Manager Commentary-Archive

Manager Commentary, 3rd Quarter 2014

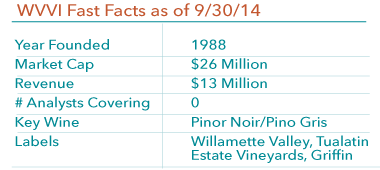

Willamette Valley Vineyards (WVVI) Case Study

As discussed in our 2Q14 Commentary, the micro-cap market entered a “stealth bear-market” earlier this year. As of the end of the third quarter, this trend has obviously continued, as negative breadth grew and the overall small-cap indexes turned negative. We view this “stealth bear-market” as a great opportunity for investors. We are working on a deep dive analysis of the micro-cap marketplace now. We will provide this supplement, which will include data points such as the number of companies trading below tangible book value, in the coming weeks. For our regular commentary, please enjoy this exciting story about one of our portfolio holdings.

What does it mean to invest with an active manager of micro-cap equities? Remember that the assets you allocate to the Perritt Funds are invested in the growth of individual small companies. the majority of these companies are led by true entrepreneurs – men and women – each with a story to tell about their business and their vision of reaching the next level. Analyzing these stories is a key element in our investment process. It can direct our focus toward companies where the opportunity ends up being the greatest.

When researching micro-cap equities, balance sheets, valuations, and economic trends all matter. But as bottom-up, fundamental investors, getting to know management teams is where the true opportunity of a company is often revealed. Our passion for our work in this asset class is fed by the access we are granted by small company management teams on a daily basis. If we were investing in Pepsico, or any other large-cap company, the CEO likely wouldn’t even return our call. As shareholders in Willamette Valley Vineyards, CEO Jim Bernau didn’t just pick up the phone, he invited us on a tour of his winery (supported by 526 owned and leased vineyard acres) outside of Portland, OR.

As mentioned above, this quarter we break from our normal Manager Commentary format and provide a cast study of Willamette Valley Vineyards. Below are highlights from conversations we’ve had with Jim which contributed to our analysis and decision to purchase the stock. The focus here is not on our story (examining analyst coverage, our nine-point evaluation or stock valuation) it is on Jim‘s story – the founding and ongoing success of Willamette Valley Vineyards. Jim’s story is a a fascinating one which we hope will help shed light on this personal, essential part of our investment process.

Fermentation: “I Started Selling Wine Out Of The Back Of My Car”

Perritt: By any stretch of the imagination, WVVI wasn’t a traditional IPO listing. Tell us about your journey.

Jim Bernau: My vision was to organize wine enthusiasts as owners of a winery. So I started out with the goal of being publicly traded. I started in 1987 with my application to the SEC and Blue Skied a number of states that were targeted for Pinot Noir enthusiasts. It was a very unusual mode; I hadn’t produced any wine before I started selling shares. But I had done some political fundraising when I was younger and use some of those marketing techniques to get people to order a prospectus. For example, I took the tombstone advertising requirements and converted them to things that looked like a wedding invitation. I wanted to identify what my affinity group was by taking my information out to wine festivals. So I hired a group of 5th graders to speak into tape recorders and record license plates of people who attended large wine festivals. Then I ran those plates through the Dept. of Motor Vehicles to identify the owners who I would then send invitations to order a prospectus. Maybe not surprising, I got a really high take rate on identifying those kinds of groups. Those are the offerings I did that funded the company. Soon I started selling wine out of the back of my car and even got some shareholders to help sell wine out of their cars, and it all worked.

The Barreling: “It Took Over 31 Years To Become An Overnight Success”

Perritt: To us, this past year appears to be an inflection point for your business.

Jim Bernau: It became very clear to me that to achieve world class status as an iconic Willamette Valley Vineyard Appalachian producer, I needed to have a very sharp focus on Pinot Noir. The Oregon wine industry is young in comparison to California or France. In 1966, there were only two commercial wineries licensed in the state. Today there are 545 and the industry has doubled in the last 10 years. Because of climate, soil and other growing conditions, Oregon has carded out this little niche of very high quality wine focused on Pinot Noir.

About 50% of our production in sales is Pinot Noir and we have really carved out a very strong brand position for that variety. And we’re growing: recently I acquired 80 acres right next to Elton Vineyards (a vineyard leased by Willamette valley) where we’re planning fifty-five acres this year after planting eighteen acres last year, and we have leased another 109 acres to plant.

As Oregon wineries have continued to populate and become known, this is a distinct advantage for us. There is a cacophony of brands in the valley now, but we’re Willamette Valley Vineyards – we own the trademark. So as time goes on, our ability to stand out with this iconic brand improves as the reputation of the valley improves, as long as we continue doing our homework and making great wine.

We’ve had some designations from different reviewers. We’ve had one from Wine Enthusiast Magazine called us one of the great wine producers. We had one from Wine & Spirits Magazine name us one of the top 100 wineries in the world. I would say the wines we’re now releasing, the 2012 Pinot Noirs will likely be regarded as the best that the industry has even made, and certainly the best we at Willamete Valley as ever made. We are just starting to get reviews on those, we just received 93 points from Wine & Spirits Magazine which is a high score. We’ve cared out a market niche where majority of our sales of Pinot Noir range from $22 to $30 a bottle. We’re serving a national and international segment in the market that I will continue to hammer home on a long term basis. And there’s not very many of us that compete in that segment. For example, we are a size where we can serve a national chain. If you go to Ruth Chris, our Pinot Noir and Riesling is on the wine list. That’s just one example.

The Vision, Uncorked: “Come and Be Entertained”

Perritt: You used retained earnings to make a sizable investment in the winery.

Jim Bernau: Consumers have changed what they want in recent years. It used to be tasting rooms where more primitive, people would come in and taste and move on. Now people want to come and be entertained. They want to have activities and different levels of experiences that are more positive and memorable. We made a significant investment in creating a world class winery destination experience here. We just had our grand opening in May and it’s really working. We probably have one of the few wineries that has a chef and a chef station in the tasting room. We have hospitality lodging adjacent to the winery. And we’ve recruited some top talent: Isabelle Meunier, the highest rated wine maker in making chardonnay from Oregon, has come on board. Drew Voigt, who used to be at Domaine Serene (another Oregon Winery) is also working with us.

I am always focused on what am I doing to increase the strategic value of the business. Making our winery a true destination is one element. Benefiting from our trademark and growth in the region is another. When I think about the decision making, I think about what would create the highest value to our shareholders. If you look at my vineyard strategy, we’ve got to be close to the largest Estate winemaker in Oregon. I developed an inventory of future vineyard land I’ll be planting a number of years into the future. That increases our strategic value because any acquirer would want to make sure they can grow the brand they purchased.