostics company preparing to move up the value chain

INTRO:

At Perritt Capital Management, we take focused positions in companies where we have a high conviction in their success; companies that are out of the mainstream of small cap investing. To highlight our process, we are pleased to present the newest installment in our ongoing series “Marvelous Microcaps – Big Ideas on Small Companies.” This series profiles companies that we believe have a niche in their existing markets or are launching a product that could disrupt their marketplace.

THE COMPANY:

Biomerica, Inc., (BMRA) is a biomedical technology company that designs, develops, and manufactures laboratory and at home testing applications for various medical conditions and diseases. They are a commercial stage company, with products in the marketplace that test for conditions such as colorectal, breast, and prostate cancers as well as diabetes, kidney diseases and gastrointestinal afflictions. They are also in the late developmental stages of an exciting new laboratory application called InFoods. InFoods is a patented blood test for patients with irritable bowel syndrome, or IBS, which detects elevated antibody levels found in the human blood system and can match them to foods that are specific or highly correlated to disease states reported by patients. Utilizing an extensive database of control subjects the parameters and statistical sensitivities of the test can be customized to fit the needs of the patient and deliver results that report which foods are aggravating their condition with a high degree of confidence. There are an estimated 25-40 million Americans with IBS and related issues, most of whom are undiagnosed. The most common reported factor that contributes to the severity of IBS in patients is pain. Since IBS is chronic in most patients, the standard of care currently is guess work on dietary changes and pain medication to alleviate symptoms. InFoods aims to address both deficiencies head on by identifying which foods pose the most harm to patients allowing doctors and nutritionists the opportunity to customize a diet plan and improve patient outcomes, the quality of their day-to-day lives and address the underlying disease rather than use pain medications to manage its symptoms.

WHY WE OWN: THE PERRITT ADVANTAGE

We purchased Biomerica several years ago, shortly prior to the pandemic after speaking with the CEO, Zack Irani. At that time, the company had just received encouraging results on the first generation of the technology that would become InFoods. While investments in early-stage healthcare diagnostic and drug companies are normally avoided due to the risks in the development pipeline, Biomerica had already successfully gone to market with their cancer diagnostics products and at the time had just announced a distribution agreement with Medline, a large healthcare supply company. We found that this revenue stream, though small, was growing steadily and believed it removed some of the funding risks so decided to take a small position. Since that time Biomerica has conducted several rounds of Research &Development and investment in their product. They recently announced the final results for their end point trial for InFoods that showed statistically significant improvement for patients that used their laboratory test in areas including pain, bloating and overall quality of life. The next step for the company is to submit a proposal to the FDA for a pivotal trial, which if successful would be followed by full FDA approval for their test to be licensed for use in patients in commercial labs. If everything goes according to schedule this trial would commence during the end of 2023.

However, in the interim the company has the capability to offer the test through specialized clinical laboratories, so they have announced that they are commercializing InFoods during the final months of 2022 within those labs that qualify. Highlighted institutions in the company’s press release include the Mayo Clinic and Beth Israel Deaconess Medical Center. While it is too early stage to gauge the potential revenue impacts from the launch, we are excited to see the efforts of the company and our investment thesis validated in the marketplace and believe these efforts will provide the company with some additional cash flow as they prepare for the final push for full commercialization of InFoods.

We remain excited shareholders and are pleased to be able to share this emerging healthcare technology company with you. We consider Biomerica to be among our more speculative holdings given the regulatory risks associated with the FDA approval process. As they move further along in that process these risks will continue to diminish but at this time, they represent the biggest obstacle to the company’s long-term prospects. While the successful end point trial and limited commercialization is an encouraging development, we also emphasize that Biomerica is an early-stage company that we chose to highlight here to illustrate the variety of investments we hold in our funds and that we would only hold it as part of a well-diversified portfolio. Currently, we only own it in our Ultra Microcap Fund due to the speculative nature of the investment.

Data here is obtained from what are considered reliable sources; however, its accuracy, completeness, or reliability cannot be guaranteed.

Fund holdings and sector allocations are subject to change at any time and should not be considered a recommendation to buy or sell any security. Please click PRCGX and PREOX for a list of the top ten holdings.

Initial Public Offering (IPO) refers to the process of offering shares of a private corporation to the public in a new stock issuance. An IPO allows a company to raise capital from public investors.

Capital expenditures (CapEx) are funds used by a company to acquire, upgrade, and maintain physical assets such as property, plants, buildings, technology, or equipment. CapEx is often used to undertake new projects or investments by a company.

Before you invest in the Perritt MicroCap Opportunities Fund or Perritt Ultra MicroCap Fund, please refer to the prospectus for important information about the investment company, including investment objectives, risks, charges, and expenses. You may also obtain a hard copy of the prospectus by calling 800-331-8936. The prospectus should be read carefully before you invest.

Mutual fund investing involves risk. Principal loss is possible. The Funds invest in smaller companies, which involve additional risks, such as limited liquidity and greater volatility. The Funds invest in microcap companies which tend to perform poorly during times of economic stress. The Ultra MicroCap Fund may invest in early-stage companies which tend to be more volatile and more speculative than investments in more established companies.

Past Performance does not guarantee future results.

The Perritt Funds are distributed by Quasar Distributors, LLC.

First published October 2022.

2022 Perritt Funds Tax Distribution Update

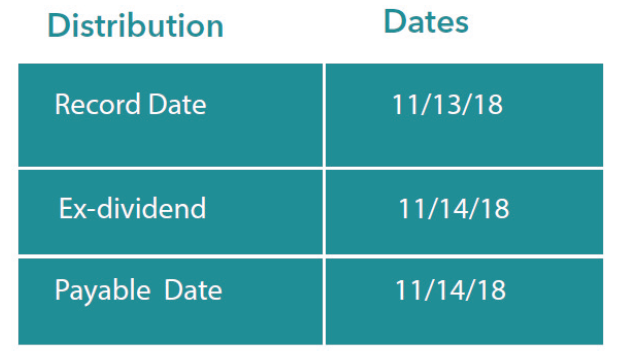

We anticipate the Perritt MicroCap Opportunities Fund and the Perritt Ultra MicroCap Fund will pay a capital gains distribution on 11/23/22 to shareholders. Based on our estimates:

- The long-term capital gains distribution in the Perritt MicroCap Opportunities Fund (PRCGX) was $0.75629 per share. The Perritt Ultra MicroCap Fund (PREOX) long-term capital gains distribution was $0.18381 per share.

- Any income or short-term gains in our Funds will be paid on 12/22/22 to shareholders of record on 12/21/22. However, neither fund is expected to have a short-term capital gain or income distribution.

Distribution figures and distribution dates are estimates only and are subject to change. Actual distributions may be substantially different (higher or lower) or may not be distributed at all.

Actual distributions on a dollar per share basis will be available on or after 11/23/2022.

Please visit our website at www.perrittcap.com/index.php or call 1-800-331-8936 for more information. Thank you for your investment and trust in the Perritt Team.

Click here for research and insights regarding small company investing.

Click here for a prospectus.

The Shyft Group, Inc.: Deliveries R Us

INTRO:

At Perritt Capital Management, we take focused positions in companies where we have a high conviction in their success; companies that are out of the mainstream of small cap investing. To highlight our process, we are pleased to present the newest installment in our ongoing series “Marvelous Microcaps – Big Ideas on Small Companies.” This series profiles companies that we believe have a niche in their existing markets or are launching a product that could disrupt their marketplace.

THE COMPANY:

The Shyft Group (SHYF) offers an unparalleled roster of commercial, retail, service specialty vehicle, and upfit brands. They uniquely combine in-depth industry knowledge, engineering and manufacturing expertise, and purposeful innovation to deliver job-enhancing efficiency-driving, ever-reliable products, and services. Their newest product is the exciting Blue Arc to support the Electric Vehicle (EV) transition. “Our industry has a responsibility to create a more environmentally sustainable future.” They are currently the only supplier in the Class 3 to Class 5 EV manufacturing. In addition, their Power Cube offers the ability to charge a fleet without significant investment by their customers.

WHY WE OWN: THE PERRITT ADVANTAGE

SHYF exemplifies what we look for in a microcap stock. Their sales have grown from $550 million in 2015 to $992m in 2021, adjusted EBITDA grew from 2.0% to 10.9% and the share price from $3.11 to $21.58 and the current price is around $22. They have both grown organically and deployed $100m toward acquisitions. Their goals are to have revenue of $1.75 billion and adjusted EBITDA of 15% by the year 2025. There is also a focus on ESG with energy efficient processes, investment in the electric vehicle portfolio, waste/water management, among others. The new EV initiative should start a substantial payback in 2025. They have secured ~40% of volume with a recent pre-order, expect $500-600m in revenue from this division alone in 2025 and have ~12% payback on their initial investment. In short, they have an excellent management track record of transforming a company, best-in-class commercial grade product, and a rock-solid balance sheet.

Data here is obtained from what are considered reliable sources; however, its accuracy, completeness, or reliability cannot be guaranteed.

Fund holdings and sector allocations are subject to change at any time and should not be considered a recommendation to buy or sell any security. Please click PRCGX and PREOX for a list of the top ten holdings.

Initial Public Offering (IPO) refers to the process of offering shares of a private corporation to the public in a new stock issuance. An IPO allows a company to raise capital from public investors.

Capital expenditures (CapEx) are funds used by a company to acquire, upgrade, and maintain physical assets such as property, plants, buildings, technology, or equipment. CapEx is often used to undertake new projects or investments by a company.

Before you invest in the Perritt MicroCap Opportunities Fund or Perritt Ultra MicroCap Fund, please refer to the prospectus for important information about the investment company, including investment objectives, risks, charges, and expenses. You may also obtain a hard copy of the prospectus by calling 800-331-8936. The prospectus should be read carefully before you invest.

Mutual fund investing involves risk. Principal loss is possible. The Funds invest in smaller companies, which involve additional risks, such as limited liquidity and greater volatility. The Funds invest in microcap companies which tend to perform poorly during times of economic stress. The Ultra MicroCap Fund may invest in early-stage companies which tend to be more volatile and more speculative than investments in more established companies.

Past Performance does not guarantee future results.

The Perritt Funds are distributed by Quasar Distributors, LLC.

First published October 2022.

Bear Market Internals

Michael Corbett

Michael Corbett

CEO, CIO, Portfolio Manager

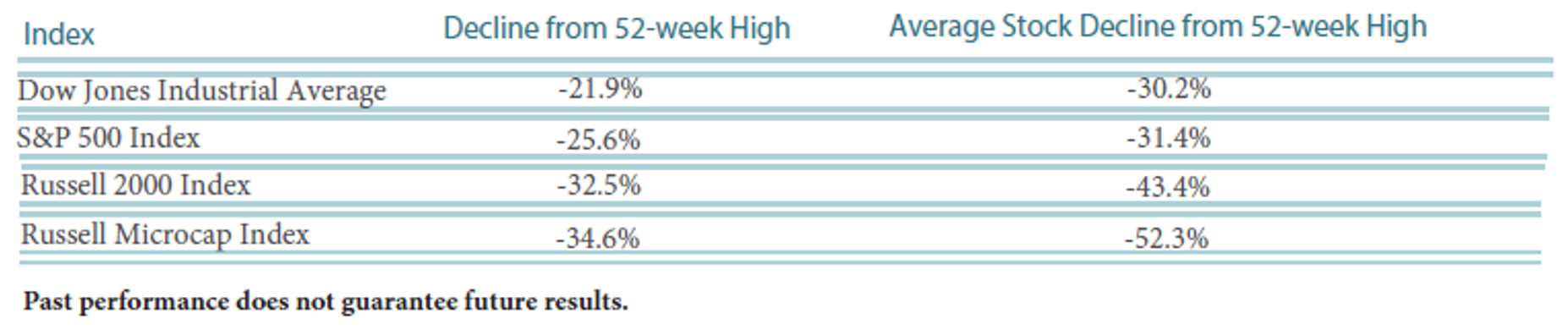

While each of the domestic indexes have clearly entered bear market territory, the average stock has experienced a far greater decline. Whether it is an individual stock or a broad index, bear markets are defined as declines of more than 20% from past their highs. As you can see in the table below, the bear market has reached each index with ranges of a 21.9% decline for the Dow Jones Industrial Average to the Russell Microcap Index decline of 34.6%. Each of these declines are as of September 30, 2022.

The average stock has experienced declines of 30.2% for Dow stocks to a whopping 52.3% for the average stock within the Russell Microcap index. The reason the declines are worse for the average stock versus the index is related to how stocks are weighted in each of these indexes. The Dow Industrial Average is weighted by a stock’s price. The other indexes are weighted by their market capitalization. For example, a stock like United Health Group (UNH) comprises more than 10% of the Dow due to its price more than $500 per share versus the average stock in the index is priced at only about $145. For the S&P 500 Index, the most heavily weighted stock is Apple (AAPL) at approximately 8% of the index due to its market capitalization of more than $2.3 trillion. Each of these stocks I mentioned have declined less than the average stock as well as less than their respective index.

The table below shows the percentage of stocks that declined in ranges. As you can see, smaller companies have experienced greater declines in this bear market. While this is not a major surprise, we argue these declines give us confidence we are closer the end of the bear market than the beginning or the middle.

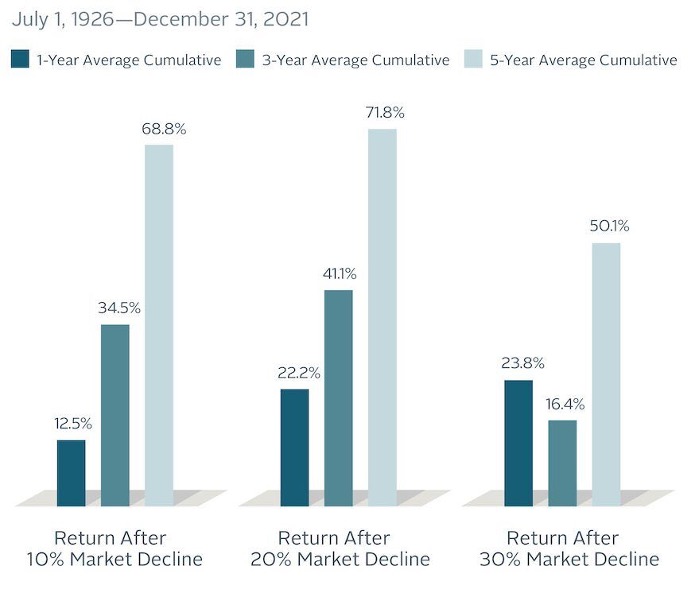

Here are a few other data points based on past bear markets. Since 1940, the average bear market during a recession lasts 13 months and declines 34%. The average bear market with no recession lasts 6 months and falls 24%. The current bear is now in its 10th month with a 25% decline. There have been eight previous times the S&P 500 has fallen 25% or more. The average returns following these declines have been 22% after one year, 37% after three, 83% after five, and 214% after ten. The Russell 2000 Index of small companies peaked in November of 2021 and is down 32.5% from its previous high. The Russell 2000 has fallen 30% or more in six previous periods, with the average 1-year, 3-year, 5-year and 10-year rebounds being 33%, 49%, 102%, and 228%.

What’s Next?

Director of Research

Remember when Fed Chairman Powell promised to kill inflation a month ago? Inflation is as prominent as ever. We knew prices were going up at the grocery store and it costs more to fill a tank of gas, but now wages are increasing, rents are skyrocketing, and of course mortgage rates are up. The recent .75-point increase is the Fed’s third such hike, boosting borrowing costs at the fastest pace in decades.

What should we expect next?

- We believe the Fed will keep raising rates until it restrains the economy and consumer spending decreases. The thought is that we will likely see rates at 4.4% to 4.6% by the end of the year. Fed Chairman Powell is a big believer that the mistake policymakers repeatedly made in the 1970s was allowing inflation to become more firmly entrenched.

- Higher rates will affect everything you do – credit card rates are the highest since 1996, mortgage rates the highest since 2008 and auto loans the highest since 2012. Consumers with credit card debt will spend an estimated additional $5.3 billion on interest.

- On the plus side, savings rates are up. Top-yielding online savings account rates are as high as 2.5%. However, they may not increase as much or as fast as you would expect.

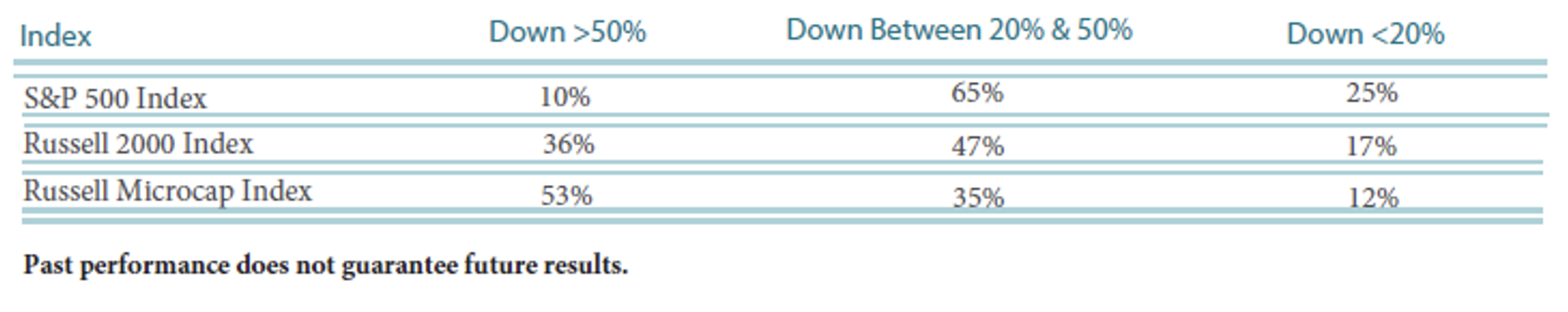

- The stock market has been declining in anticipation of this move by the Fed. During the five most recent rate hike cycles, the three leading stock market indexes only declined during one rate hike cycle. The period of 2008-2019 was an exceptional period due to the Housing Bubble.

Past performance does not guarantee future results. Index performance is not illustrative of fund performance. One cannot invest directly in an index. For fund performance please visit www.perrittmutualfunds.com.

Bowman Consulting Group: An emerging opportunity in the engineering and construction industry

INTRO:

At Perritt Capital Management, we take focused positions in companies where we have a high conviction in their success; companies that are out of the mainstream of small cap investing. To highlight our process, we are pleased to present the newest installment in our ongoing series “Marvelous Microcaps – Big Ideas on Small Companies.” This series profiles companies that we believe have a niche in their existing markets or are launching a product that could disrupt their marketplace.

THE COMPANY:

Bowman Consulting Group (BWMN) provides engineering and planning services for construction, transportation, energy, and mining industries. They provide a wide range of services including project planning and management, environmental consulting, design services, and engineering consulting among others. They do not engage in any of the actual construction on a project. Instead, Bowman’s contribution comes in the form of what is called human capital, or in other words their employees and their knowledge base. Bowman has been public since the spring of 2021 with the stated strategy of pursuing a roll-up strategy to grow their national footprint and become a top tier operator in their industry. They operate in a highly fragmented space and management estimates there are well over a thousand private competitors from which to select acquisition candidates. Projects they have been a part of include highway projects for the State of Illinois, infrastructure projects at copper mining sites for Freeport McMoRan, data centers, distribution centers, park and municipal construction, and retail construction projects for national chains, such as Walgreens, 7-Eleven, and Starbucks.

WHY WE OWN: THE PERRITT ADVANTAGE

Perritt purchased Bowman during its IPO based on the strong outlook for the space and our belief that the consulting space within the engineering and construction industry remains ripe with opportunities for consolidation and rapid growth. While roll-up strategies can be risky, we believe that it’s a viable strategy in specific industries where internal capital needs are low, the businesses generate operating profits, and there is a component of the business that requires a physical presence. In the case of Bowman, they operate in a space that requires very little capital expenditures due to low equipment needs; they do not take on project risk as a general contractor thus minimizing their downside risk on specific contracts that could adversely impact operating profitability; and they have demonstrated the ability to grow revenues organically in the double digits while also pursuing their roll-up strategy, so revenue growth is not dependent on acquisitions alone. We previously had remarkable success with an investment in a similar company named NV5 Global (NVEE), which IPO’d in 2013 with revenues of $60.58 million, a market capitalization of $25.26 million at a share price of $6.00. Today, NVEE has revenues of $767 million, a market cap of $2.1 billion, and a share price of $137.17 per share. While we do not know if Bowman will be able to achieve similar success, management has noted NVEE as one of the models for their strategy and we believe it demonstrates the viability of a roll-up strategy in the engineering and construction consulting industry.

The results so far have been encouraging. Since their IPO in the spring of 2021, Bowman has completed twelve acquisitions and grown revenues organically in the double digits. In their last quarterly report, they reported revenues of $62.4 million which represented a growth of almost 71% from the previous quarter in June of 2021 when they were first public. Organic growth has accounted for half of their revenue growth this year, with the other half coming from their twelve acquired businesses. They have generated cash from operations in each quarter since they have been public when the expenses of the IPO process led to modest cash burn of less than $1 million. In terms of headcount, they have grown their staff internally by 10% while also acquiring over six hundred employees of which 92% remain with the company post-merger. In a human-capital driven business, staff retention is paramount, and we believe these numbers reflect management’s success in shepherding their most valuable resources.

We consider Bowman Consulting to be a high conviction name and hold the security in both Perritt Funds. We were able to participate in the IPO by utilizing our external network of research brokerage houses and have continued to add to the position when we have felt conditions were favorable. While it is still early in the process and there are risks involved that could derail their strategy, we believe that the risk/reward with BWMN is attractive and that they are poised to continue growing both organically and through acquisitions for the near future.

Data here is obtained from what are considered reliable sources; however, its accuracy, completeness, or reliability cannot be guaranteed.

Fund holdings and sector allocations are subject to change at any time and should not be considered a recommendation to buy or sell any security. Please click PRCGX and PREOX for a list of the top ten holdings.

Initial Public Offering (IPO) refers to the process of offering shares of a private corporation to the public in a new stock issuance. An IPO allows a company to raise capital from public investors.

Capital expenditures (CapEx) are funds used by a company to acquire, upgrade, and maintain physical assets such as property, plants, buildings, technology, or equipment. CapEx is often used to undertake new projects or investments by a company.

Before you invest in the Perritt MicroCap Opportunities Fund or Perritt Ultra MicroCap Fund, please refer to the prospectus for important information about the investment company, including investment objectives, risks, charges, and expenses. You may also obtain a hard copy of the prospectus by calling 800-331-8936. The prospectus should be read carefully before you invest.

Mutual fund investing involves risk. Principal loss is possible. The Funds invest in smaller companies, which involve additional risks, such as limited liquidity and greater volatility. The Funds invest in microcap companies which tend to perform poorly during times of economic stress. The Ultra MicroCap Fund may invest in early-stage companies which tend to be more volatile and more speculative than investments in more established companies.

Past Performance does not guarantee future results.

The Perritt Funds are distributed by Quasar Distributors, LLC.

First published September 2022.

Hudson Global, Inc.: provides talent solutions for mid-to-large cap multinational companies and government agencies

INTRO:

At Perritt Capital Management, we take focused positions in companies where we have a high conviction in their success; companies that are out of the mainstream of small cap investing. To highlight our process, we are pleased to present the newest installment in our new series “Marvelous Microcaps – Big Ideas on Small Companies.” This series profiles companies that we believe have a niche in their existing markets or are launching a product that could disrupt their marketplace.

THE COMPANY:

Hudson Global, Inc. (HSON) provides customized recruitment process outsourcing (RPO) and total talent solutions to companies worldwide. The company operates in Asia Pacific (70% of 2021 revenues), the Americas (17%), and Europe (13%). RPO is a business model where a company outsources the management of the recruitment function (in whole or in part) to a third-party expert to drive cost, quality, efficiency, service, and scalability benefits.

HSON developed Project RPO to respond to their clients quickly with the ability to fill job roles in less than 30 days. Timely and cost-effective, the average recruitment outsourcing project may be implemented in as little as a few weeks and typically lasts between three to twelve months.

WHY WE OWN: THE PERRITT ADVANTAGE

HSON report their first quarter 2022 earnings per share of $0.97 which exceeded the $0.30 estimate. They earned $1.07 in 2021 and are anticipated to earn $3.24 in 2022 while trading at 11.1x earnings. HSON has marked a strong return after the pandemic by growing revenue 50.6% annually. They have used free cash flow for share repurchases and acquisitions. The October 2020 purchase of Coit Group and November 2021 acquisition of Karani, LLC represent adding complementary service offerings and expanding globally.

Hudson’s key strong point is its exclusive focus on the RPO market over the last couple of years. This market is expected to grow by 10-15% CAGR (Compound Annual Growth Rate) over the next couple of years and they are the only independent company operating in the sector, with others being divisions of larger companies.

We believe the share price does not fully reflect the improving fundamentals, specifically free cash flow generation, long-term EPS growth forecast of 20% and a healthy balance sheet.

Data here is obtained from what are considered reliable sources; however, its accuracy, completeness, or reliability cannot be guaranteed.

Fund holdings and sector allocations are subject to change at any time and should not be considered a recommendation to buy or sell any security. Please click PRCGX and PREOX for a list of the top ten holdings.

Perritt. Marvelous Microcaps – Big Ideas on Small Companies.

Compound annual growth rate or CAGR, is the mean annual growth rate of an investment over a specified period of time longer than one year.

EPS growth rate is the speed at which the earnings per share are growing.

Free cash flow is the cash a company generates after taking into consideration cash outflows that support its operations and maintain its capital assets.

Before you invest in the Perritt MicroCap Opportunities Fund or Perritt Ultra MicroCap Fund, please refer to the prospectus for important information about the investment company, including investment objectives, risks, charges, and expenses. You may also obtain a hard copy of the prospectus by calling 800-331-8936. The prospectus should be read carefully before you invest.

Mutual fund investing involves risk. Principal loss is possible. The Funds invest in smaller companies, which involve additional risks, such as limited liquidity and greater volatility. The Funds invest in microcap companies which tend to perform poorly during times of economic stress. The Ultra MicroCap Fund may invest in early-stage companies which tend to be more volatile and more speculative than investments in more established companies.

Past Performance does not guarantee future results.

The Perritt Funds are distributed by Quasar Distributors, LLC.

First published July 2022.

Bear Market Becomes Official

Michael Corbett

Michael Corbett

CEO, CIO, Portfolio Manager

The stock market “officially” became a bear market this week, defined as a 20% decline in the S&P 500 Index. Our regular readers know that we have already been in a bear market for some time. High flying tech stocks and the Russell 2000 Index of small company stocks both peaked February 2021, sixteen months ago as of this writing. Much of the remainder of the market peaked in November 2021.

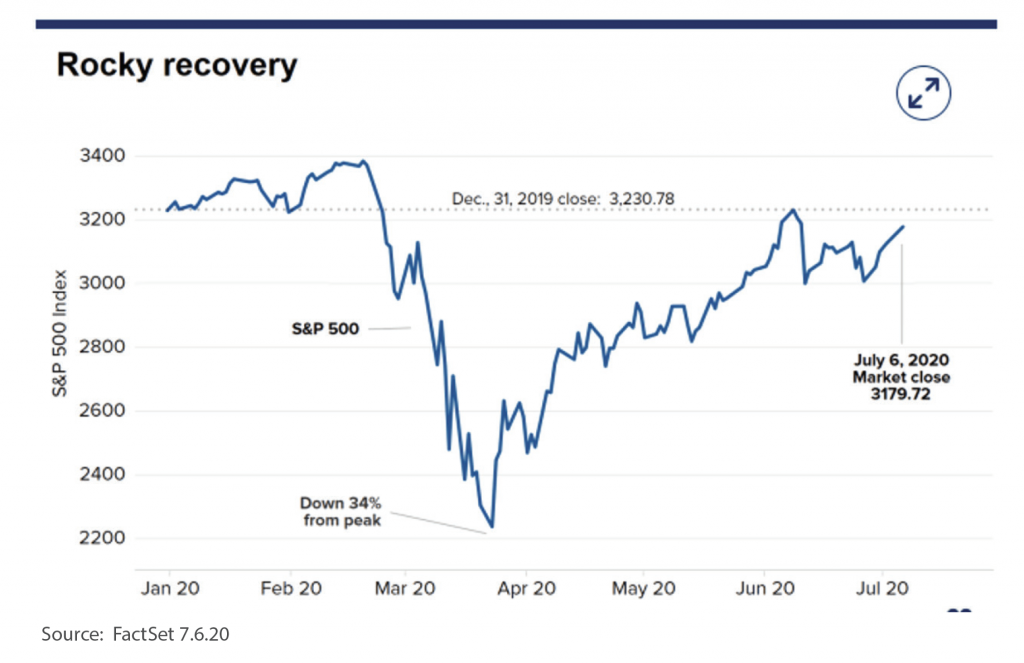

Viewed with this understanding, there is optimism that we may already be a good way through the fall. The average bear market lasts just over 300 days, and the current sell-off has been uniquely difficult because of its long duration. The S&P 500 declined for seven straight weeks beginning in March, the longest stretch of continuous losing weeks since 2001.

While market corrections are common – on average the market experiences a 10% decline once a year and a 20% fall once every six years – the last two market declines did not last long. The COVID-19 related bear market lasted only 33 days before bottoming and rising to new highs; and a nearly 20% correction that ended on Christmas eve in 2018 lasted only 90 days before starting a new rebound. Investors can be forgiven for recent memories that corrections are quick and painless. This time has been different.

The Fed remains committed to slowing inflation and will likely slow the economy with its actions. Interest rates were increased again this week with expectations for more. Their goal is to combat high inflation and prevent a wage-price spiral from taking hold. Rising rates are intended to slow consumer and business spending, which should eventually have a downward impact on inflation, while also raising the risk of recession.

Much of the economic correction the Fed is seeking has already been accomplished. Mortgage rates are higher, the housing and job markets have shown signs of slowing, and investors have certainly taken losses. However, it is debatable if the Fed can manage an economic “soft landing” – the slowing of inflation without causing a recession. Currently markets are pricing in a more recessionary outcome.

Bear markets that occur outside of a recession tend to be less severe and less lengthy. Recessionary bear markets result in greater losses and a longer time before recovery. If the economy avoids a recession, then we may be closer to the end of this bear market than the beginning. If not, there could be more difficulties ahead.

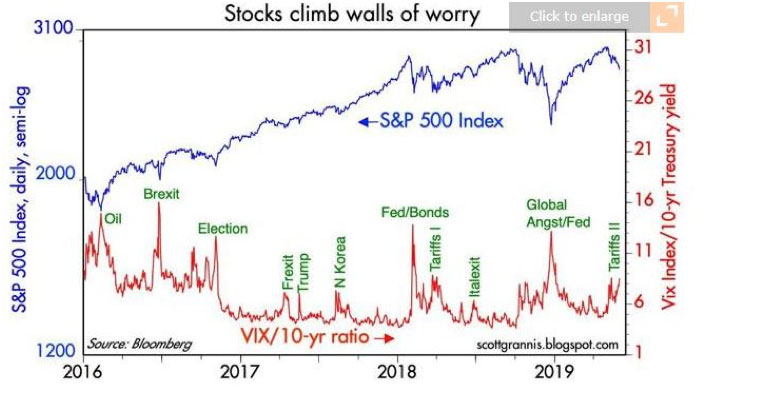

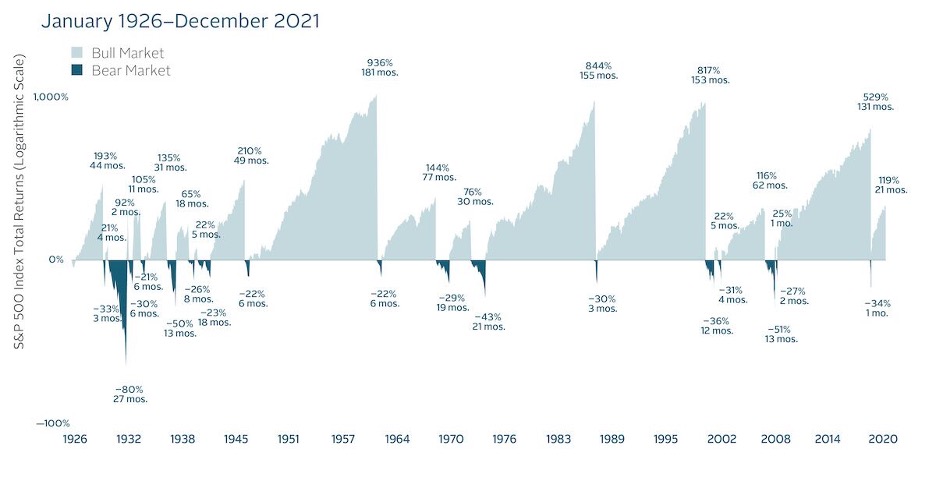

Markets are unpredictable, but they are good at reminding investors that stock prices do not simply go up, uninterrupted forever. We know this is a difficult environment. We believe the best strategy is to stay the course and focus on the long term, but every day one’s faith in the long-term is being tested. Remember we have been here before. We cannot know the precise timing or magnitude of bear markets, but history has taught us that the good times outweigh the bad. As seen below, the S&P 500 Index has experienced 17 bear markets since its inception, and when bull and bear markets are viewed together, it is clear equities have rewarded disciplined investors over the long term.

Source: Dimensional Fund Advisors

Time in the market beats timing the market

Times like these are typically when investors feel the grip of panic and want to sell everything and wait on the sidelines. However, historically this has been the worst strategy. The stock market is the only store in town that when they cut prices, customers run out the door. Warren Buffet’s adage, “be greedy when others are fearful,” is supported by the numbers. As seen in the table below, stocks have historically delivered strong returns following downturns.

Sticking with your plan helps put you in the best position to potentially capture the recovery. If you are looking for someone to talk to help you stay on your path, we are here for you. If you are concerned about your spending or savings plans, or if you have tax or estate complexities causing paralysis, let’s talk. In the meantime, we remain committed to managing your money with the same attention and care we do our own.

FAMA/FRENCH TOTAL US MARKET RESEARCH INDEX 1926—12/31/2021: Fama/French Total US Market Research Factor + One-Month US Treasury Bills. Source: Ken French website

ProPhase Labs, Inc.: An emerging play in laboratory and genetic testing

INTRO:

At Perritt Capital Management, we take focused positions in companies where we have a high conviction in their success; companies that are out of the mainstream of small cap investing. To highlight our process, we are pleased to present the newest installment in our new series “Marvelous Microcaps – Big Ideas on Small Companies.” This series profiles companies that we believe have a niche in their existing markets or are launching a product that could disrupt their marketplace.

THE COMPANY:

ProPhase Labs, Inc. (PRPH) is a provider of diagnostic services, OTC pharmaceutical products, and contract manufacturing services for third-party companies. Their diagnostics services consist primarily of processing COVID-19 tests through their wholly owned laboratory in Garden City, NJ. They also have a subsidiary called ProPhase Precision Medicine which was formed in August of 2021 in conjunction with their purchase of Nebula Genomics, Inc., a genetic testing company that sells kits online. Their consumer product lines primarily manufactures and markets nutritional supplements, sexual health supplements, and cold and cough lozenges.

The diagnostics business comprised approximately 87% of their revenues for 2021. This division was founded in October of 2020 in conjunction with the purchase of their initial laboratory in New Jersey to address the need for additional laboratory testing capacity as screening for the COVID-19 became more commonplace. As testing increased, the Company built a state-of-the-art 25,000 square feet lab in Garden City, NY which became their new headquarters. The outbreak of the Omicron Variant during this past winter led to that division growing revenues significantly as testing volume reached record levels. On a consolidated basis, the company reported revenues of $47.5 million in the most recent quarter, up from $15.3 million the previous year, an increase of 211%. They reported net income of $12.5 million and earnings-per-share of $0.81. They also announced a special dividend of $0.30 per share due to their strong results. Notably, just in the past two quarters combined, the Company reported $32.7 million in adjusted EBITDA on approximately 15.5 million shares outstanding. 69% of their testing revenues came from funding from the Department of Health Human Resources (HRSA) through a program for the uninsured. Funding for this program ended on March 22, 2022, and management stated on their most recent earnings call that due to this, revenues will be sequentially lower for the rest of the year, but each quarter will be higher on a year-over-year basis. There is also expected to be some seasonality with COVID-19 similar to the flu so testing revenues are expected to be higher in the winter than in the summer quarters.

WHY WE OWN: THE PERRITT ADVANTAGE

We own ProPhase Labs in both of our mutual funds and believe in the name due to their ability to position themselves strategically and execute in their marketplaces as demonstrated by their success in establishing a presence in two exciting markets with their COVID-19 and genetic testing capabilities. While there are some questions around the funding mechanism for uninsured patients through HRSA, the Biden administration is pushing for funding to be reinstated and the company is only accepting patients with insurance or that meet certain other criteria. This will mean lower revenues from that division for at least the rest of the year, but it likely will remain profitable with the goal to fund future growth opportunities for the company. The projected cash flow from this subsidiary along with approximately $21 million in net cash on their balance sheet sheet and over $50 million in net working capital should provide ample funding for their emerging growth opportunity in their genetic testing kits. While these kits are currently available online, ProPhase is working to sell them through their brick-and-mortar channels where they already have relationships through their other subsidiaries. Per commentary from CEO Ted Karkus during the recent earnings call, these tests provide the consumer with access whole genome sequencing. This is a key differentiator for personalized health related information compared to more well-known offerings from Ancestry.com and 23andMe that provide more limited genetic information primarily used for ancestry analysis. They are intended to provide consumers with detailed information regarding their genetic makeup and any diseases or conditions they may be predisposed to. Once consumers have their results, they can learn more about each potential condition through an extensive library of information that ProPhase provides allowing them to get the information they need to both understand their results and discuss them with their healthcare provider. We believe that this new offering and its extension into brick-and-mortar retailers later this year will fuel the next stage of growth for the company. In addition, their healthy balance sheet reduces the risk of any capital raises taking place during these challenging times in the market.

We consider ProPhase Labs to be a high conviction name. It is currently a top ten holding for both funds and we are encouraged by their most recent results, their return of capital to shareholders in the form of a special dividend in March and June, as well as their commitment to continuing to drive growth through their purchase of Nebula Genomics and its future integration into their distribution network.

Perritt. Marvelous Microcaps – Big Ideas on Small Companies.

Consumer Confidence and Microcap Stock Performance

Michael Corbett

Michael Corbett

CEO, CIO, Portfolio Manager

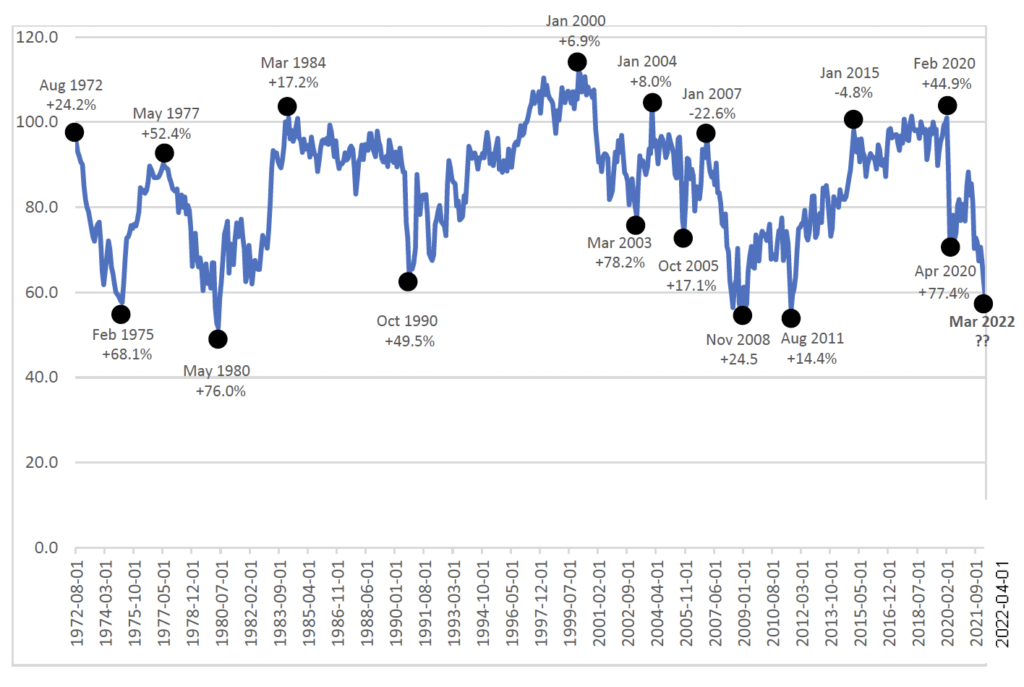

As the old adage says, a picture is worth a thousand words. The chart below shows how strong microcap performance can be in times following extremes in consumer sentiment.

We have plotted the University of Michigan Consumer Sentiment Index readings over the past 50 years. You will see microcap stock returns marked for the 12-month periods following consumer confidence peaks and troughs. While the average consumer confidence reading is 86, the extremes dip to near 50 and rise to more than 110.

Consumers can be a particularly moody bunch, but investors can be moodier. While most of the peak and trough points produced positive results for microcap stocks in the following 12-months, the degree of the returns is far stronger from trough periods. See for yourself.

Consumer Confidence and Microcap Stock Performance

Chicago Atlantic (REFI)

INTRO:

At Perritt Capital Management, we take focused positions in companies where we have a high conviction in their success; companies that are out of the mainstream of small cap investing. To highlight our process, we are pleased to present the newest installment in our new series “Marvelous Microcaps – Big Ideas on Small Companies”. This series profiles companies that we believe have a niche in their existing markets or are launching a product that could disrupt their marketplace.

THE COMPANY:

Chicago Atlantic (REFI) is a real estate finance company that is structured as a real estate investment trust, or REIT. A REIT is a pass-through vehicle, which means that the company does not pay federal income taxes if 90% or more of its taxable income is passed through to shareholders. This means that REITS often come with attractive dividend yields along with the opportunity for capital appreciation as their portfolio grows. While REIT investing is not a primary focus for us at Perritt, we will purchase one from time to time if we believe there is a unique value proposition to be had and we believe this is the case with Chicago Atlantic.

Chicago Atlantic lends to businesses in the cannabis space, in the form of senior loans secured by facilities and equipment. Due to the inconsistent nature of the United States’ cannabis laws, primarily the continued categorization as a schedule one controlled substance by the Federal government, banking in the space is difficult, with a limited number of firms serving the space. Most commercial banks that operate in states where cannabis is legal will not transact with businesses in the space due to the local and federal laws being at odds with each other; and since most banks operate in multiple states, they are regulated on the federal level. As a result, most businesses turn to the private lending markets for capital needs and Chicago Atlantic is one of those private lenders. Chicago Atlantic has operated for three years, reviewing over 500 loan applications and currently has 32 loans outstanding across 23 different portfolio companies. As of their last report dates March 16, 2022, loan commitments total approximately $324.2M. The company is new to the public markets, having completed their IPO last December to raise growth capital, all of which has already been committed to new loans.

WHY WE OWN: THE PERRITT ADVANTAGE

We took a position during the Initial Public Offering (IPO) in both of our funds based on our expectations that they would quickly deploy the additional capital that they raised from the IPO and subsequently raise their dividend as they received more money interest payments from a larger loan portfolio. During their last earning report in March, they reported an increase in their quarterly dividend payment from $0.26 cents per share to $0.40 per share, an increase of 53.8%. On an annualized basis this increase puts their forward dividend yield (the projected yield over the next 12 months) at 9%. We also believe that there are opportunities for capital appreciation in the stock price as the portfolio of loans grow.

We believe that the management team behind Chicago Atlantic has demonstrated a strong due diligence process, having reviewed over 500 applications, and maintaining a loan portfolio of 32 loans totaling $324M, with an additional $979 million in opportunities currently being evaluated in their pipeline. With the cannabis industry growing in multiple states as recreational legalization becomes more widespread, we believe that there is plenty of runway for Chicago Atlantic to continue to grow their loan portfolio with the same disciplined approach. Management recently stated on their conference call that they believe they are only in the second inning for the industry expansion due to the trends towards increased legalization across multiple jurisdictions. We also believe that their expertise in evaluating cannabis related loan applications, relationships with brand name cannabis firms, and pipeline of opportunities provide a competitive advantage over conventional commercial lenders in the event of banking legalization on the federal level.

We consider Chicago Atlantic to be a high conviction name with the caveat that cannabis space itself still is immature in many jurisdictions and that investing in the space comes with risks not found in other industries. Since purchasing Chicago Atlantic REIT in both funds during their IPO last December, we have subsequently added to name as initial results have confirmed our original thesis. We believe that the robust due diligence process they have in place, as well as their focus on the cannabis space will likely continue to allow for success in the future.

Perritt. Marvelous Microcaps – Big Ideas on Small Companies.

Radiant Logistics, Inc.: Third-party logistics company providing multi-modal transportation and logistics services

INTRO:

At Perritt Capital Management, we take focused positions in companies where we have high conviction of their success; companies that are out of the mainstream of small cap investing. To highlight our process, we are pleased to present the fifth installment in our new series “Marvelous Microcaps – Big Ideas on Small Companies”. This series profiles companies that we believe have a niche in their existing markets or are launching a product that could disrupt their marketplace.

THE COMPANY:

Radiant Logistics, Inc. (RLGT) is a third-party logistics company providing multi-modal transportation and logistics services primarily in the United States and Canada. They offer domestic and international air and ocean freight forwarding services, freight brokerage services and other value-added supply chain services. Bohn Crain founded the company in 2005 to execute a consolidation strategy in the transportation and logistics sector. Bohn has extensive experience at Schneider Logistics, Inc., CSX Corporation, and other similar companies. In a world with a volatile shipping environment, Radiant provides best-of-breed services to their customers and partners.

Radiant has consistently focused on bringing value to the agent-based forwarding community. They enable their strategic operating partners to be equity owners in the business. They offer unique succession planning and liquidity opportunities for station owners. Their network participants benefit from RLGT’s increased purchasing power, expanding network of global trading partners and their ongoing investment in technology. Through their shipment tracking tools customers can know exactly where their products are at any moment.

WHY WE OWN: THE PERRITT ADVANTAGE

Radiant recently reported second quarter earnings that were stellar. Their industry has been hit with tight capacity and strong demand. New capacity is limited as labor shortages and tight supply chains keep new capacity from coming online. RLGT has had a history of growing both organically and by making acquisitions. They recently acquired Navegate which helps it expand its digital platform and manage international, cross border and domestic freight delivery. Their services include customs brokerage, international ocean and air freight forwarding, domestic truck brokerage, drayage and transload services. Navegate’s proprietary global trade management software platform has been recognized as the “Top 50 Logistics Companies in North America” * over the last several years.

Radiant’s balance sheet is under levered allowing them to make more acquisitions and buy back their stock. In the second quarter alone, they repurchased $4.6m of stock. RLGT plans to use roughly 50% of its free cash flow to repurchase more stock and make additional tuck-in acquisitions. Their stock remains cheap relative to their peers, trading at 4x AEBITDA. Radiant has a strong management team and slim cost structure will help enable them to possibly grow revenue and increase margins. In addition, some of their hard-hit verticals, such as trade shows and retail store fixturing are returning to normal allowing further growth.

Perritt. Marvelous Microcaps – Big Ideas on Small Companies.

Interest Rate Hikes and Micro-Cap Stock Performance

Michael Corbett

Michael Corbett

CEO, CIO, Portfolio Manager

One of the primary duties of the Federal Reserve is to foster economic conditions that achieve price stability. Over the past 12 to 18 months, the Fed has explained that the inflation we have been experiencing is short-term and transitory. They have maintained that price stability will return soon. In November 2021, however, the Fed abandoned the “transitory” statements, acknowledging longer-term inflation in the economy. What factors influence the Fed’s decisions and actions? In addition to raising the Fed Funds rate recently, we see several economic indicators that lead to the expectation that the Fed will raise the Fed Funds rate several more times. With the Consumer Price Index and the Producer Price Index reporting the highest increase in more than 30 years, some believe 6 or 7 increases are likely in the next year.

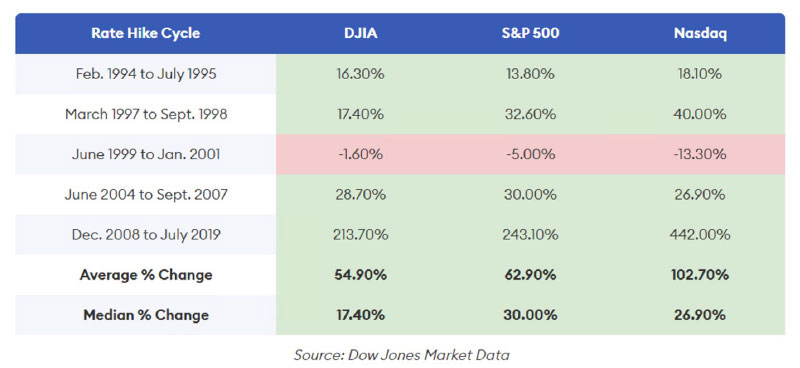

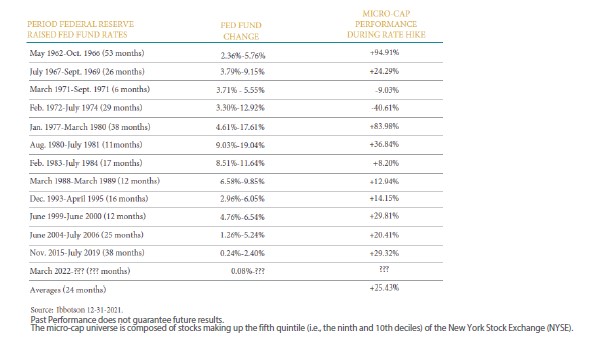

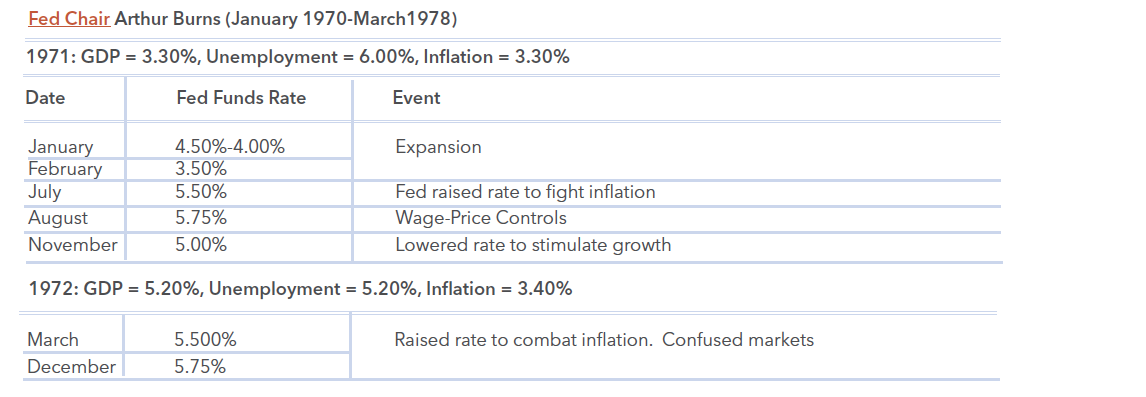

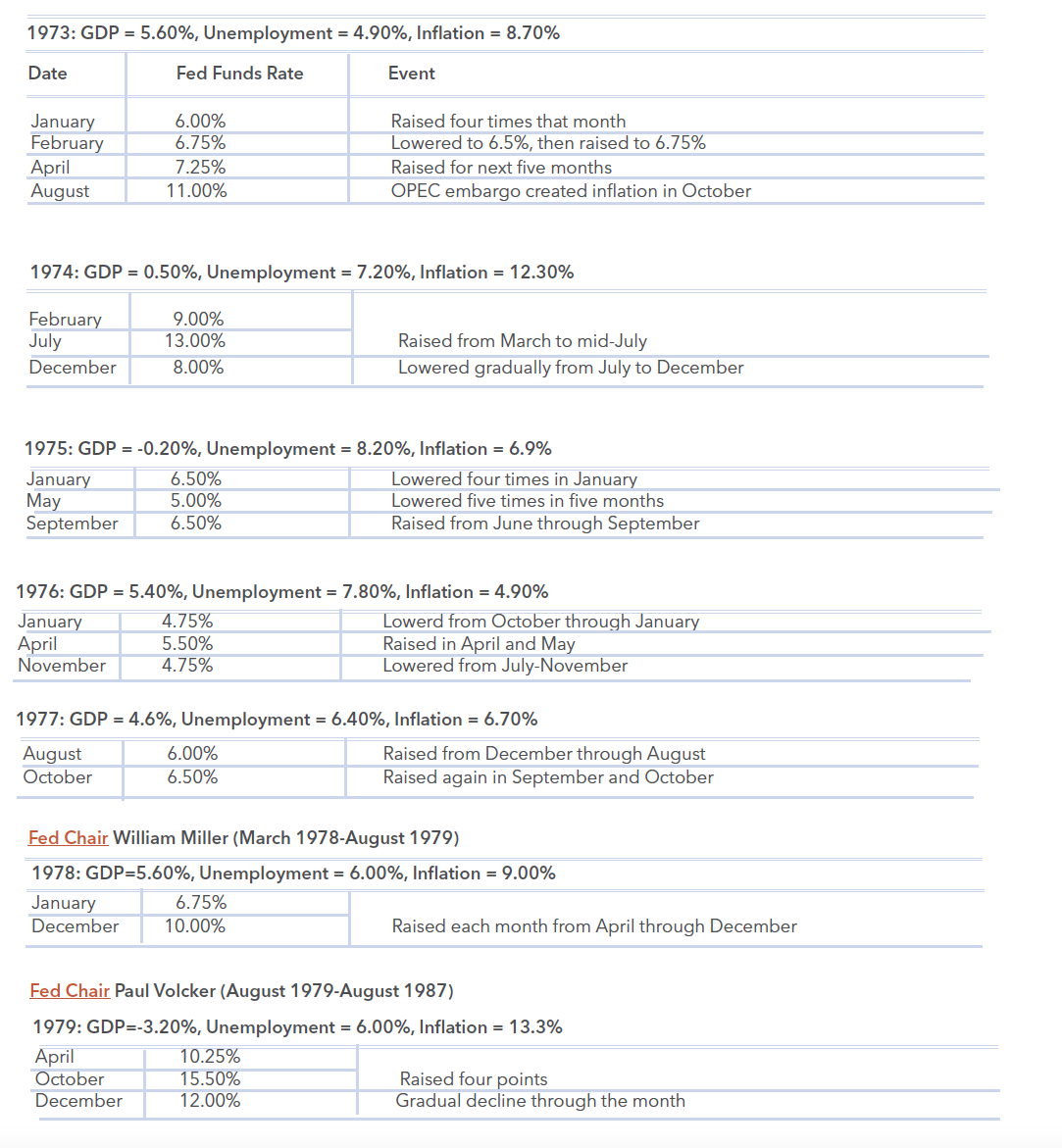

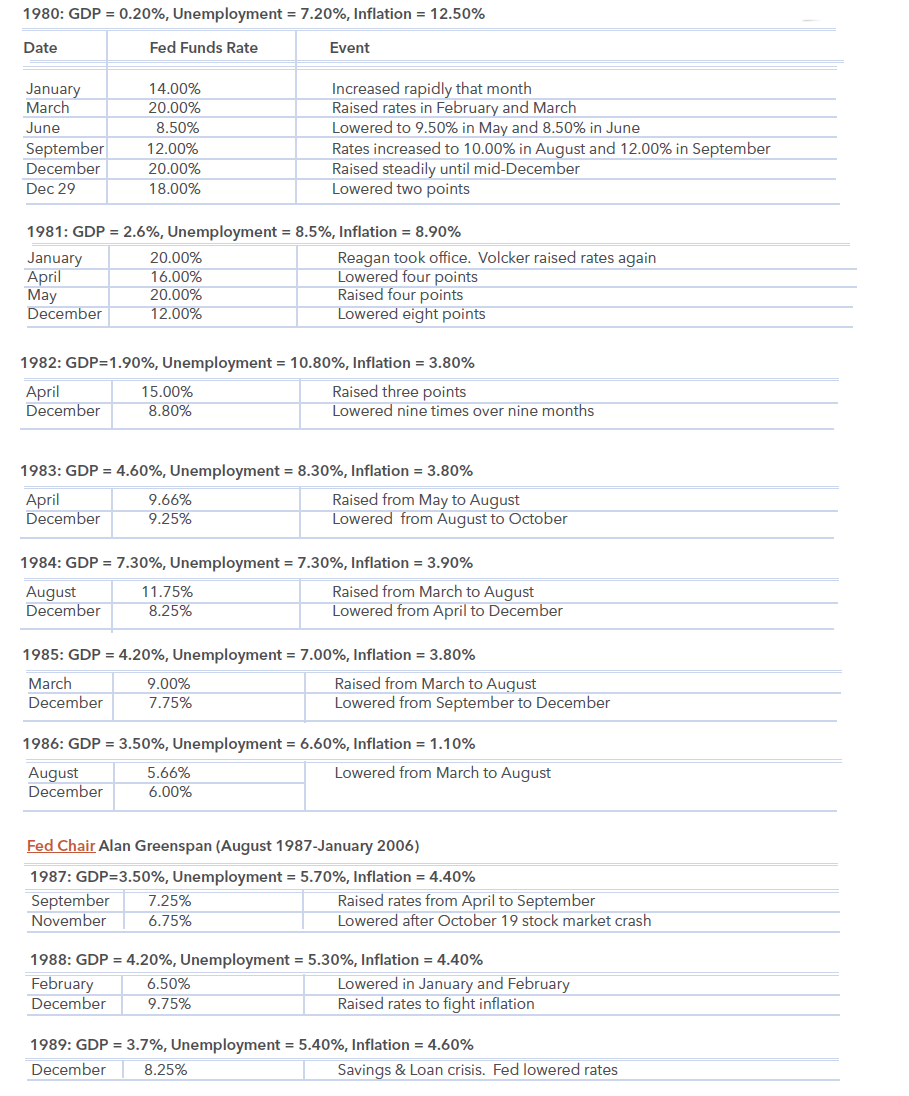

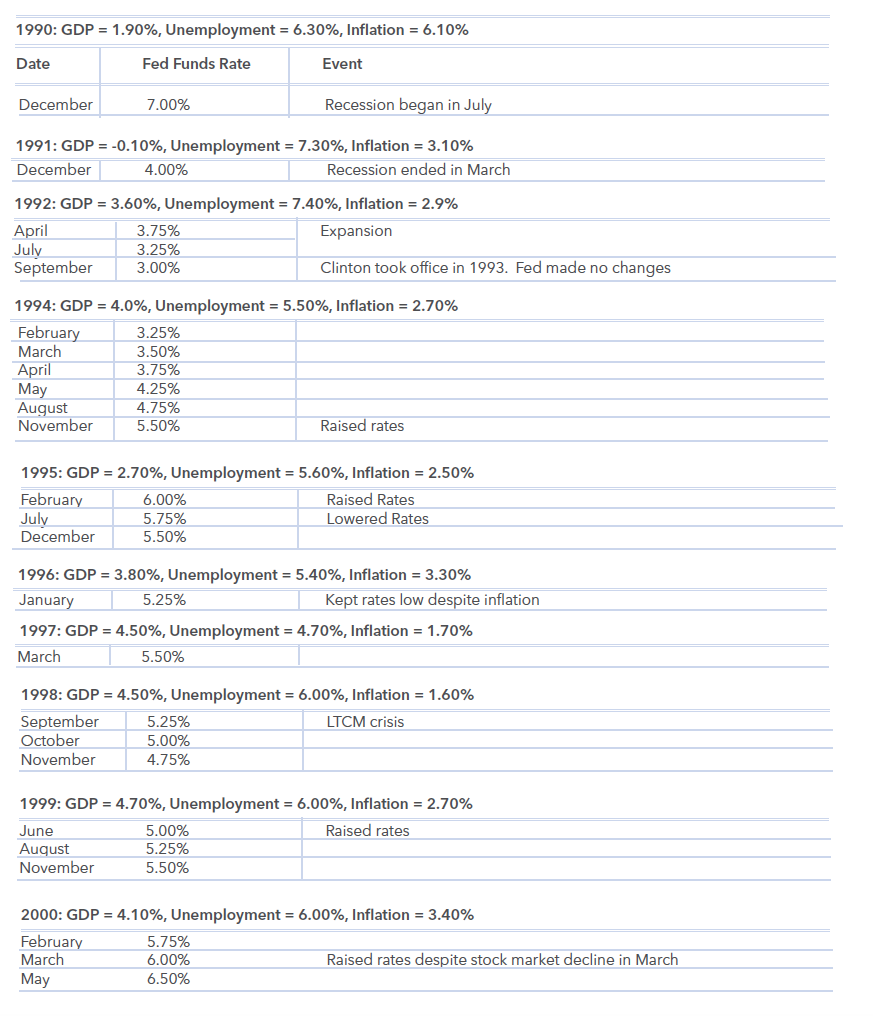

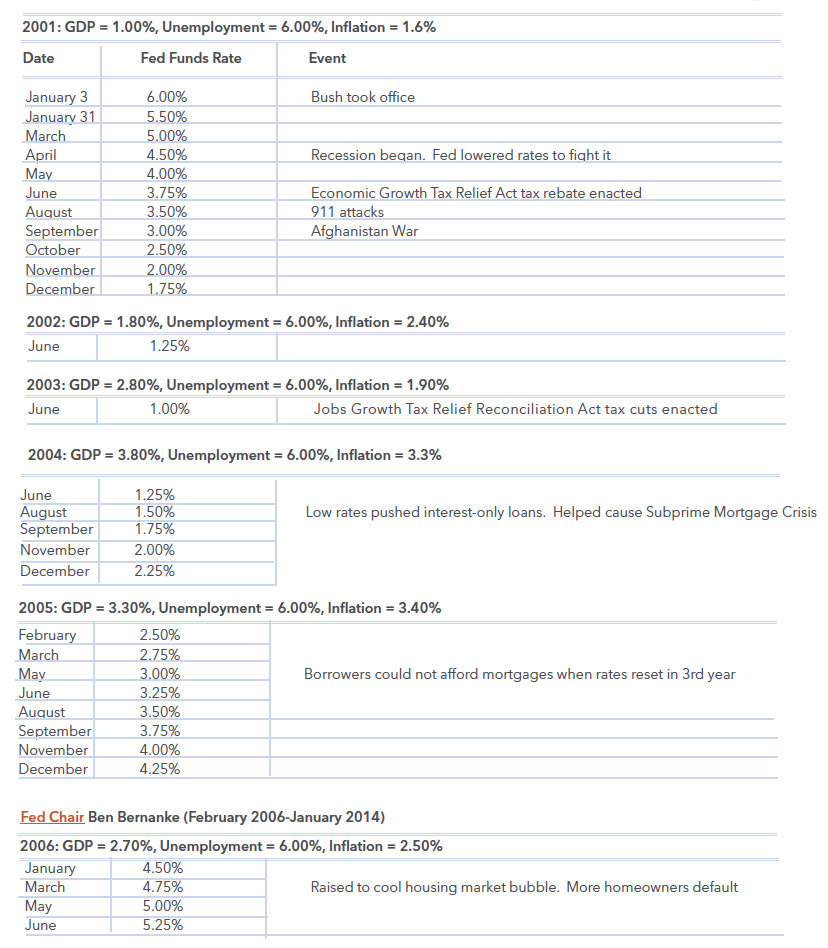

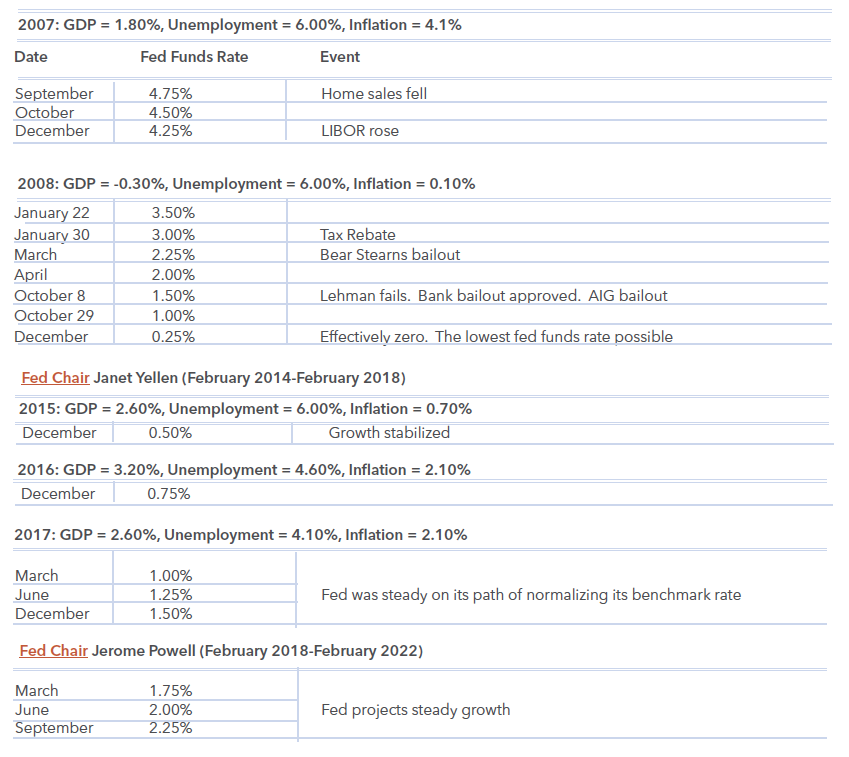

The numbers tell the story, and they appear to be forcing the Fed to head back to their playbook. The question is: How do rising interest rates impact stock prices, particularly micro-cap stocks? In the table below, we assembled the past twelve periods when the Federal Reserve raised the Fed Funds rate. This data comes from the Federal Reserve Economic Data (FRED). As you can see, the average length of time the Fed raised rates was 24 months, with the least time being 6 months and longest being 53 months. We also included the range of increases which include a modest increase of rates from 4.75% to 6.54% in the 1999/2000 period to a drastic increase of 4.61% to 17.61% in the 1977/1980 period.

We then gathered the micro-cap performance from the Duff & Phelps’ Ibbotson Annual Yearbook. The performance results are from the month-end date when the Fed raised rates until the month-end when they stopped raising rates. As you can see, micro-cap stocks rose in ten of

the twelve periods when the Fed raised rates, and the average gain was more than 25%. There are two notable periods I would like to address. First, the 1972 to 1974 period certainly was a negative period for micro-cap stocks with a 40.61% decline, but that period was also plagued by other social and severe economic factors. However, the second period to note is 1977 to 1980 which was also affected by several social and economic factors. Although inflation was severe in the late 1970s, the strength of the economy drove the performance of micro-cap stocks to an exceptional gain of nearly 84%. We believe that the current economic situation could be like the second period. While inflation is part of the picture, we expect that the strength of the economy could drive robust performance for micro-cap stocks.

MarketWatch Interview

By Michael Brush

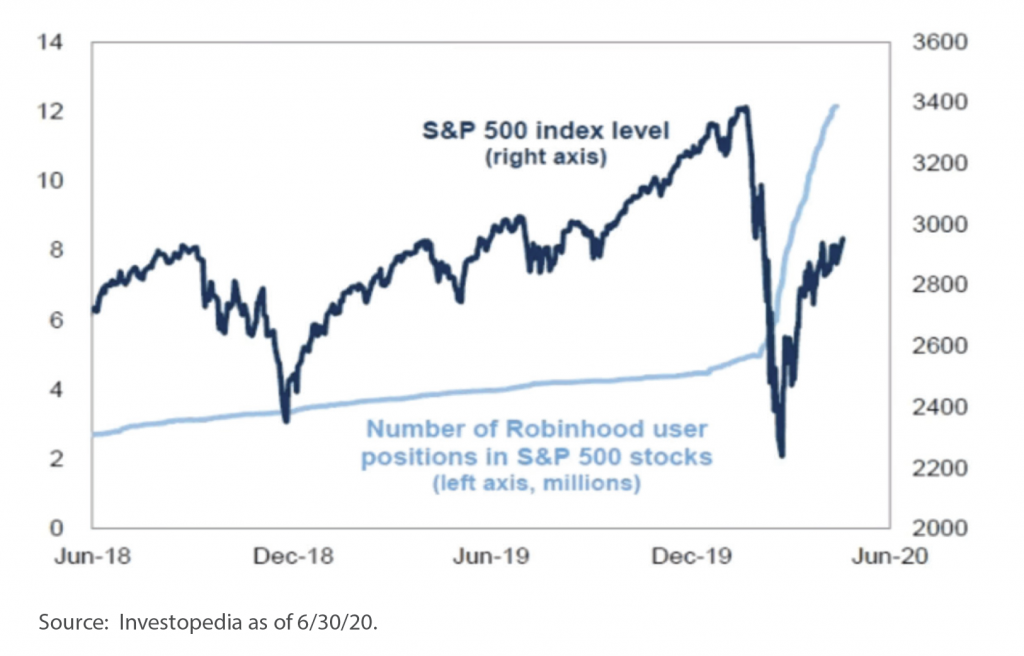

If the huge downside volatility in large-cap darlings such as Netflix and Facebook have you queasy, here’s a potential alternative: Go small.

Small companies have already been beaten up in the rolling market correction since last summer. So much so, they now look cheaper than they have in decades, despite solid growth.

Here are three reasons you should consider smaller companies now, and seven names that have good potential, according to experts in the space.

Reason #1: They look cheap

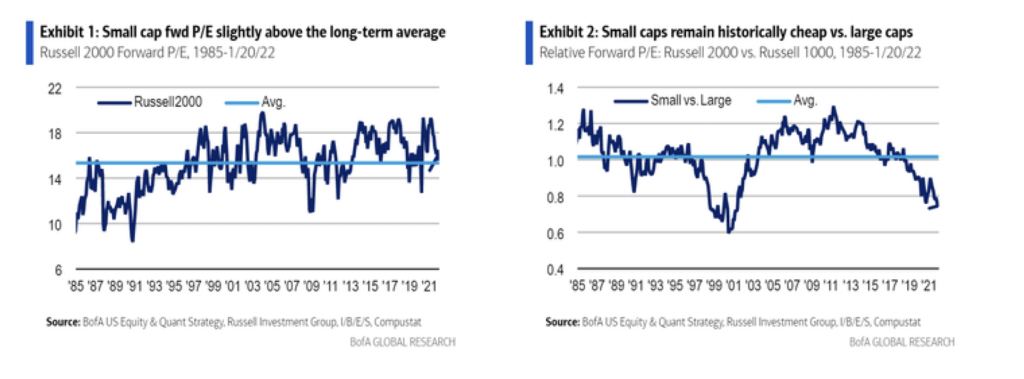

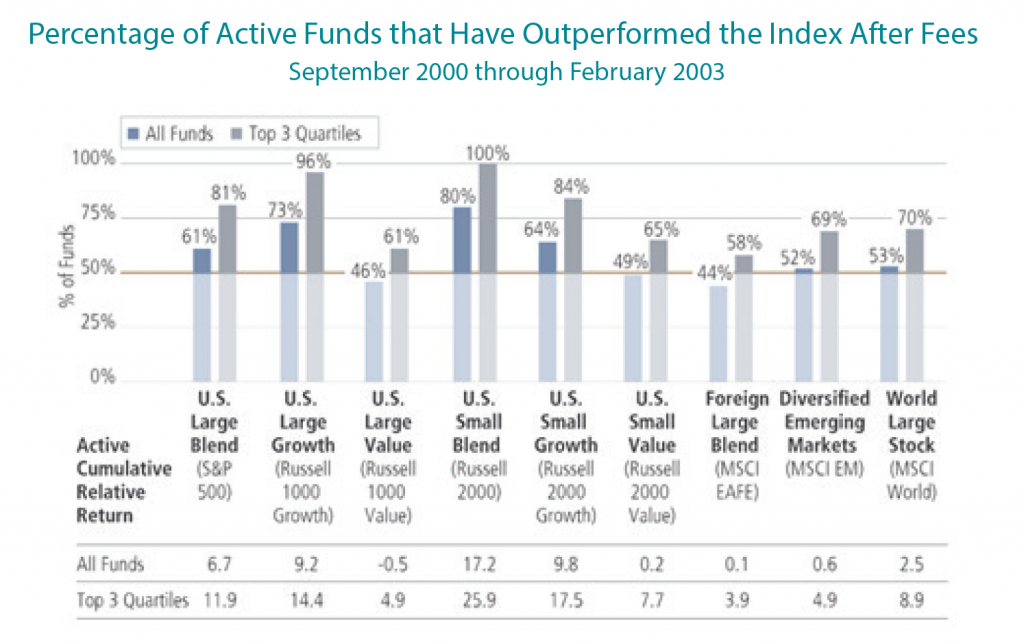

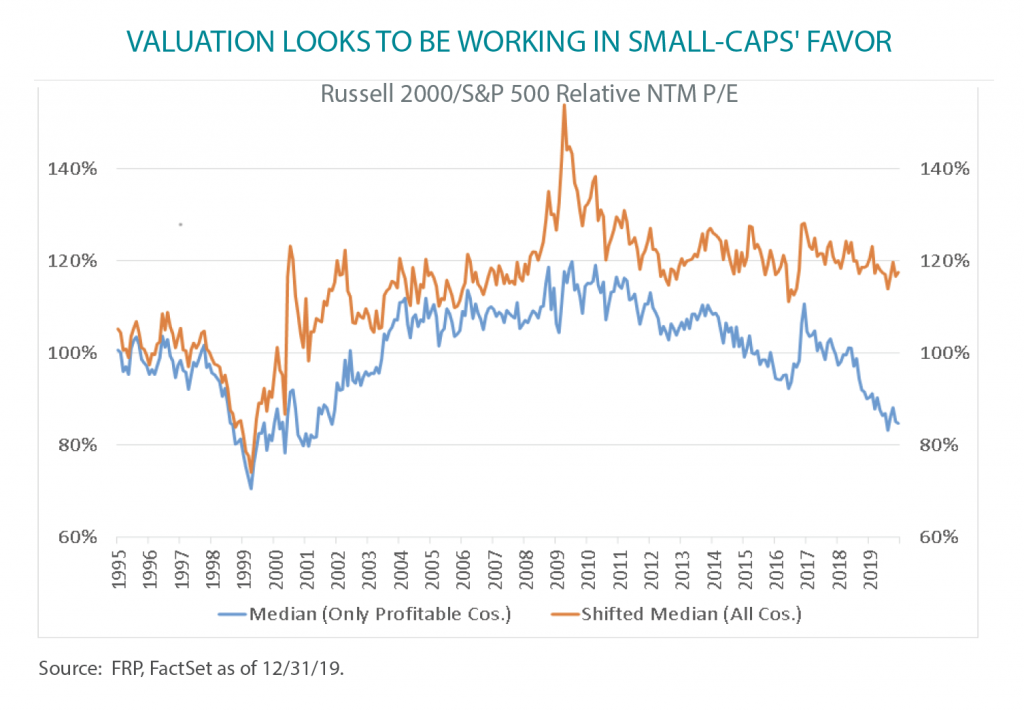

Relative to large-cap stocks, small-cap and mid-cap stocks — known in the industry as smidcaps — have only ever been cheaper once before in recent history. That was during the tech bubble. Using forward earnings, their price-to-earnings (P/E) ratio is currently around 0.7 that of larger-cap stocks. That’s the lowest since this ratio nearly touched 0.6 in 2000, notes James Paulsen, an economist and the chief market strategist at Leuthold.

The smaller names of the S&P 600 trade at 14.5 times forward earnings vs. 20.2 for the S&P 500. Smidcaps also trade in line with their historical valuations.

Despite this relative discount, smidcap earnings are currently going up a lot faster than large-cap earnings, says Paulsen. But they get no respect.

“Their businesses have expanded. But they have not gotten a multiple expansion,” says Perritt Capital Management’s Michael Corbett, who specializes in small-cap investing. “They have had multiple contraction.”

Here is a visualization of what Paulsen and Corbett are talking about, from Bank of America.

“Small-caps now trade at a historical discount to large-caps on every valuation metric we track,” says one Bank of America analyst.

“This period reminds me of the late 1990s and early 2000s when it only made sense to buy large-cap and dot-com names,” says Corbett. “At some point, investors could not justify the prices anymore.”

We may be seeing the beginning of that now, given the recent stunning declines in Netflix and Facebook shares, on weaker-than-expected business trends and guidance.

Reason #2: Smaller companies have done better in a strong economy

Despite worries about recession because the Federal Reserve will be raising interest rates, the economy will likely be strong this year due to various types of embedded stimulus, predicts Paulsen. This includes low inventory levels that need to be raised, and strong consumer and corporate balance sheets.

Smidcap companies have outperformed when there’s growth for several reasons. First, they can raise prices, which boosts margins. Since smaller companies tend to be leaner, more of the pricing gains fall to the bottom line.

“Inflation could change the dynamic,” says Corbett. “They are behind the curve on raising prices, but they will likely catch up. The margins and earnings profile could look dramatically better.”

Next, smaller companies tend to be based in cyclical businesses, and cyclicals have done better when the economy is strong, says Corbett. They were also hit harder by the COVID-related lockdowns, in part because they usually have less diversified businesses, says Tyler Laundon, chief analyst at the Cabot Small-Cap Confidential stock letter. This means they have more room to improve as COVID recedes and the economy gets back to normal.

Reason #3: Consumer confidence will likely increase

Consumer confidence is low. But I think it will improve as it becomes more apparent that Omicron marks the end of the pandemic, as inflation eases, and as more people find jobs and get more pay hikes. Historically, smidcap stock performance shows a strong correlation with consumer confidence, says Paulsen. As confidence increases, people consider riskier investments — like smidcaps.

Stocks

To find names, I consulted experts in this space. Besides Corbett at Perritt Capital Management and Laundon at Cabot Small-Cap Confidential, I checked in with Bruce Kaser at Cabot Turnaround Letter, a value investor who goes into the smidcap space.

Lamb Weston

Market cap: $9.4 billion

If you order fries with your meal, you’re probably a customer of this company. Lamb Weston is a big supplier of frozen fries cooked up in restaurants. Based in Idaho (of course), this company sells to the top 100 restaurant chains in North America and overseas, including McDonald’s. You can also find its spuds in grocery stores.

The company has been posting strong sales growth, but earnings have been hit by inflation and supply chain problems. These should turn out to be temporary issues. “The company is well-managed, has a strong market position, generates healthy profits and cash flow, and should eventually resolve its cost problems,” says Kaser at Cabot Turnaround Letter. I suggested this one in my stock letter Brush Up on Stocks at around $57 in early November. It’s now up 13% compared to a 2.7% decline for the S&P 500.

WildBrain

Market cap: $402 million

WildBrain manages content and consumer licensing for popular brands like Peanuts, Teletubbies, Strawberry Shortcake, Caillou and Inspector Gadget. Revenue increased 18% in the third quarter. The Canadian company plans to continue to grow by rolling out new consumer products and content. For example, it recently signed a deal with Apple TV+ for the production of a new “Yo Gabba Gabba!” series, and access to historical content. This follows a similar deal that put Peanuts on the Apple platform. It also recently signed a deal with Moose Toys to roll out new toy sets. “Revenue growth should be better than expectations,” predicts Corbett.

Infrastructure and Energy Alternatives

Market cap: $436 million

This infrastructure construction company specializes in wind and solar energy projects. But it also does design, construction and restoration of roads, bridges and industrial infrastructure. The stock got ahead of itself by early last year on excessively bullish sentiment, but it has fallen 60% since. Yet revenue growth looks solid. Third-quarter sales grew 37% and the company raised 2021 sales guidance to $2.1 billion at the high end, from $1.95 billion. The company should benefit from the recent federal infrastructure bill, says Corbett.

Shutterstock

Market cap: $3.4 billion

Shutterstock runs an online marketplace for digital photos, video footage and music. Contributors upload content and earn royalties on sales. Users typically put the content in marketing materials, media content and games. Third-quarter sales grew 18%. Shutterstock does well in part because it is huge, says Laundon. It features over 1.9 million contributors who have added more than 390 million images and 23 million footage clips. It has over 2 million active paying customers.

Legacy Housing

Market cap: $633 million

The housing market is hot. Energy prices keep going up. This company potentially offers a way to benefit from both trends. Legacy Housing sells manufactured homes and “tiny houses” that cost $22,000 to $140,000. It does nearly half its business in Texas, which makes this an energy play. Concerns about rising mortgage rates (priced off the 10-year government bond yield) are an overhang, but Corbett doesn’t see this as an issue. “You would have to have interest rates skyrocket for real problems to happen,” he says. He thinks the 10-year bond yield could rise to 2.25% by year-end, and that won’t be enough to kill demand. Third-quarter sales grew 29%.

Xometry

Market cap: $2.1 billion

This company operates a digital marketplace serving the $260 billion industrial manufacturing industry. Its platform helps manufacturers get instant quotes on parts. It wants to be the Amazon.com of this archaic market, but with a high-tech twist. Buyers can upload 3D design files with detailed specs when shopping for parts.

Xometry launched in the U.S. nearly 10 years ago. Now it’s expanding into Europe and Asia, notes Laundon, who says Xometry is well-positioned to turn this business on its head. The company has guided for 63%-66% fourth quarter sales growth. Active buyers increased 61% in the third quarter.

Photronics

Market cap: $1.1 billion

You’ve heard about the chip shortage. Photronics may benefit. It sells glass plates with images of electronic circuits used to make chips. These photomasks help chip makers put circuit patterns on semiconductor wafers. The chip shortage has increased demand for its product. In the fourth quarter sales grew 6% sequentially and 21% year over year, in part, because of newfound pricing power. “That is what has changed. The margins are likely going to improve,” says Corbett.

Quest Resources: One person’s garbage is another’s treasure!

INTRO:

At Perritt Capital Management, we take focused positions in companies where we have a high conviction in their success; companies that are out of the mainstream of small cap investing. To highlight our process, we are pleased to present the fourth installment in our new series “Marvelous Microcaps – Big Ideas on Small Companies”. This series profiles companies that we believe have a niche in their existing markets or are launching a product that could disrupt their marketplace.

At Perritt Capital Management, we take focused positions in companies where we have a high conviction in their success; companies that are out of the mainstream of small cap investing. To highlight our process, we are pleased to present the fourth installment in our new series “Marvelous Microcaps – Big Ideas on Small Companies”. This series profiles companies that we believe have a niche in their existing markets or are launching a product that could disrupt their marketplace.

THE COMPANY:

Quest Resources (QRHC) is a provider of waste management services to businesses in the Fortune 1000 space. Operating as an “asset-light” provider of services, Quest is an outsourced managed services provider for their customers. Utilizing a proprietary technology platform, they analyze the needs of their customers and find the best local providers of waste management services to address customer’s needs. The majority of their business is driven by the recycling and disposal of regulated waste streams: such as food, construction, and automotive waste, hazard chemicals and general recycling. While a private residence may rely on municipal waste services to collect their trash from the curb once a week, most municipal sanitation providers do not service private businesses nor regulated waste streams necessitating the use of commercial providers of these services. By targeting the Fortune 1000 market, Quest Resources are servicing clients with complex requirements. In fact, their average customer has five different waste streams spread out across multiple locations which requires the use of multiple service providers. Quest’s business proposition is that they take over the waste management needs of a portion or all of a company’s locations, aggregating the services under the Quest umbrella. From that point, they will find the best service provider for each waste stream in the local area and outsource the physical disposal to that provider. The value add to their customers is that they do not need to find these providers themselves and they do not have to handle multiple invoices for waste removal. In the case of regulated waste streams, Quest helps to provide an audit trail for businesses to use in the event regulators need to see records for compliance purposes. While Quest mainly utilizes third-party service providers, they will operate their own waste management services in certain verticals in geographies where they have significant customer concentration.

WHY WE OWN: THE PERRITT ADVANTAGE

Today Quest is a top holding for the Ultra MicroCap Fund and has been recently graduated to the MicroCap Opportunities fund, however, the origin of our research in the name goes back to 2014. At that time, the company had grown revenues significantly from $67 million in 2013 to $174 million in 2014. However, the previous management team achieved this growth by underpricing their services and losing money on new contracts. These poor operating results led to a steep sell off in the company’s stock which necessitated the hiring of a new management team led by current CEO Ray Hatch. Under Ray’s leadership, the company extricated themselves from the money losing contracts signed by the previous management and began the process of building out their technology platform and reorganizing their sales force. Perritt initiated a position when the initial results from their internal initiatives began to show improvements in the company’s prospects. Today, these efforts have paid off, with gross margins* more than doubling in the past five years from 7.8% at the end of 2016 to 18.7% on a trailing twelve-month basis as of the most recent quarter. The improved margins along with prudent management of other corporate expenses have allowed Quest to go from a money losing business to a profitable business that is ready for the next phase of expansion.

With the turn-around behind them, the firm has begun to focus on future growth. They recently completed a series of acquisitions in 2021 that saw them purchase four waste management companies throughout the continental U.S. These acquisitions bring some of the services that Quest has been providing their customers in house which will allow them to capture additional margin growth as they capture more of their customer’s dollar spend. With the company now profitable, they have the ability to consistently generate cash to pay for further growth through acquisitions while continuing to grow organically by leveraging their internal sales force and technology platform.

We consider Quest Resources to be a high conviction name. The name is a top ten holding for the Perritt Ultra MicroCap Fund and was added to the Perritt MicroCap Opportunities fund last year as results improved. We are optimistic that they have the right technology, service offerings and most importantly, leadership to drive their success going forward.

*Gross Margins represent the percentage of revenue that remains after accounting for the direct costs of selling a product or service.

Perritt. Marvelous Microcaps – Big Ideas on Small Companies.

iCAD, Inc.: Breast cancer detection solutions built on artificial intelligence

INTRO:

At Perritt Capital Management, we take focused positions in companies where we have high conviction of their success; companies that are out of the mainstream of small cap investing. To highlight our process, we are pleased to present the fourth installment in our new series “Marvelous Microcaps – Big Ideas on Small Companies”. This series profiles companies that we believe have a niche in their existing markets or are launching a product that could disrupt their marketplace.

THE COMPANY:

iCAD (ICAD) operates through two segments, Cancer Detection and Cancer Therapy. Their advanced breast cancer detection solutions are built on artificial intelligence that enable radiologists to find cancer earlier and faster. Their Breast Health Solutions suite operates in 2D and 3D and rapidly and accurately analyzes each image detecting both malignant soft tissue densities and calcifications with unrivaled accuracy. The company’s ProFound AI Risk product works with 3D mammography and is the first and only clinical decision support tool to estimate breast cancer risk for each woman. This will move the breast mammography industry from age-based screening to risk-based screening leading to both prevention and treatment of breast cancer.

With their innovative technology, they expanded the breast cancer detection to also detect and treat other cancers. Xoft Brain IORT recently treated the first patient with glioblastoma (brain cancer). Xoft is FDA-cleared and licensed for the treatment of cancer anywhere in the body. It used the world’s smallest X-ray source to deliver a precise, concentrated dose of radiation directly to the tumor site thus targeting only the cancer cells and not damaging nearby healthy cells. IORT and Xoft allow oncologists and surgeons to deliver a full course of radiation treatment in one day, at the time of surgery, while the patient is already under anesthesia. Other cancers that can be treated are non-melanoma skin cancer, Endometrial, and cervical cancer.

WHY WE OWN: THE PERRITT ADVANTAGE

The marketplace in breast imaging for this product is huge and largely untapped. Approximately 20% of breast cancers are not detected and traditional mammograms generate many false positives. ICAD’s product operates more efficiently, accurately, and faster. The current install base is about 1350 units marketed by a sales force of only 13. The Therapy segment’s potential is huge to treat many types of cancer in the operating room removing the need for many sessions of radiation. The platform also provides for a razor-razorblade model resulting in recurring revenues.

Third quarter of 2021 had 31% revenue growth which missed analysts’ estimates by $500,000. The stock has fallen more than 30% providing a great buying opportunity. They have cash of $35.8 million which should be sufficient to fund their future growth. A new CEO was appointed in December and Insiders have bought stock recently.

ICAD traded at a little more than 3 times 2022 sales estimates which reflects 30% growth with 72% gross margins. They have been affected by Covid-related slowdowns in procedures, which we believe will increase as the effects of the COVID pandemic diminish. They have been aggressively pursuing subscription offerings which will likely increase recurring revenues. This is a stock that has disruptive technology and is currently selling at bargain bin prices.

Perritt. Marvelous Microcaps – Big Ideas on Small Companies.

Michael Corbett visits Fortitude Gold (FTCO) mine

Portfolio Manager and CIO Michael Corbett visits Fortitude Gold (FTCO) mine, November 2021

Fund holdings and sector allocations are subject to change at any time and should

not be considered a recommendation to buy or sell any security. For the top ten

holdings for the Perritt MicroCap Opportunities Fund please click PRCGX and

PREOX for the Perritt Ultra MicroCap Fund.

Identiv: A specialty security company venturing out into new horizons

INTRO:

At Perritt Capital Management, we take focused positions in companies where we have a high conviction in their success; companies that are out of the mainstream of small cap investing. To highlight our process, we are pleased to present the second installment in our new series “Marvelous Microcaps – Big Ideas on Small Companies”. This series profiles companies that we believe have a niche in their existing markets or are launching a product that could disrupt their marketplace.

THE COMPANY:

Identiv, Inc. (INVE) is a technology company operating in the security space specifically addressing needs around physical and logical access to secure sites and identity verification for access and cyber security purposes. In addition to that they provide asset tracking, archiving, and monitoring products. The company sells both hardware and software on a contract and subscription basis. They market their products through a diversified network of distributors, security system integrators and value add resellers. In addition to their core security markets, the company has leveraged their expertise in radio-frequency identification (RFID) technology to expand use into several other markets where asset tracking and verification needs were not being sufficiently met, opening several new market opportunities for their products in an increasingly networked world.

Identiv, Inc. offers a wide variety of products including hardware for controlling access to secure facilities such as government facilities, corporate facilities, schools, and apartment buildings. These range from the ubiquitous number pads found on many secure entry points to state-of-the-art passive, touchless RFID readers that allow for frictionless entry for authorized individuals while preventing access to those without authorization. The company offers products in the video surveillance space that include features such as facial recognition, vehicle recognition and object identification/tracking. This data is then stored for future use as indexed records for their customers and as real time data around occupancy and utilization. The core competencies of the company in the security space have given the company substantial expertise in the development and use of RFID technology. The key long term growth driver for the company is leveraging their expertise to expand its use in the security space as well as its deployment in other industries.

WHY WE OWN: THE PERRITT ADVANTAGE

We own Identiv in both mutual funds and the investment thesis is based on the growth prospects of the company, their patent portfolio, and the strength of the company’s financials. The company has leveraged their expertise in security focused RFID technology to bring the technology to other verticals. As an example, CVS Pharmacies uses Identiv’s RFID technology in their labels to enable a program called Spoken Rx™ , designed for consumers with visual impairment to scan any prescription label with their phones to receive an audio readout of their prescription. They recently announced the rollout of this program in all CVS locations nation-wide. In other use cases their labels have been used on prefilled syringes in healthcare settings to track the time, place and medication used in injections and been used to track blood samples in laboratory settings. Outside of healthcare, Nike has installed Identiv’s tags inside of some of their shoes. These tags can provide consumers with additional features and serve as verifications of authenticity which can be popular with collectors. The company also has sold their technology and services into the cannabis space with a recent contract award from a customer for an initial order of 20 million units. To date the company estimates their devices have been installed on 1.5 billion physical objects worldwide with the market potential for networked devices being in the hundreds of billions.