News

Opinion: Small-cap stocks haven’t been this cheap in decades, and they now have three tailwinds

By Michael Brush

If the huge downside volatility in large-cap darlings such as Netflix and Facebook have you queasy, here’s a potential alternative: Go small.

Small companies have already been beaten up in the rolling market correction since last summer. So much so, they now look cheaper than they have in decades, despite solid growth.

Here are three reasons you should consider smaller companies now, and seven names that have good potential, according to experts in the space.

Reason #1: They look cheap

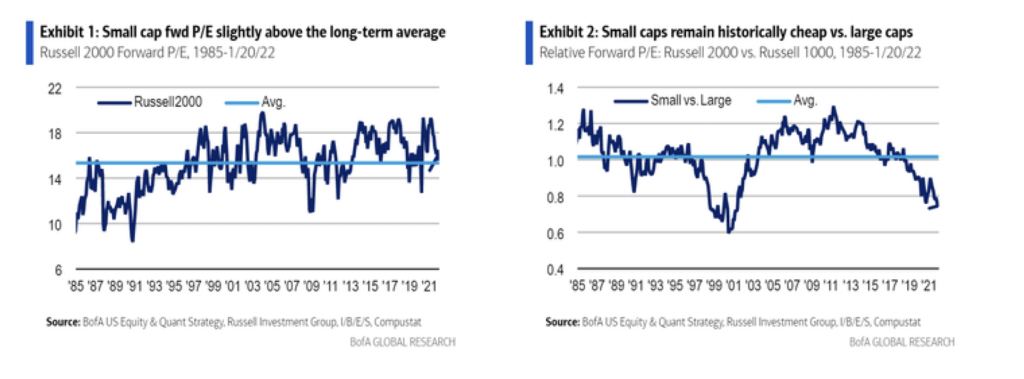

Relative to large-cap stocks, small-cap and mid-cap stocks — known in the industry as smidcaps — have only ever been cheaper once before in recent history. That was during the tech bubble. Using forward earnings, their price-to-earnings (P/E) ratio is currently around 0.7 that of larger-cap stocks. That’s the lowest since this ratio nearly touched 0.6 in 2000, notes James Paulsen, an economist and the chief market strategist at Leuthold.

The smaller names of the S&P 600 trade at 14.5 times forward earnings vs. 20.2 for the S&P 500. Smidcaps also trade in line with their historical valuations.

Despite this relative discount, smidcap earnings are currently going up a lot faster than large-cap earnings, says Paulsen. But they get no respect.

“Their businesses have expanded. But they have not gotten a multiple expansion,” says Perritt Capital Management’s Michael Corbett, who specializes in small-cap investing. “They have had multiple contraction.”

Here is a visualization of what Paulsen and Corbett are talking about, from Bank of America.

“Small-caps now trade at a historical discount to large-caps on every valuation metric we track,” says one Bank of America analyst.

“This period reminds me of the late 1990s and early 2000s when it only made sense to buy large-cap and dot-com names,” says Corbett. “At some point, investors could not justify the prices anymore.”

We may be seeing the beginning of that now, given the recent stunning declines in Netflix and Facebook shares, on weaker-than-expected business trends and guidance.

Reason #2: Smaller companies have done better in a strong economy

Despite worries about recession because the Federal Reserve will be raising interest rates, the economy will likely be strong this year due to various types of embedded stimulus, predicts Paulsen. This includes low inventory levels that need to be raised, and strong consumer and corporate balance sheets.

Smidcap companies have outperformed when there’s growth for several reasons. First, they can raise prices, which boosts margins. Since smaller companies tend to be leaner, more of the pricing gains fall to the bottom line.

“Inflation could change the dynamic,” says Corbett. “They are behind the curve on raising prices, but they will likely catch up. The margins and earnings profile could look dramatically better.”

Next, smaller companies tend to be based in cyclical businesses, and cyclicals have done better when the economy is strong, says Corbett. They were also hit harder by the COVID-related lockdowns, in part because they usually have less diversified businesses, says Tyler Laundon, chief analyst at the Cabot Small-Cap Confidential stock letter. This means they have more room to improve as COVID recedes and the economy gets back to normal.

Reason #3: Consumer confidence will likely increase

Consumer confidence is low. But I think it will improve as it becomes more apparent that Omicron marks the end of the pandemic, as inflation eases, and as more people find jobs and get more pay hikes. Historically, smidcap stock performance shows a strong correlation with consumer confidence, says Paulsen. As confidence increases, people consider riskier investments — like smidcaps.

Stocks

To find names, I consulted experts in this space. Besides Corbett at Perritt Capital Management and Laundon at Cabot Small-Cap Confidential, I checked in with Bruce Kaser at Cabot Turnaround Letter, a value investor who goes into the smidcap space.

Lamb Weston

Market cap: $9.4 billion

If you order fries with your meal, you’re probably a customer of this company. Lamb Weston is a big supplier of frozen fries cooked up in restaurants. Based in Idaho (of course), this company sells to the top 100 restaurant chains in North America and overseas, including McDonald’s. You can also find its spuds in grocery stores.

The company has been posting strong sales growth, but earnings have been hit by inflation and supply chain problems. These should turn out to be temporary issues. “The company is well-managed, has a strong market position, generates healthy profits and cash flow, and should eventually resolve its cost problems,” says Kaser at Cabot Turnaround Letter. I suggested this one in my stock letter Brush Up on Stocks at around $57 in early November. It’s now up 13% compared to a 2.7% decline for the S&P 500.

WildBrain

Market cap: $402 million

WildBrain manages content and consumer licensing for popular brands like Peanuts, Teletubbies, Strawberry Shortcake, Caillou and Inspector Gadget. Revenue increased 18% in the third quarter. The Canadian company plans to continue to grow by rolling out new consumer products and content. For example, it recently signed a deal with Apple TV+ for the production of a new “Yo Gabba Gabba!” series, and access to historical content. This follows a similar deal that put Peanuts on the Apple platform. It also recently signed a deal with Moose Toys to roll out new toy sets. “Revenue growth should be better than expectations,” predicts Corbett.

Infrastructure and Energy Alternatives

Market cap: $436 million

This infrastructure construction company specializes in wind and solar energy projects. But it also does design, construction and restoration of roads, bridges and industrial infrastructure. The stock got ahead of itself by early last year on excessively bullish sentiment, but it has fallen 60% since. Yet revenue growth looks solid. Third-quarter sales grew 37% and the company raised 2021 sales guidance to $2.1 billion at the high end, from $1.95 billion. The company should benefit from the recent federal infrastructure bill, says Corbett.

Shutterstock

Market cap: $3.4 billion

Shutterstock runs an online marketplace for digital photos, video footage and music. Contributors upload content and earn royalties on sales. Users typically put the content in marketing materials, media content and games. Third-quarter sales grew 18%. Shutterstock does well in part because it is huge, says Laundon. It features over 1.9 million contributors who have added more than 390 million images and 23 million footage clips. It has over 2 million active paying customers.

Legacy Housing

Market cap: $633 million

The housing market is hot. Energy prices keep going up. This company potentially offers a way to benefit from both trends. Legacy Housing sells manufactured homes and “tiny houses” that cost $22,000 to $140,000. It does nearly half its business in Texas, which makes this an energy play. Concerns about rising mortgage rates (priced off the 10-year government bond yield) are an overhang, but Corbett doesn’t see this as an issue. “You would have to have interest rates skyrocket for real problems to happen,” he says. He thinks the 10-year bond yield could rise to 2.25% by year-end, and that won’t be enough to kill demand. Third-quarter sales grew 29%.

Xometry

Market cap: $2.1 billion

This company operates a digital marketplace serving the $260 billion industrial manufacturing industry. Its platform helps manufacturers get instant quotes on parts. It wants to be the Amazon.com of this archaic market, but with a high-tech twist. Buyers can upload 3D design files with detailed specs when shopping for parts.

Xometry launched in the U.S. nearly 10 years ago. Now it’s expanding into Europe and Asia, notes Laundon, who says Xometry is well-positioned to turn this business on its head. The company has guided for 63%-66% fourth quarter sales growth. Active buyers increased 61% in the third quarter.

Photronics

Market cap: $1.1 billion

You’ve heard about the chip shortage. Photronics may benefit. It sells glass plates with images of electronic circuits used to make chips. These photomasks help chip makers put circuit patterns on semiconductor wafers. The chip shortage has increased demand for its product. In the fourth quarter sales grew 6% sequentially and 21% year over year, in part, because of newfound pricing power. “That is what has changed. The margins are likely going to improve,” says Corbett.