Manager Commentary, 3rd Quarter 2019

Stick to your Knitting

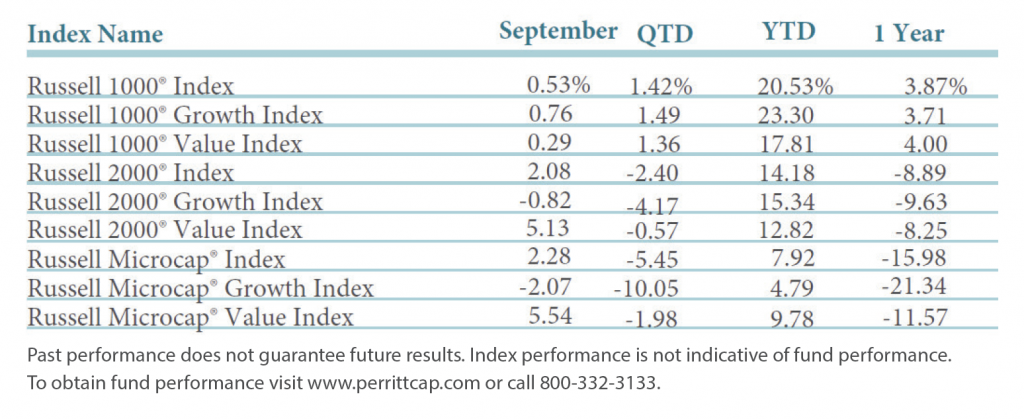

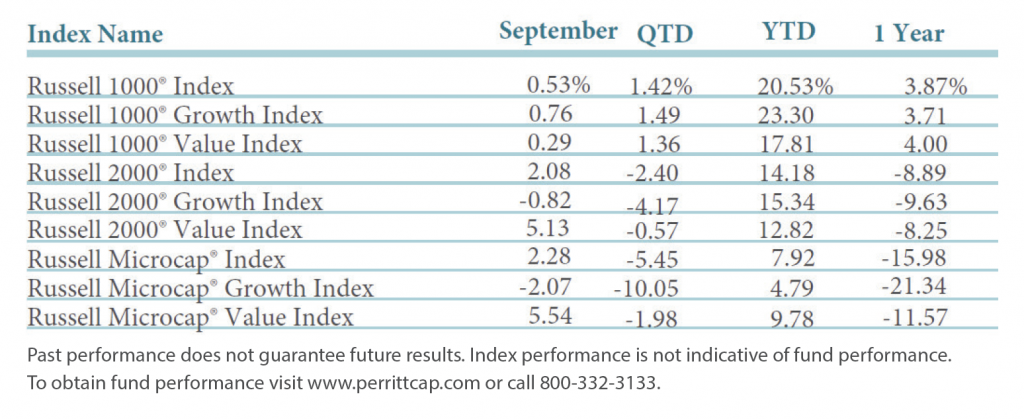

The Russell 2000 Index finished the third quarter down 2.40% and the Russell Microcap Index fell 5.45%. For the 52-week period both indexes are down despite decent performance year-to-date. The table below recaps the recent performance for all the Russell Indexes. The bright point is that small-caps outperformed large-caps and small-cap value beat small-cap growth in September. While one month does not make a trend, we are encouraged.

There is certainly a plethora of worries pestering the market: tariffs, interest rates, debt, recession, insider selling and the repo market to name a few. Many have argued that “this time is different” and all of these worries can be overcome. No matter what concern, the prevailing thought has been that growth will continue to be the place to invest because value is obsolete. We will tell you that “this time is different” does not apply to this thought.

Historically, we have always expected our investments to be valuable when they generated profits. But since the dot-com bubble, many profitless companies have been the sweet spot for investing. There is a place for these risky investments, but in our view they should not totally replace the more humdrum companies who do produce profits and have value. Investors are willing to pay more for the high-flyers when times are good because everyone is optimistic. When there is a wall of worry, as there is now with uncertainty in the market and the economy, value companies in our opinion will garner attention because they are cheap, and the fundamentals are solid and not a pipedream.

Besides focusing on these solid value investments, we also like companies with little or no debt. Perritt MicroCap Fund has almost 30% of its holdings with zero debt and Perritt Ultra MicroCap Fund has 48% with no debt, which compares to the Russell Microcap Index holding only 7% of companies with no debt. Even in a low interest rate environment, it is important to us that a portion of our investments are unencumbered. In our opinion, these will also be some of the most reliable companies in the microcap space.

We don’t think “this time is different.” We will stick to our knitting of seeking to be rewarded by finding solid micro-cap companies. Some of the best times for investing have been in difficult periods which gives us a chance of participating in the recovery.

The information provided herein is opinion and is not intended to be a forecast of future events, a guarantee of future results, nor investment advice.

Russell 1000 Index is an index of approximately 1,000 of the largest companies in the U.S. equity market.

Russell 1000 Growth Index refers to a composite that includes large and mid-cap companies located in that United State that also exhibit a growth probability.

Russell 1000 Value Index refers to a composite that includes large and mid-cap companies located in that United State that also exhibit a value probability.

Russell 2000 Index is an index that measures the performance of approximately 2,000 small-cap companies in the Russell 3000 Index, which is made up of 3,000 of the biggest U.S. stocks.

Russell 2000 Growth Index measures the performance of Russell 2000 companies having higher price-to-book ratios and higher forecasted growth values.

Russell 2000 Value Index measures the performance of Russell 2000 Index companies with lower price-to-book ratios and lower forecasted growth values.

Russell Microcap Index is a capitalization weighted index of 2,000 small-cap and micro-cap stocks that captures the smallest 1,000 companies in the Russell 2000, plus 1,000 smaller U.S.-based listed stocks.

Russell Microcap Growth Index measures the performance of those Russell Microcap companies with higher price-to-book ratios and lower forecasted growth values.

Russell Microcap Value Index measures the performance of those Russell Microcap companies with lower price-to-book ratios and lower forecasted growth values.

Price-to-Book is calculated by dividing a company’s stock price by its book value per share, which is defined as its total assets minus any liabilities.

Debt is a financial instrument used as leverage for borrowing or purchasing purposes by corporations. A company with low or zero/no debt can enjoy higher profit margin and higher solvency.

One cannot invest directly in an index. Growth stocks typically are more volatile than value stocks; however, value stocks have a lower expected growth rate in earnings and sales.

The fund’s investment objectives, risks, charges, and expenses must be considered carefully before investing. The statutory and summary prospectuses contain this and other important information about the investment company and may be obtained by calling (800) 331- 8936. Read carefully before investing.

Click here for a current prospectus. Fund holdings and sector allocations are subject to change at any time and should not be considered a recommendation to buy or sell any security.

Click here for the Fund’s top 10 holdings: PRCGX, PREOX.

Mutual fund investing involves risk. Principal loss is possible. The fund invests in smaller companies, which involve additional risks, such as limited liquidity and greater volatility. The fund invests in micro-cap companies which tend to perform poorly in times of economic stress.