Marvelous Microcaps

Drilling Tools International Corp (DTI)

INTRO:

At Perritt Capital Management, we take focused positions in companies where we have a high conviction in their success; companies that are out of the mainstream of small cap investing. To highlight our process, we are pleased to present the newest installment in our ongoing series “Marvelous Microcaps – Big Ideas on Small Companies.” This series profiles companies that we believe have a niche in their existing markets or are launching a product that could disrupt their marketplace.

THE COMPANY:

Drilling Tools International Corp (DTI) is an oil and gas service company. They provide oilfield equipment and services to oil and natural gas sectors in North America, Europe, and the Middle East. The company offers a wide range of products and services, including downhole tool rentals, machining, and inspection services to support the global drilling and wellbore construction industry. Products offered include bottom hole assembly components, drill pipe and drill pipe accessories, and ancillary equipment and handling tools. Their rental fleet consists of downhole drilling tools used in horizontal and directional drilling of oil and natural gas. They offer tool rental services, inspection, machining, and repair services. Drilling Tools International is based in Houston, Texas.

WHY WE OWN: THE PERRITT ADVANTAGE

We believe that Drilling Tools International is a deep value play in the oil and gas space. Trading at just eight-tenths of book value and producing strong cash flows, valuations are increasingly attractive despite the weakness in the underlying stock and the sector they operate in. The company recently reported results for their 2024 fiscal year and reported $17.2 million in free cash flow, which was double their previous year. In addition, they issued formal guidance indicating that they will grow revenues by 12% on a year over year basis despite the underlying weakness in the oil and gas industry.

They are growing revenues through a series of acquisitions and increasing traction in their international markets, especially in the Middle East, where they expect strong growth in 2025. On the acquisition front, the company has completed four major acquisitions, purchasing competing service companies as well as new technology at compelling multiples. They have financed these acquisitions through debt financing, which they can easily afford given their strong cash generation from the rental business.

As stated above, the valuation multiples on the stock are extremely attractive at these levels. In addition to trading at just eight-tenths of book value, the company is trading at an enterprise value to EBITDA ratio of just three times. This is well below their historic norms, and we expect these multiples to go up as they demonstrate success in their execution this year. We also expect that multiples will go up should we see recovery on the macro side with an increase in oil prices. In the meantime, we are confident that they will generate sufficient cashflow to fund their internal capital needs as well as fuel their M&A strategy. We are excited for what the future holds for DTI and look forward to what 2025 will bring for the stock.

Meet Us in Person at the Following Events

The Wall Street Journal – December 2019

Small stocks have taken off recently-and the very smallest have done the best of all.

The Russell Microcap Index gained 4.5% for the month of November, besting the small-cap benchmark Russell 2000’s monthly gain of 4%. Meanwhile both of those indexes handily outperformed the S&P 500’s gain of 3.4% and the Dow Jones Industrial Average’s of 3.7%

Click here to view.

SSN Network – November 2019

In this Wall Street View, the host, Robert Kraft spoke with Mike Corbett, CIO and Portfolio Manager to discuss the new accounting standards for leases and Perritt’s Q3 2019 investor letter.

Click here to listen to the interview with Michael Corbett.

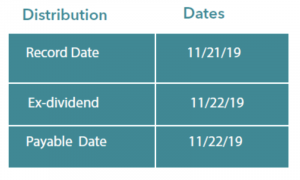

2019 Distribution Update

The Perritt MicroCap Opportunities Fund and the Perritt Ultra MicroCap Fund paid long-term capital gains distributions on 11/22/19 to shareholders of record on 11/21/19.

-

- The long-term capital gains (LTCG) distribution in the Perritt MicroCap Opportunities Fund (PRCGX) was $0.80330 per share and $0.02347 per share in the Perritt Ultra MicroCap Fund (PREOX).

- There was no ordinary income or short-term capital gains distribution in either of the Funds for 2019.Long-Term Capital Gains distribution:

Please visit our website at www.perrittcap.com/index.php or call 1-800-331-8936 for more information. Thank you for your investment and trust in the Perritt Team.

Click here for research and insights regarding small company investing.

Click here for a prospectus.

Manager Commentary, 3rd Quarter 2019

Stick to your Knitting

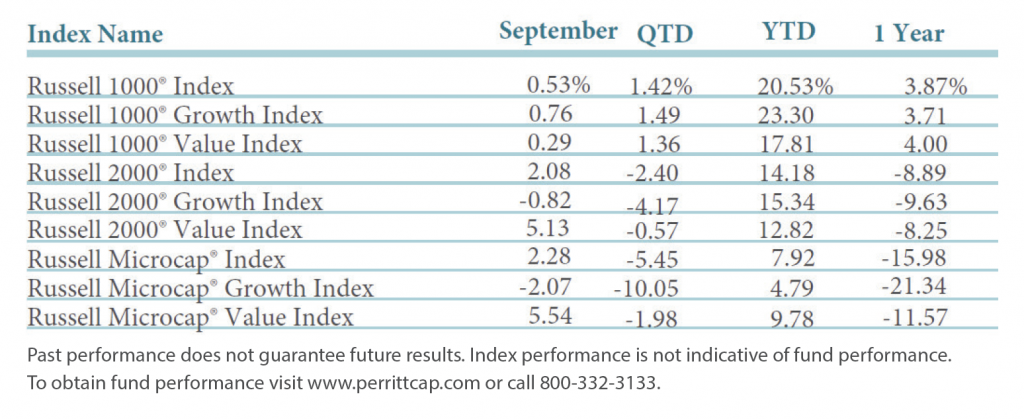

The Russell 2000 Index finished the third quarter down 2.40% and the Russell Microcap Index fell 5.45%. For the 52-week period both indexes are down despite decent performance year-to-date. The table below recaps the recent performance for all the Russell Indexes. The bright point is that small-caps outperformed large-caps and small-cap value beat small-cap growth in September. While one month does not make a trend, we are encouraged.

There is certainly a plethora of worries pestering the market: tariffs, interest rates, debt, recession, insider selling and the repo market to name a few. Many have argued that “this time is different” and all of these worries can be overcome. No matter what concern, the prevailing thought has been that growth will continue to be the place to invest because value is obsolete. We will tell you that “this time is different” does not apply to this thought.

Historically, we have always expected our investments to be valuable when they generated profits. But since the dot-com bubble, many profitless companies have been the sweet spot for investing. There is a place for these risky investments, but in our view they should not totally replace the more humdrum companies who do produce profits and have value. Investors are willing to pay more for the high-flyers when times are good because everyone is optimistic. When there is a wall of worry, as there is now with uncertainty in the market and the economy, value companies in our opinion will garner attention because they are cheap, and the fundamentals are solid and not a pipedream.

Besides focusing on these solid value investments, we also like companies with little or no debt. Perritt MicroCap Fund has almost 30% of its holdings with zero debt and Perritt Ultra MicroCap Fund has 48% with no debt, which compares to the Russell Microcap Index holding only 7% of companies with no debt. Even in a low interest rate environment, it is important to us that a portion of our investments are unencumbered. In our opinion, these will also be some of the most reliable companies in the microcap space.

We don’t think “this time is different.” We will stick to our knitting of seeking to be rewarded by finding solid micro-cap companies. Some of the best times for investing have been in difficult periods which gives us a chance of participating in the recovery.

Manager Commentary, 1st Quarter 2019

LAND OF THE UNICORNS

There is a herd of unicorns prancing through Wall Street and the bulk of money is chasing them. A “unicorn” refers to a startup, usually venture-backed, that achieves a private valuation in excess of $1 billion whether they are profitable or not when they become public. What once seemed impossible is commonplace today. The two king unicorns are Uber, the $1.8 billion money losing taxi company, which could go public next month with a value of $120 billion, and Lyft, who lost $911 million in 2018 and had a valuation of $20 billion upon their offering.

The estimate for upcoming offerings in 2019 is $80 billion which is double the yearly average since 1999. Historically, peaks in IPOs have indicated the top of the stock market and a precursor to recession. Both 1999 and 2007 were very strong years for IPOs leading to nasty bear markets thereafter.

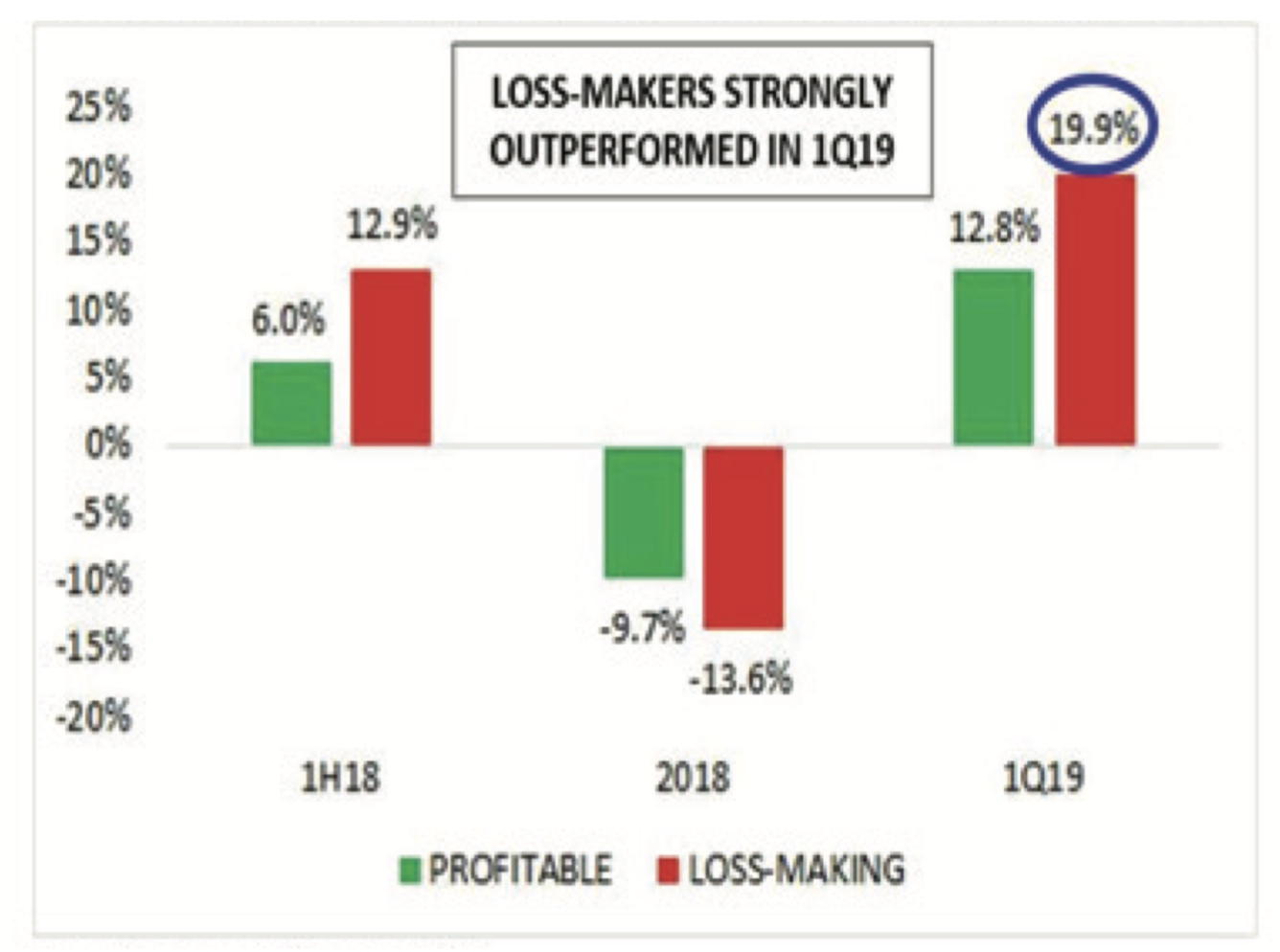

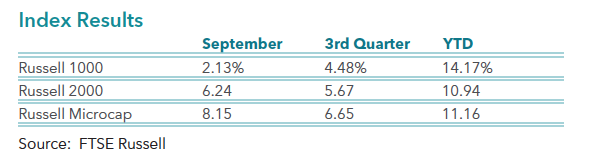

The proportion of companies reporting losses before going public in the U.S. is the highest since the dot com boom in 2000. Of the companies that went public in 2018, +80% of them were unprofitable. And of the 100+ companies to complete an IPO since 2010, 64% were unprofitable. As can be seen from the chart below, the Russell 2000 loss-making companies outperformed profitable ones by more than 600 basis points (bps) in the first half of 2018 and are doing so by more than 700 bps so far in 2019. The unprofitable companies in the Russell Microcap Index outperformed the profitable ones by 420 bps.

Back to the Future…1Q19 Performance Mirrored 1H18

Loss-Makers surged again in 1Q, with Biotech and Software leading the way

Loss-making companies in the Russell 2000 are Outperforming in ’19 as they did in 1H’18

Source: Furey Research Partners and FactSet.

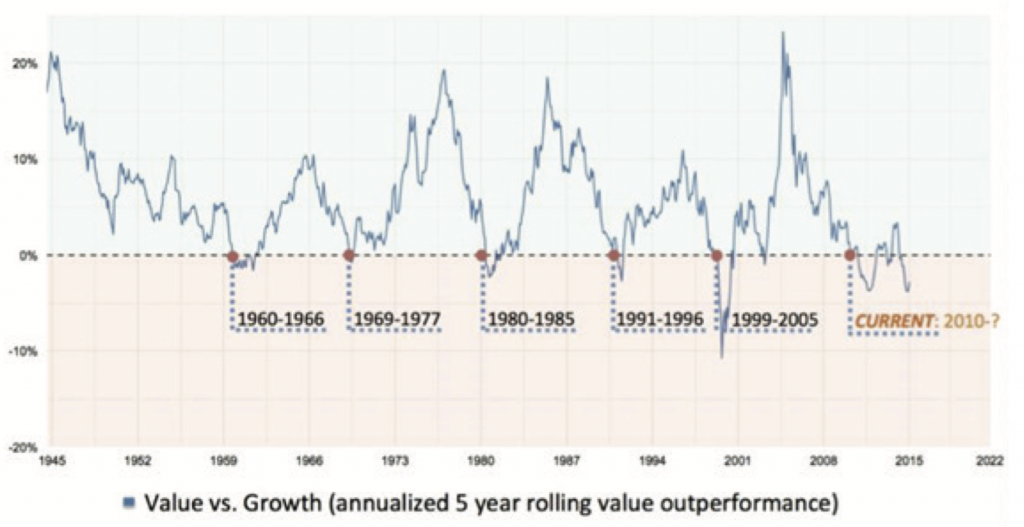

There is a great amount of money going into these IPO stocks leaving little for the rest of the market. Investors are dumping shares of established, profitable companies to buy these new stocks. The question being asked is if value investing is dead. Since 2010 with the start of quantitative easing and its impact on the yield curve, we have seen growth companies have an advantage over value. This has been the longest, broadest period of loose monetary policy and consequently the longest period of underperformance by value stocks. In the first quarter of 2019 alone the Russell 2000 Growth Index rose 17.14%, or 521 bps better than the Russell 2000 Value Index which gained 11.93%. Value stocks have beat growth stocks by 4% each year between 1926-2008, but growth stocks are currently enjoying their longest rally on record, having been the place to be ever since global stock markets bottomed out in early 2009. The chart below gives a better picture of how long growth has been outperforming value in this current period. While we clearly don’t know when the tide will turn for value, it seems clear to us that we are closer to the end of growth’s dominance than the beginning.

Growth Has Outperformed Value Six Times Since 1945

Each Time Value Has Had A Significant Recovery*

All performance information is hypothetical and not the actual performance of an investment fund. Historical performance is not necessarily indicative of future performance. The data used in this study is publicly available and can be accessed at http://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html

* Data from Kenneth French, the Fama/French benchmark. Portfolios are rebalanced quarterly using two independent sorts, on size (market equity, ME) and book-to-market (the ratio of book equity to market equity, (BE/ME). The size breakpoint (which determines the buy range for the Small and Big portfolios) is the median NYSE market equity. The BE/ME breakpoints (which determine the buy range for the Growth, Neutral, and Value portfolios) are the 30th and 70th NYSE percentiles.

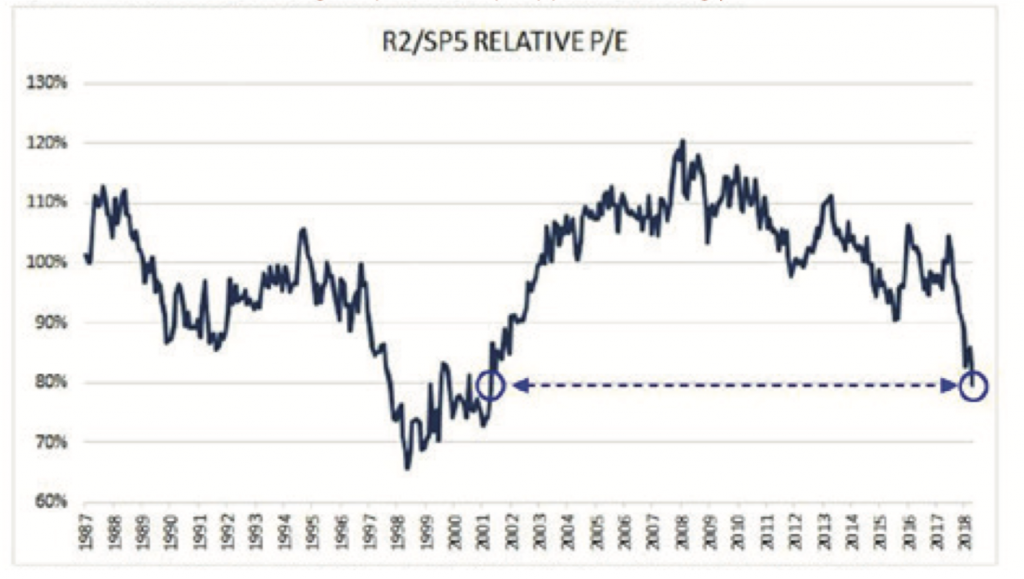

Despite the Strong Quarter, Relative Valuation Remains Compelling

Relative to large-caps, small caps appear increasingly attractive

Source: Furey Research Partners and FactSet. Data as of 1/29/19.

Represents median P/E using latest available 12-month earnings.

IN THE NEWS…

Meet Us in Person at the Following Events

Meet Us in Person at the Following Events

Perritt Funds, Inc. Reorganization – February 2019

We are pleased to anounce that on January 4, 2019, the Board of Directors of Perritt Funds, Inc. approved: a plan of reorganization pursuant to which the Perritt Low Priced Stock Fund (PLOWX) will be reorganized into the Perritt MicroCap Opportunities Fund (PRCGX); and (2) the subsequent liquidation and dissolution of the Low Priced Stock Fund, effective on or about February 22, 2019. Click here to read more.

Market Watch – December 2018

The key is to find losers that may rebound early next year.

It almost seems redundant to think about singling out year-end tax-loss-selling bargains to shop for now, given that so many stocks have been crushed.

But the market correction is exactly what makes this a suitable tactic — now more than ever.

Click here to read more.

Meet Us in Person at the Following Events

Charles Schwab – October 2018

The Perritt MicroCap Opportunities Fund (PRCGX) was named to Charles Schwab’s Mutual Fund OneSource Select List® as of October 20, 2018. The Mutual Fund OneSource Select List® is comprised of no-load and no-transaction fee mutual funds that the Charles Schwab investment Advisory, Inc. has screened rigorously for performance, risk, and expenses. The purpose of the Select List is to help investors sort through the thousands of available mutual funds.

To view the Press Release, click here.

Dr. Gerald W. Perritt Passes Away

October 9, 2018, Chicago – Perritt Capital Management announced that Dr. Gerald W. Perritt, age 75, the firm’s founder, passed away Saturday morning, October 6, 2018.

“We are sad to report the loss of our founder, friend, teacher, and mentor. Dr. Perritt was a pioneer in the mutual fund industry. He was one of the first in the industry to track performance and industry dynamics, and to champion mutual funds as an investment option. He launched The Mutual Fund Letter in 1981, a monthly newsletter tracking the mutual fund industry. Dr. Perritt’s flagship newsletter was Investment Horizons where he wrote about micro-cap investing. He also created the Perritt MicroCap Opportunities Fund, one of the first micro-cap mutual funds, in 1988,” stated Michael J. Corbett, the current CEO of Perritt Capital Management.

Dr. Perritt was a prolific writer, sharing his insights and expertise through newsletters and books, including Small Stocks, Big Profits, Mutual Funds Made Easy and Expanding Your Investment Horizons. He was also a columnist for Forbes Magazine. Dr. Perritt was frequently quoted in such publications as The Wall Street Journal and Barron’s. “He was always generous to share his wisdom, knowledge, and experience with his staff, grooming successful investors.” said Corbett

Teaching was a passion for Dr. Perritt. He taught and mentored many throughout his illustrious career. He served as professor at several prestigious universities, including Ball State University, Babson College, University of Miami and DePaul University.

Michael J. Corbett added, “Our thoughts and prayers are with Dr. Perritt’s family and loved ones.”

Charles Schwab – July 2018

The Perritt MicroCap Opportunities Fund (PRCGX) was named to Charles Schwab’s Mutual Fund OneSource Select List® as of July 20, 2018. The Mutual Fund OneSource Select List® is comprised of no-load and no-transaction fee mutual funds that the Charles Schwab investment Advisory, Inc. has screened rigorously for performance, risk, and expenses. The purpose of the Select List is to help investors sort through the thousands of available mutual funds.

To view the Press Release, click here.

Manager Commentary, 2nd Quarter 2018

2nd QUARTER REVIEW

As stated in our fourth quarter 2017 commentary, we believed the tax cuts would benefit small-cap stocks. This benefit has been the case for some names following recent results, but not all companies. We also stated in that commentary that since several companies have operations around the world and some have deferred tax assets that need to be adjusted or written down, the adjustments to earnings estimates is not simple. This prediction has turned out to be the case across the small-cap universe after the recent round of reports. As we said in the first quarter commentary, the market was a bit of a Jekyll and Hyde type of period, which was characterized first as low volatility and momentum to explosive volatility and fundamental driven market. We are now seeing an even different kind of market, which we will discuss later in this commentary.

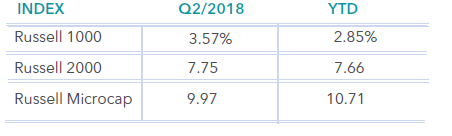

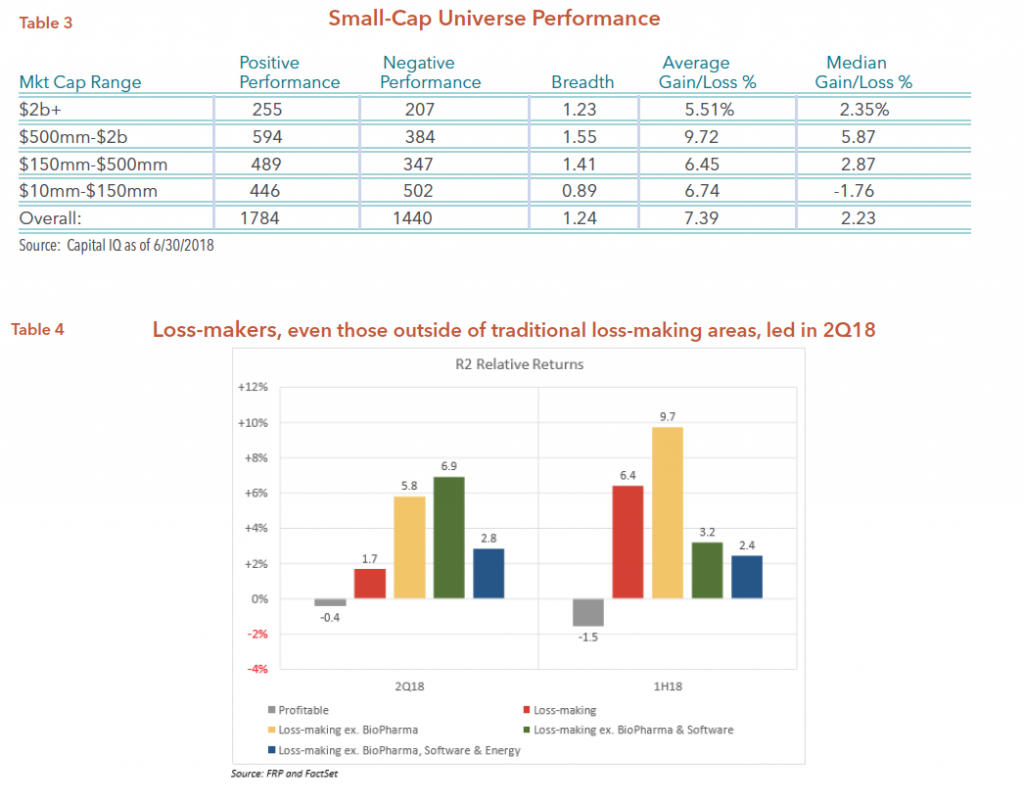

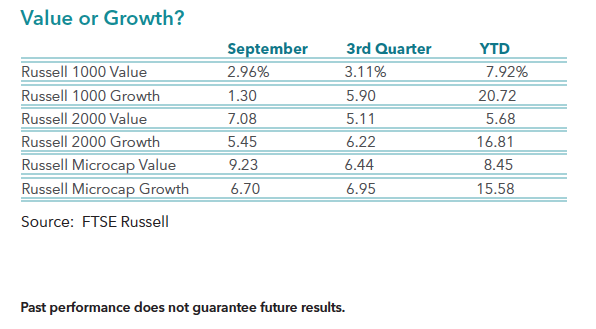

Volatility has certainly increased in 2018, but net results is that smaller stocks have been the leaders. As can be seen in the table below, small stocks beat large stocks and microcap stocks beat small stocks. With the uncertainty of the Tariff impact on the economy and strengthening dollar, investors grew more interested in placing bets on smaller stocks during the past quarter. We believe these two factors drove the superior performance for small and micro-cap stocks in the second quarter.

Past performance does not guarantee future results. Index performance is not indicative of fund performance. To obtain fund performance, click here: https://www.perrittcap.com/funds/

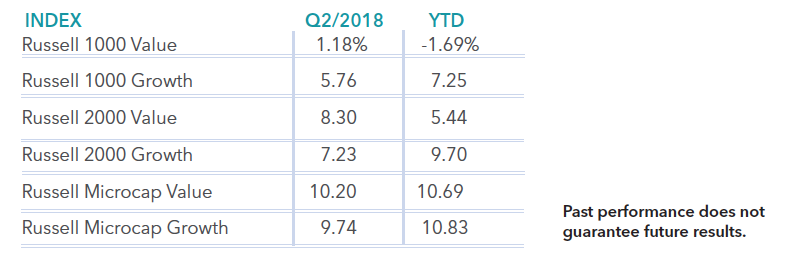

With a strong U.S. economy, one would think value would outpace growth stocks, but it was a mixed performance for large stocks versus small stocks. Value stocks outperformed growth stocks for small- and micro-cap stocks, but the degree was very modest. The table below shows that growth bested value for large stocks by a wide margin. As measured by the Russell 1000 Growth and Russell 1000 Value Index, growth stocks outpaced value stocks by 4.58% during the second quarter. The main reason that growth outperformed was the continued strength of FAANG stocks (Facebook, Apple, Amazon, Netflix and Google). The breadth of the overall market remains very mixed. As measured by the Russell 2000 Value and Russell 2000 Growth Index, value stocks modestly outperformed growth stocks during the second quarter, but growth stocks remained solidly ahead for the year-to-date period. The results are similar for the Russell Microcap Value and Russell Microcap Growth Indexes, but the margin of outperformance for growth stock is only modest for the year-to-date period.

We believe the most interesting data are in the following two tables. These tables give us a better indication of the overall market strength and how quality is performing. As you may know, we measure quality of companies by the level or degree of profitability. As you can see from Table 3, the breadth of the overall market is positive, but the degree is not too strong. Given the high single digit gains from all the indexes in the past quarter, one would think the breadth would be even stronger. Our friends at Furey Research supplied us with Table 4, which tells us this rally in the past quarter was dominated by very low quality stocks. As you can see from the table, profitable companies within the Russell 2000 Index were down 0.4% in the second quarter and finished down 1.5% for the year. On the other end of the spectrum, loss-making (not profitable) companies saw their stock prices climb 6.9% during the past quarter.

We believe this low quality rally may be related to the recent strength in the bond market as well as the recent strength in the U.S. dollar. Low interest rates tend to help risk assets. The yield on the 10-year government bond has recently declined from just over the 3% level to the 2.8% level and the dollar climbed by 5.5% relative to the Euro. We argue this strength in the bond market and the dollar are both short-term in nature. Some of the factors that influence this strength are lower tax rates, particularly for U.S. corporations that were bringing dollars home from overseas markets. We estimate that more than $300 billion was returned to the U.S. market for U.S. corporations. We also argue that the 3% level for the 10-year bond is an attractive level for many investors. We believe, however, that investors will be disappointed due to our belief that higher rates may be in store later this year, as well as next year.

The U.S. economy continues to strengthen, and most indicators such as the Leading Economic Indicator (LEI) show no signs of the economy faltering any time soon. Recent reports show that inflation is rising. Our friends at Furey Research argue that the recently passed tariffs may produce greater inflation. We believe Jim Furey brings up some very important points about tariffs and the markets. Below is an excerpt of his thoughts on this subject. Enjoy!

So what gives with tariffs and investors? What could the consensus be getting wrong when it comes to tariff worries? We have a theory about how the imposition of tariffs could be bullish for stocks and bearish for bonds. It makes a great deal of sense to us, the more we consider it.

Could it be that the way the press and main street financial commentators think about tariffs is totally incorrect? We think maybe. Certainly, the press, which disdains Trump, has a reason to view them bearishly. But the source of the tariff misunderstanding runs deeper.

Living U.S. investors and commentators tariff experience is theoretical and different from their education. Text books taught today’s U.S. investors everything they know, or think they understand about tariffs. The consensus believes tariffs led to the 1930’s Great Depression. But is that true? If you ask Ben Bernanke that question, he will answer, I believe that tariffs were not an economic positive, but it was the highly restrictive monetary policy that caused the Great Depression. If Bernanke is correct, and we suspect he is, there are several questions to ask that might shed light as to why stocks are doing well today in the face of imposed tariffs.

Question 1. What are tariffs’ primary economic impact? First and foremost, tariffs raise the price of imported goods. That creates a pricing umbrella that allows domestic firms to raise price and presumably profits if their own costs don’t escalate. Stop for a moment. Ponder the prior sentence. Tariffs allow domestic companies to raise prices and if costs don’t increase to post higher profits. The press and many commentators are not talking about that outcome.

Question 2. What does the domestic economic, indeed the global economy require, to normalize interest rates, to drive tax revenues and to service government debt levels? You got it. Inflation is required. Stay with me. If tariffs don’t damage the U.S. economy enough to slow growth because the economy is being stimulated by tax cuts, deregulation and improved sentiment, might it be that tariffs are bullish because they lead to higher profits for domestic companies? It’s true that small-caps, which are heavily domestic, are leading. One of the most consistent positive small-cap correlations we monitor is inflation expectations. You have seen us comment on it many times. In light of our earlier comment that tariffs’ primary economic impact is to increase inflation, let’s examine investor inflation expectations through the lens of TIPs spreads versus U.S. government 10-year bond prices.

Question 3. Will the Fed respond to tariff’s higher inflation by hiking faster and repeating the 1930s mistake hiking during a time of rising tariffs? We don’t believe the Fed will choose to hike continually if tariffs continue to rise, especially with weakening overseas economies. We don’t deny that tariffs slow growth on the margin due to higher prices. Remember, Fed officials are human and have emotions. The new Fed chair does not want to be remembered as the chairman who hiked into rising tariffs as overseas growth slowed. It would repeat the 1930 mistake.

Our point today is that the incremental slowdown due to tariffs in todays U.S. economy won’t be sufficient to slow growth below investors’ expectations. In fact, the consensus thought about tariffs’ danger has greatly exaggerated the impact of existing and discussed tariffs place on a $20 trillion-dollar economy. To be sure, the $34 billion of Chinese tariffs announced to match the U.S. imposed sanctions impact less than 2.5% of the U.S. economy.

We foresee a day in the next six months when the Fed, fearing slowing growth overseas and tariffs impact indicate they are pausing or complete in their quest normalizing rates. If that occurs, it will change fixed income investors playbook immediately. While the Fed has been “normalizing” the fixed income investors winning playbook has been to sell the curve’s short end and go long the long end. As soon as the Fed says it will halt normalizing that means the playbook reverses. Fixed income investors will buy the short end and sell the long end. That will immediately steepen the yield curve.

When the Fed says they are done or pausing in their normalization the steeping yield curve will indicate rising growth, in our view. Small-cap portfolios overweight cyclical industries are positioned for that day to arrive. Algo investors will react by buying stocks in such an environment unless the pause is accompanied by a Fed warning on U.S. growth. Recall my wording. The Fed will say they are pausing due to overseas weakness and uncertain tariff impacts. They won’t be pausing, in our view currently, due to weakening U.S. growth.

The Street – July 2018

The first half of 2018 brought a rebound in the IPO market not seen for the past 20 years, driven to large extent by an appetite for healthcare and technology stocks.

So far this year, 120 companies have issued IPOs on U.S. exchanges raising a total of $35.2 billion, according to the Wall Street Journal citing Dealogic, which keeps data since 1995. In the past 12 months, more than 60% of the IPOs have been focused in healthcare and tech stocks, according to data from Renaissance Capital.

Click here to read the full article.

Meet Us in Person at the Following Events

Meet Us in Person at the Following Events

Meet Us in Person at the Following Events

Meet Us in Person at the Following Events

Value vs. Growth stocks – February 2018

We’ve talked a lot about the similarities of the markets in the last few years relative to the late 90’s. Here is exhibit A of that notion. This is a chart of the performance of Value vs. Growth stocks since 1998. We’re approaching the most extreme levels of 1999-2000. The only saving grace is that many more Allocators and Macro Strategists are starting to question whether it’s time to rotate to value. I can only hope so, sooner than later too.

Financial Advisor Magazine – January 2018

Microcap equities are some of the least researched publicly invested securities. Due to their under-researched and under-followed nature, they tend to be inefficiently priced, which can offer great upside potential for investors. “Microcaps represent a formidable crack in the so-called ‘efficient market theory’.”

Look for the article in Financial Advisor Magazine Online, Seeking Alpha, Harvest Exchange, Institute Blog & LinkedIn Pulse.

Market Watch – December 2017

People have a lot of gains to offset so the normal tax-loss selling may be intense. One investor’s loser can be another one’s winner. Often it makes sense to pick up shares of companies getting pressured by tax-loss selling.

Click here to read the full article.

Charles Schwab – October 2017

The Perritt MicroCap Opportunities Fund (PRCGX) was named to Charles Schwab’s Mutual Fund OneSource Select List® as of September 30, 2017. The Mutual Fund OneSource Select List® is comprised of no-load and no-transaction fee mutual funds that the Charles Schwab investment Advisory, Inc. has screened rigorously for performance, risk, and expenses. The purpose of the Select List is to help investors sort through the thousands of available mutual funds.

To view the Press Release, click here.

Morningstar – October/November 2017

Laura Lallos at Morningstar interviews Portfolio Manager Michael Corbett about the inefficiencies and opportunities in micro-caps.

Click here to read the full article.

Manager Commentary, 3rd Quarter 2017

SMALL-CAPS LEAD IN SEPTEMBER and THIRD QUARTER

The small- and micro-cap markets started the third quarter with a modest correction, but finished the quarter with a monster gain in September. All equity markets produced posi- tive results in the third quarter, but the real stars were smaller stocks. As you can see from the table below, the Russell 2000 Index outperformed the large-cap Russell 1000 Index in both September and the third quarter. The Russell Microcap Index was the strongest performer with a 8.15% gain in September and a 6.65% gain for the quarter. The renewed promise of lower taxes from the Trump Administration was certainly a big catalyst for the rally. However, the strengthening economy and improved corporate profits were also reasons for the gains.

LEADERSHIP

A deeper look at the recent performance of value and growth stocks show that leadership may be changing. While value related stocks performed well in 2016, the real leader this year has been growth stocks. As the table below shows, growth has been the place to be year-to-date, as well as for the third quarter, but value stocks outperformed growth in September. As measured by the Russell Value and Growth Indexes, this outperformance was the case for large stocks, small stocks, and micro-cap stocks.

The change in leadership may be related to the movement within the bond market. The 10-year Treasury yield hit a recent low of 2.05% on September 7th, but climbed the rest of the month to its current level of 2.35%. In our opinion, a rising yield environment tends to be a positive for value-oriented stocks, and not necessarily for long duration sensitive growth stocks. Regardless, we are encouraged by these recent trends, mainly because the overall breadth of the market is improving. While value has outperformed growth, all stocks are rising.

OUTLOOK

It remains to be seen if the recent renewed strength in small stocks and value stocks will continue in the near term. However, we often remind ourselves and our investors about history. We believe the small stock market experienced a stealth bear market in both 2014 and 2015, which was followed by a real bear market from June 2015 to February 2016. The Russell 2000 Index and the Russell Microcap Index declined in that bear market by more than 26% and 29% respectively. Small stocks have not experienced a significant decline since the lows of February 2016, which means this bull market was only 19 months ago. In our opinion, the small-cap bull market still has room to run.

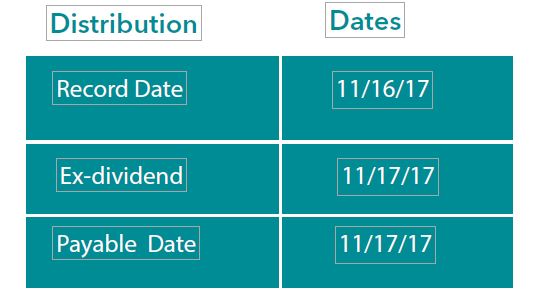

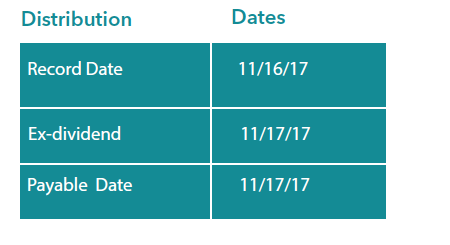

PERRITT FUNDS TAX DISTRIBUTION UPDATE

The Perritt MicroCap Opportunities Fund, the Perritt Ultra MicroCap Fund and the Perritt Low

Priced Stock Fund will pay a distribution on 11/17/17 to shareholders. Based on estimates:

- The Long-Term Capital Gain distribution in the Perritt MicroCap Opportunities Fund (PRCGX) will be approximately 19%, roughly 8% in the Perritt Ultra MicroCap Fund (PREOX), and about 5% in the Perritt Low Priced Stock Fund (PLOWX).

- No short-term income or short-term gains will be paid in the Perritt Ultra MicroCap Fund nor the Perritt Low Priced Stock Fund. The Perritt MicroCap Opportunities Fund may pay a modest short-term income gain of approximately 1%.

Shareholders of record on 11/17/2017 will receive distirubtions.

Distribution figures and distribution dates are estimates only and are subject to change. Actual distributions may be substantially different (higher or lower) or may not be distributed at all.

Actual distributions on a dollar per share basis will be available on or after 11/17/17.

PERFORMANCE UPDATE

Click here for performance.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 800-331-8936.

Yahoo Finance – October 2017

You can read recent press coverage of The Perritt MicroCap Opportunities Fund by clicking here.

Fund holdings and sector allocations are subject to change at any time and should not be considered a recommendation to buy or sell any security. Click here for fund holdings.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-800-331-8936.

Please click here for standardized performance.

Meet Us in Person at the Following Events

2017 Distribution Update

The Perritt MicroCap Opportunities Fund, the Perritt Ultra MicroCap Fund and the Perritt Low Priced Fund paid long-term capital gains distributions on 11/17/17 to shareholders of record on 11/16/17.

- The long-term capital gains (LTCG) distribution in the Perritt MicroCap Opportunities Fund (PRCGX) was $8.06541 per share, $1.92699 per share in the Perritt Ultra MicroCap Fund (PREOX) and $1.07162 per share in the Perritt Low Priced Stock Fund (PLOWX).

- The short-term capital gains (STCG) distribution paid on 12/29/17 to shareholders of record on 12/28/17 in the Perritt MicroCap Opportunities Fund (PRCGX) was $0.32806 per share and $0.01375 per share in the Perritt Low Priced Stock Fund (PLOWX). There was no STCG distribution in the Perritt Ultra MicroCap Fund (PREOX) and no ordinary income distribution in any of the funds.

LTCG distributions: