Manager Commentary-Archive

Manager Commentary, 2nd Quarter 2013

“I Get No Respect!” Until Lately….

Q: What Has Been The Cause Of The Outsized Returns Seen In Several Individual Small Company Names?

A: As Rodney Dangerfield might say: Respect. We understand that micro-cap is an inefficient asset class containing many misunderstood companies and select our individual stocks with great care. When companies are misunderstood by investors, you can find them priced to return many multiples of your initial purchase should the investment pan out. Patience is part of the micro-cap discipline, as it can take many years for a story to play out and for a company to finally get recognition. Lately we have seen several once misunderstood micro-cap stocks finally gaining respect, which has contributed to our strong performance of late. Two recent examples show that our investments in these stocks increased by 500% and here we outline their progress from highly misunderstood to highly respected and potentially overbought.

Addus HomeCare (ADUS) – Addus provides assisted living and skilled home nursing services. You can rarely explain a misunderstood stock with a single concept because if it was that simple it would not be misunderstood. There are four intertwined parts to the Addus story and why investors had no confidence the company could succeed:

- A large portion of Addus’ business was linked with the State of Illinois, and there was a perception that the state would never pay the bills.

- Addus operated a nursing home business which had very low margins. Management was able to divest this business at a nice multiple, improved the company’s balance sheet and financial strength.

- Because of the two issues above, investors did not believe that Addus could deploy capital to buy other business, which they subsequently were in fact able to.

- Addus was plagued by operating inefficiencies which no one believed they could improve.

- Again management proved doubters wrong as it fixed these issues and increased profitably.

From the beginning Addus was a broken IPO, as the stock went public at $9.00 and immediately missed expectations, dropping to $3.00-$4.00 right out of the gate. We sat down with the entire management team, it was twelve people in their offices which may have set a new record, and we listened to them pounding the table about how they would fix the four issues above and practically beg for institutional sponsorship. We became one of the only institutional investors in Addus and were rewarded when the stock finally received the market’s respect and increased 500% from our initial purchase.

“We have seen several once misunderstood micro-cap stocks finally gaining respect, which has contributed to our strong performance of late.”

Virtus Investment Partners (VRTS)* is an asset management firm which uses a model of sub-advisors, each with a distinct specialty and brand. Like Addus, Virtus came to the market as a highly misunderstood company, in this instance in a reverse merger. The company was valued at $100 million despite having $20 billion under management. We were intrigued because at this level the market said Virtus was worth 0.5% of AUM versus 1.5%-2.5% norm for the industry. Doing our homework we found that another $10 billion AUM was soon to come onto the balance sheet as contracts expired. So a company that was already undervalued was in reality vastly undervalued as AUM was in fact $30 billion and not $20 billion. Investors woke up and finally gave Virtus its respect over the past year, as our initial investment increased by over 500%.

Q: Does The Volatility In The Bond Market Have An Impact On Smaller Companies?

A: As many investors know, intermediate-and long-term long bond prices declined significantly over the past several months as interest rates began to rise. The reason for the rise in interest rates is related to expectations regarding Federal Reserve policy. The only reason the Fed would taper or shift toward a higher interest rate policy is because the economy is improving. Thisshould bode well for smaller companies that are more economically sensitive. We recently completed a historical analysis of this relationship in a research paper you can find on our website: Take Away The Punch Bowl, Small Cap Stocks May Keep Drinking, Rate Hikes and Small Cap Stock Returns.

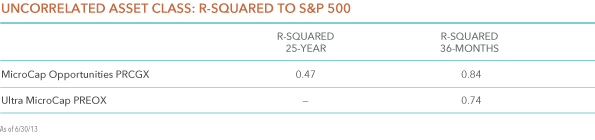

Q: Do You See Any Change In Correlation Among Small And Micro-Cap Stocks?*

A: Over the life of our MicroCap Funds, the portfolios have experienced lower correlation to the overall stock market. The Perritt MicroCap Opportunity Fund’s R-squared measurement is 0.47 versus the S&P 500 Index over the twenty-five year life of the Fund. However, during the 2007 to 2011 timeframe, correlation increased significantly. We have noticed that correlation has starting to normalize toward a lower level over the past year. This is a positive because individual companies are once again starting to march to the beat of their own drummer, which implies fundamentals are working through to stock prices.

Performance as of 6/30/13*

The Perritt MicroCap Opportunity Fund’s R-squared measurement is 0.47 versus the S&P 500 Index over the twenty-five year life of the Fund.

Attribution Analysis

Click here for standardized fund performance.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-800-331-8936. The funds impose a 2% redemption fee for shares held less than 90 days. Performance data quoted does not reflect the redemption fee. If reflected, total return would be reduced.

Micro Cap Opportunities Fund (PRCGX)

- The MicroCap Opportunities Fund gained 4.72% in the second quarter, outperforming the Russell 2000 Index (3.08%) but lagging the Russell MicroCap Index (5.10%). Year to date the Fund’s 19.54% return is higher than both indexes.

- Stock selection contributed to all of the positive returns relative to the indexes. Stock selection added 5.02% versus the Russell 2000 Index and 4.12% versus the Russell MicroCap Index. Stock selection in six of the Fund’s eight equity sectors added to relative outperformance.

- Stock selection was most pronounced in the health care, financials and consumer discretionary sectors.

- We continue to stress that our investors monitor the high level of exposure to financials in the Indexes. Financials now account for nearly 30% of the Russell MicroCap Index. Our underweight to financials added to the funds relative performance in the second quarter as financial names, notably REITS, struggled.

- Our biggest winners drove the returns, as the top five holdings provided 2.1% of portfolio return during the quarter. In aggregate, top five holdings have returned 118.3% year to date.

Ultra MicroCap Fund (PREOX)

- The Ultra MicroCap Fund gained 5.91% in the second quarter, versus 5.10% for the Russell Micro Cap Index.

- We always stress the difficulty of comparing this fund to a benchmark as it invests in companies far below the traditional radar, as demonstrated by its average market capitalization of just $59 Million (the lowest of all 8,012 equity Funds, according to Morningstar as of 7/26/13).

- Strong stock selection was concentrated in our top names, as the top five holdings contributed 3.5% to performance. Stock selection in five of the Fund’s eight equity sectors added to relative outperformance.