Marvelous Microcaps

Paysign, Inc. (PAYS)

INTRO:

At Perritt Capital Management, we take focused positions in companies where we have a high conviction in their success; companies that are out of the mainstream of small cap investing. To highlight our process, we are pleased to present the newest installment in our ongoing series “Marvelous Microcaps – Big Ideas on Small Companies.” This series profiles companies that we believe have a niche in their existing markets or are launching a product that could disrupt their marketplace.

THE COMPANY:

Paysign, Inc. (PAYS) provides prepaid card programs, comprehensive patient affordability offerings, digital banking services, and integrated payment processing service for businesses, consumers, and government institutions. It offers solutions for corporate rewards, prepaid gift cards, general purpose reloadable debit cards, employee incentives, consumer rebates, donor compensation, clinical trials, healthcare reimbursement payments and pharmaceutical payment assistance, and demand deposit accounts accessible with a debit card. The company also operates a customer service center; and offers a communication suite, including a kiosk, mobile app, two-way SMS, text alerts, and cardholder web portal. It markets its prepaid card solutions under the Paysign brand. The company serves companies and municipalities that require payment solutions for rewards, rebates, payment assistance, and other payments to their customers, employees, agents, and others. Paysign, Inc. was founded in 1995 and is headquartered in Henderson, Neveda.

WHY WE OWN: THE PERRITT ADVANTAGE

We were initially attracted to Paysign, Inc. due to their market position within the plasma center marketplace, where they are a dominant player in the prepaid debit card market. Through their services, plasma centers can issue prepaid debit cards to their donors. This has been a consistent and reliable source of revenue for the company. They serve over 480 plasma donation centers as of the end of the most recent quarter. Since that time, they have signed up an additional 132 established plasma donation centers through an expansion of a relationship with a major plasma collection company. These recent customer acquisitions will bring in an incremental $9-10 million in revenue to the company per analyst estimates on top of the estimated $87 million in revenue they are projected to do in 2026 from their existing business. Their plasma line of business is their primary source of revenue, with plasma centers accounting for approximately 75% of their revenue in 2024.

More recently, the company has been making forays into the pharmaceutical benefits program space where they issue cards for programs that administer discounts and rebates to patients. This segment accounts for approximately 22% of their revenue and is the growth engine for the company. In 2024, they added thirty-three new programs and so far, have added at least 14 more in 2025. Revenues in this segment increased by 252% as of Q4 2024 due to the addition of new programs. The company projects that this segment will grow to 37% of revenue by the end of 2025. We are encouraged by the company’s growth in this segment as these are long lived programs with healthy margins.

We believe this is a classic source of stable revenue feeding the growth vehicle story with the plasma segment supporting growth in the pharmaceutical benefits business. While they have experienced lackluster growth from the plasma segment recently, it generates respectable cashflow and supports the growth in their new lines of business. The recent addition of new customers, as well as the acquisition of a company called Gamma Innovation, should bring growth back into the plasma segment. With growth returning to the plasma segment and continuing for the pharmaceutical benefits segment, we believe Paysign is positioned for a robust year of growth in 2026 and beyond.

Bragg Gaming Group Inc. (BRAG)

INTRO:

At Perritt Capital Management, we take focused positions in companies where we have a high conviction in their success; companies that are out of the mainstream of small cap investing. To highlight our process, we are pleased to present the newest installment in our ongoing series “Marvelous Microcaps – Big Ideas on Small Companies.” This series profiles companies that we believe have a niche in their existing markets or are launching a product that could disrupt their marketplace.

THE COMPANY:

Bragg Gaming Group Inc. (BRAG) operates as an iGaming content and technology solutions provider serving online and land-based gaming operators with its proprietary and exclusive content. Utilizing their own internal studio, they offer crafted casino game titles using data driven insights from in-house brands. In addition to their proprietary content portfolio, they complement their offerings with a wide cross section of exclusive titles from selected studio partners under the Powered by Bragg program. The company builds games on its own RGS technology that are distributed via the Bragg Hub content delivery platform and are available to customers. Its PAM technology powers various iCasino and sportsbook brands and is supported by in-house managed, operational, and marketing services. They have a geographic presence in the U.S., Canada, Brazil, Mexico, Peru, Belgium, Croatia, Czech Republic, Germany, Greece, Italy, Portugal, Romania, Serbia, Spain, Sweden, Switzerland, and the United Kingdom. They are based in Toronto, Canada.

WHY WE OWN: THE PERRITT ADVANTAGE

We believe that Bragg Gaming is an attractive investment opportunity in the iGaming and iCasino space. The company is going through a transition in their business, where they are harvesting the cashflows from their legacy established markets in Europe and using those assets to penetrate new markets in North America and Latin America, notably in the United States and Brazil. As the U.S. and Brazil work to liberalize their iGaming markets, Bragg is positioning themselves to take advantage of growth opportunities within these markets.

They are accomplishing this growth through a series of partnerships and acquisitions. In Brazil, they recently announced the acquisition of an equity stake in, and the signing of an exclusive content partnership with a company called RAPIDPLAY LTD, a gaming studio renowned for its localized, high-performance content tailored to the Brazilian and broader Latin American markets. In the U.S., they have recently announced a key partnership with Caesars Entertainment. This partnership elevates Bragg from being a content supplier to a technology partner where they will leverage their existing platform to help Caesars develop their own proprietary content as well as use Bragg’s content to deliver unique gaming experiences to their customers.

We believe this is a classic source of stable revenue feeding the growth vehicle story with the company’s revenue and cashflow from their European operations feeding growth in the North American and Latin American markets. As European revenues decline in certain markets due to regulatory pressures, their revenues from North America and Latin America should begin to have a material impact on the company’s bottom line. In their last report, they highlighted triple digit revenue growth in the U.S. with that market slated to be about 15% of revenues by the end of the year. This represents a material impact from a market where they did not have a presence until very recently. As regulatory hurdles around iGaming are lowered in the U.S., Brag should be able to continue to further penetrate this marketplace and grow their revenue further. We are excited about what the future has to offer for Bragg Gaming.

Arq, Inc. (ARQ)

INTRO:

At Perritt Capital Management, we take focused positions in companies where we have a high conviction in their success; companies that are out of the mainstream of small cap investing. To highlight our process, we are pleased to present the newest installment in our ongoing series “Marvelous Microcaps – Big Ideas on Small Companies.” This series profiles companies that we believe have a niche in their existing markets or are launching a product that could disrupt their marketplace.

THE COMPANY:

Arq, Inc. (ARQ) is an environmental technology company producing activated carbon (AC) products that reduce or reverse environmental liabilities. The AC market is entering a period of supply shortage. AC removes impurities, contaminants, and pollutants in many industries. When carbon is activated, it results in a highly porous substance that can absorb compounds. ARQ has a patented process that can be tailored to each customer. Management is in the process of turning around the company’s legacy powdered activated carbon (PAC) operations into higher margin granular activated carbon (GAC) operations.

WHY WE OWN: THE PERRITT ADVANTAGE

New management entered in 2023 with the focus of optimizing and improving the financial performance of the PAC business. In 2023, 24% of the contracts had a negative gross margin. At the end of 2024, only one contract remained with negative gross margins of 2%. They have lowered their borrowing costs to half of the previous rate. Then they concentrated on the GAC expansion in the beginning 1Q25 as they begin to phase it into the PAC production site. They have $57.4m in cash to expand two additional GAC lines. These two new lines will start 1Q25 and 1Q27, each with an incremental twenty-five million pounds of production. EBITDA could grow at an 81% CAGR from 2024 to 2028. They have a longer-term opportunity in asphalt emulsions. This could surpass the GAC business.

Ultralife Corporation (ULBI)

INTRO:

At Perritt Capital Management, we take focused positions in companies where we have a high conviction in their success; companies that are out of the mainstream of small cap investing. To highlight our process, we are pleased to present the newest installment in our ongoing series “Marvelous Microcaps – Big Ideas on Small Companies.” This series profiles companies that we believe have a niche in their existing markets or are launching a product that could disrupt their marketplace.

THE COMPANY:

Ultralife Corporation (ULBI) designs, manufactures, installs, and maintains power, and communication and electronics systems worldwide. The company operates in two segments: Battery and Energy Products and Communications Systems. The Battery and Energy Products segment produces a variety of offerings ranging from lithium 9-volt batteries to multi-kilowatt module lithium-ion battery systems. They also produce various charging systems including rugged military and commercial battery charging systems and smart chargers. The Communications Systems segment provides communications systems and accessories to support military communications systems. Products include but are not limited to radio frequency amplifiers, power supplies and cables, connector assemblies, amplified speakers, and satellite communications systems. The company was founded in 1991 and is headquartered in Newark, New York.

WHY WE OWN: THE PERRITT ADVANTAGE

We believe Ultralife Corporation is an undiscovered opportunity within the microcap space. The company has just one analyst covering the stock and is currently trading at just its book value. While they stumbled in their most recent quarter’s results due to the timing of certain orders, the company has been able to grow revenues nicely over the past several years, ending the most recent quarter with trailing twelve-month revenues of $165.2mil, up from $98.3mil just three years ago. The company has been able to achieve this growth through a combination of organic sales growth and mergers and acquisitions. Their most recent acquisition was of a company named Electrochem, a company making $34 million in annual revenue. They completed this acquisition for $50 million and it will complement their offerings in the lithium battery space.

We believe they fill a niche market in addressing ruggedized military and commercial needs in both the battery and communications system segments. They have successfully sold these products into the medical and healthcare, government and defense, oil and gas, energy storage, and safety, security, and industrial markets. By addressing mission-critical needs within these markets, they establish themselves as a reliable supplier which makes for repeatable purchasing patterns from customers. This is demonstrated by the robust backlog of revenues they currently have, representing 48% of their trailing twelve-month sales. They are also generating record levels of cash, spinning off $17.4 mil in adj. EBITDA on a trailing twelve-month basis.

While they stumbled on revenue growth in the most recent results due to the timing of certain orders, we believe that the company has an attractive valuation profile at this time. It is a profitable company generating ample cash and trading at slightly less than the book value of its assets. They have focused on controlling costs and more dollars should drop to the bottom line as new orders come in. We are excited about what the future has to offer to Ultralife Corporation.

Opinion: Year-end selling is hitting these 7 stocks. How their tax loss can be your gain.

Foot Locker, CVS Health, and Charles River Laboratories are among hard-hit stocks that look ready to recover.

By: Michael Brush

PHOTO: AFP/GETTY IMAGES

Hard-core investors hunt for stock-market castoffs every holiday season. Specifically, they look for stocks that fell so much during the year, they get hit by waves of tax-loss selling from investors wanting to offset capital gains.

This “tax loss selling” turns banged-up stocks into bargains. To round up names, I recently checked in with four money managers. Stock candidates needed just two qualifications. The stocks had to be down a lot this year — to trigger the tax-loss selling. And the money managers had to be able to make the case that these shares had a good chance to rebound over the next year or two.

Quick traders might also exploit a different angle. These stocks could see a rebound in early January, as the heavy tax-loss selling subsides. This is a tactic commonly used by several traders I know.

The money managers collectively highlighted these seven stocks:

- Foot Locker (FL +1.53%): got knocked off its perch as a leading sneaker retailer three years ago when Nike decided to cut out intermediaries and sell direct to consumers. Nike’s move did not work out well, so now it is partnering with retailers again, including Foot Locker. Nike realized “they need retail partners to reach people who do not buy online,” Allspring Special Mid Cap Value fund (WFMIX) portfolio manager Bryant VanCronkhite said in a recent interview.

This should help Foot Locker make a comeback. Under new management since late 2022, the company is building relationships with vendors including Birkenstock and Ugg and overhauling its aging stores. Foot Locker is also improving its online retail platform and loyalty program. These changes should help produce sales growth. Says VanCronkhite: “The market is giving them too little credit.”

- CVS Health (CVS +1.19%): has used acquisitions to become a health care conglomerate. It is now a pharmacy benefit manager, an insurer via its Aetna division, and a healthcare service provider.

CVS shares are under pressure in part because of the constant threat of healthcare reform. But it is a business with decent growth. Sales grew 6.3% year-over-year in the most recent quarter to $95.4 billion, beating estimates. CVS could see improved growth because the Aetna insurance division is now in turnaround mode.

With CVS stock near a 10-year low, John Buckingham at The Prudent Speculator thinks the combined valuation of its parts well-exceeds the market value. He thinks strong cash flow, restructuring and potential growth make CVS a compelling name for patient value investors.

- Charles River Laboratories (CRL+2.68%): Excess capacity in biotech research services has put downward pressure on pricing at Charles River Laboratories and other providers.

But VanCronkhite at Allspring Global Investments believes the company’s stock is poised for a comeback. “Clients are about to reestablish their development programs,” he says, which should boost revenue growth and as a result bring new investors.

- Valaris (VAL +0.72%): Investors have sold offshore energy drilling companies because of concerns about project delays and supply-chain issues. So now oil companies have pushed back offshore-well development.

But this is only a temporary setback, for the next six months or so, says Robert Robotti of Robotti & Company Advisors. “There has been lull in timing of the activity, but no projects have been cancelled,” Robotti says. He believes that drilling activity will pick up in 2025 to start a two- or three-year cycle.

If he is right Valaris could rally from its severely depressed levels. The stock trades at just three times trailing earnings, or 91% below its five-year average, according to LSEG. Robotti says the company sells for around 35%-50% of what its assets are worth.

On the supply side, two factors favor Valaris. Companies in this business are reluctant to build new drilling vessels because they are expensive. Second, rival Seadrill could get acquired by one of the three other big players in the space. That would mean 75% of drill ships would be controlled by just three companies. These factors would contribute to more realistic pricing.

- Interfor (IFP +1.20%): The shares of this Canadian lumber company are down sharply this year because of weak lumber prices. Robotti says Interfor’s assets are worth three- to four times its current enterprise value. What could bring the stock back? Housing shortages in the U.S. due to chronic undersupply, plus population growth, suggest a pickup in home construction. The demand will boost lumber prices, especially because fires and beetles have destroyed many trees in British Columbia, which limits supply.

TWO SMALL-CAP CANDIDATES

Small-cap stocks can be risky. Their relatively low trading volumes mean the shares can get pushed around a lot. But this is what makes small-caps potentially good year-end tax-loss selling candidates. The tax-related selling can impact share prices more than it would with larger caps.

For help identifying potential small-cap winners once tax-loss selling subsides, I turned to Michael Corbett, the CEO of Perritt Capital Management, which specializes in smaller companies. Aside from a potential rebound as selling subsides, small-cap stocks could see new strength because they have been so overlooked. “They have been ignored,” Corbett says. “They are so cheap, it’s ridiculous.”

- DLH Holdings (DLHC +1.70%): offers technology- and health-care outsourcing services to government agencies. The company says it has a pipeline of potential business worth $4 billion. Corbett thinks DLH could collect $1 billion of that over the next three- to five years. Adding $100 million to $200 million a year to annual sales of $395 million would catch investors’ attention. A risk here is that the company has a lot of debt, but Corbett thinks it has the cash flow to manage it.

- Aviat Networks (AVNW (+1.86%): The shares of this microwave and wireless network services provider are down substantially, because of what Corbett believes is a temporary pullback in spending on its services by a major telecom provider. Aviat Networks insists the delay will last one- or two quarters, Corbett notes, “and then business should improve.” A return to Aviat’s prior earnings pace is possible, he adds, which could give the stock a boost.

Michael Brush is a columnist for MarketWatch. Brush writes a stock newsletter called Brush Up on Stocks. He has no positions in any of the stocks mentioned in this article. Follow him on X @mbrushstocks

Lakeland Industries (LAKE)

INTRO:

At Perritt Capital Management, we take focused positions in companies where we have a high conviction in their success; companies that are out of the mainstream of small cap investing. To highlight our process, we are pleased to present the newest installment in our ongoing series “Marvelous Microcaps – Big Ideas on Small Companies.” This series profiles companies that we believe have a niche in their existing markets or are launching a product that could disrupt their marketplace.

THE COMPANY:

Lakeland Industries (LAKE) is a manufacturer of industrial protective clothing and accessories for the industrial and public protective clothing market worldwide. They also offer a full suite of firefighting and heat protective apparel to protect against fire. Their suite of product offerings includes high-end chemical protective suites that provide protection against highly concentrated toxic and/or lethal chemicals and biological toxins. They also offer a wide range of disposable protective clothing as well as woven garments. Applications for their products include but are not limited to electronic clean rooms, petrochemical and refining applications, and electrical utilities.

The company manufactures their products through a global manufacturing base spread across North America, Europe, and Asia. They market and sell their products to a worldwide network of safety and industrial supply distributors through an in-house sales team as well as customer service groups and independent sales representatives. End users include public safety, energy, clean room, utilities, industrial, and healthcare customers. The company was founded in 1982 and is based in Huntsville, Alabama.

WHY WE OWN: THE PERRITT ADVANTAGE

We were originally drawn to Lakeland as an investment due to their robust range of product offerings and sustainable cash flows. At the time, the company had a well-established position within the industrial safety garment space, having been operating in that segment for several decades. While these markets generated a robust cashflow, they represented mature markets for the company and growth in those markets was limited. After several years of low growth, the board of directors elected to change the management team and pursue a series of acquisitions that changed the face of the company.

Under the new management team, Lakeland has embarked on a series of acquisitions in the fire and safety space, entering a new $2 billion market. They have made several acquisitions, including Pacific Helmets based in New Zealand, Eagle Technical Products based in the UK, LHD Group based in Germany and Jolly Scarpe Boots based in Italy. These acquisitions have enabled Lakeland to provide a full product suite of head-to-toe offerings in the fire and safety space. The acquisitions also opened new markets to them including the public safety space in Europe, where they previously had no presence.

The acquisition of LHD also provides Lakeland with a blueprint to establish a new market in total care services. After each turnout, a fire suit must undergo cleaning to get toxic chemicals and other harmful pollutants off them. LHD provides these services in their European locations and Lakeland intends to bring these services to other markets, opening a compelling recurring revenue stream for a company that has previously relied on one-time sales.

The new management team is also focused on streamlining their sales organization. As part of these efforts, they transitioned their North American sales force to a third-party industrial sales organization called Line Drive. This transition allows their internal sales force to focus their efforts on engaging with end users and driving market penetration while Line Drive handles sales into their third-party distribution partners such as the large industrial catalog companies like Grainger. While it is too early to tell if this strategy will be successful, it opens new opportunities for them to further penetrate their mature markets in North America and could reignite growth in a stagnant sales channel.

We believe that Lakeland is well positioned to produce growth in their end markets over the next couple of years as they successfully expand their presence in the fire and safety space. We expect that they will continue to expand their market penetration through both organic growth and mergers & acquisitions activities funded by their internal cash flows and borrowing capacity. This in turn may lead to greater returns for shareholders.

Alico, Inc. (ALCO)

INTRO:

At Perritt Capital Management, we take focused positions in companies where we have a high conviction in their success; companies that are out of the mainstream of small cap investing. To highlight our process, we are pleased to present the newest installment in our ongoing series “Marvelous Microcaps – Big Ideas on Small Companies.” This series profiles companies that we believe have a niche in their existing markets or are launching a product that could disrupt their marketplace.

THE COMPANY:

Alico, Inc. (ALCO) is an agricultural and land management company with 103,000 acres of land in Florida. It is also one of the largest citrus producers in the U.S. The land not being used for citrus is leased for grazing rights, hunting, farming, and mining and oil extraction rights. Given the preponderance of hurricanes in Florida, the company has started efforts to transition citrus groves to developable residential and commercial land. Regardless of what the land is used for, the current enterprise value is $277 million. That equates to a very economical $5000/acre for Florida land.

WHY WE OWN: THE PERRITT ADVANTAGE

We believe ALCO is an undiscovered gem with its growth opportunities and potential monetization of non-core land assets. Any stock weakness due to weather and the effect on the citrus crops is an opportunity to buy the stock. Hurricane Milton did not cause significant tree damage but there will be a measurable fruit drop in some areas. Tropicana is their largest customer amounting to 88% of 2023 revenue. There may be a further increase in orange juice prices due to the storms in Florida. ALCO just renewed their contract with Tropicana for 3 more years and at prices that are 33-50% higher.

In the third quarter of 2024, ALCO sold 798 acres of citrus groves for $7.2m or $9000/acre. Using management’s estimates, their real estate could be worth about $50/share. There is considerable upside as some of the land is near major cities and could be worth quite a bit more. This is a company that has a solid business evidenced by a long-term contract with a major client for its citrus product. Underlying all of this is a hugely valuable asset in their land.

Perrit Ultra MicroCap Merger

The Board of Directors of the Perritt Funds, Inc. are pleased to announce the acquisition of the assets and liabilities of the Ultra MicroCap Fund by the Perritt MicroCap Opportunities Fund effective after the close of business on October 25, 2024. The acquisition is described in more detail in the prospectus.

https://www.perrittcap.com/wp-content/uploads/Perritt_Prospectus.pdf

You should review the prospectus carefully and retain it for future reference.

2024 Perritt Funds Tax Distribution Update

The Perritt MicroCap Opportunities Fund paid a long-term capital gains distribution on 10/24/24 to shareholders.

- The long-term capital gains distribution in the Perritt MicroCap Opportunities Fund (PRCGX) was $2.03329 per share and $0.27029 in The Perritt Ultra MicroCap Fund (PREOX).

- There will not be any income or short-term gains in the Perritt MicroCap Opportunities Fund or the Perritt Ultra MicroCap Fund this year.

Long-Term Capital Gains distribution:

Please visit our website at www.perrittcap.com/index.php or call 1-800-331-8936 for more information. Thank you for your investment and trust in the Perritt Team.

Alliance Entertainment Holding Corporation (AENT)

INTRO:

At Perritt Capital Management, we take focused positions in companies where we have a high conviction in their success; companies that are out of the mainstream of small cap investing. To highlight our process, we are pleased to present the newest installment in our ongoing series “Marvelous Microcaps – Big Ideas on Small Companies.” This series profiles companies that we believe have a niche in their existing markets or are launching a product that could disrupt their marketplace.

THE COMPANY:

Alliance Entertainment Holding Corporation (AENT) is a wholesaler, retailer, distributor, and e-commerce provider for the entertainment industry worldwide. The company offers vinyl records, video games, DVDs, blu-rays, toys, collectibles, compact discs, and other entertainment and consumer products. It also provides third party logistics products and services. They distribute their products through a multi-channel strategy.

The global physical media industry is a $10 billion dollar business and Alliance Entertainment is the category leading distributor. In this capacity, they serve as the gateway between brands and retailers, representing over six hundred suppliers and distributing products to over 4,000 channel partners. Brands represented include such prestigious names as Walt Disney Studios, Universal Music Group, and Sony Pictures. Channel partners include large retailers such as Walmart, Target, Best Buy, and Amazon as well as 2,500 independent music stores. In total, Alliance Entertainment ships a selection of 325,000 SKUs to over 35,000 storefronts in seventy countries.

The company is led by Executive Chairman Bruce Ogilvie Jr. and CEO Jeffery Walker. Jeff Walker founded the company in 1990 with one retail music store and subsequently started a music wholesaling business in 1995. Through this wholesaling business, they merged with Alliance Entertainment in 2013 with Jeff taking over as CEO of the combined entity and retaining the name Alliance Entertainment Holdings. Today, the company is based in Plantation, Florida with their primary operations being run out of a state-of-the-art warehouse in Shepherdsville, Kentucky.

WHY WE OWN: THE PERRITT ADVANTAGE

We view Alliance Entertainment Holdings as an attractive name for several reasons. We were originally drawn to the company after it went public via a SPAC, or Special Purpose Acquisition Company and subsequently sold off in the open market. To offer a brief synopsis, a SPAC is a publicly traded shell company listed on the stock exchange with the purpose of acquiring (or merging with) a private company without going through the initial public offering process which often carries significant and regulatory burdens. Often, the companies that go public via this method are under followed by analysts on the street and have difficulty getting traction with the investing public which puts pressure on the stock. This was the case for Alliance Entertainment, which rapidly sold off from the price where it went public at $10.00 to a low of $0.70 over the course of 2023.

Aside from the lack of attention that many SPACs get from the investing public, Alliance Entertainment also had several one-time issues hit them in 2023 that caused the company to go from making money to losing money. First off, they accumulated too much inventory in 2022 and subsequently had to sell off some of that at a discount. They were also hit with one time supply chain disruptions that caused them to experience excessive transportation costs for the year. All this culminated in them going from making $60 million in EBITDA (earnings before interest, taxes, depreciation, and amortization) in 2022 to losing $17.6million on an EBITDA basis in 2023 (the company operates on a June end fiscal year, and all numbers cited here reflect that). However, during this time and carrying into 2024, the company initiated several investments and cost savings initiatives in the business that we believe could lead to a robust turnaround of their prospects.

First off, they consolidated their distribution facilities from two to one location, shutting down their facility based in Minnesota and consolidating all activity in their facility in Kentucky. At the same time, they made a comprehensive investment in automation and operations streamlining in their facility in Kentucky that reduced shipping times and improved overall warehouse performance. Through these efforts, they were able to realize nearly $400K in annual labor savings and save $460K by retiring equipment that needed to be modernized.

These efforts began to bear fruit for the company in fiscal 2024 as they were able to recover from losing money to making $24million in EBITDA, which we view as a partial recovery from losses of 2023. They were also able to reduce inventory levels by 35%, which allowed them to free up much needed working capital, which was used to reduce indebtedness by 40%, reducing their interest expense. This has left the company in an advantageous position to execute on their inorganic growth strategy via acquisitions.

The company has made ten successful acquisitions in its history including the namesake Alliance Entertain Holdings group. This Merger & Acquisition strategy has allowed them to grow rapidly in a physical media product category that only grows in the mid-single digit percentages each year. They plan to use acquisitions to get into new, complementary product categories, acquire new e-commerce distribution channels, and roll up strategic distributors in the space.

We believe that during 2024, the company has overcome the challenges of 2023 and re-emerged stronger and more nimble heading into fiscal year 2025. Their investments in automation and process improvements will continue to bear fruit and we expect they can get EBITDA margins back to 5%, which equates to $55milliom in EBITDA at today’s run rate. It is our thesis that they will be able to build upon this success going forward and contribute positively to value creation for shareholders.

Ceragon Networks (CRNT)

INTRO:

At Perritt Capital Management, we take focused positions in companies where we have a high conviction in their success; companies that are out of the mainstream of small cap investing. To highlight our process, we are pleased to present the newest installment in our ongoing series “Marvelous Microcaps – Big Ideas on Small Companies.” This series profiles companies that we believe have a niche in their existing markets or are launching a product that could disrupt their marketplace.

THE COMPANY:

Ceragon Networks (CRNT) is a leading solutions provider of end-to-end wireless connectivity. Their customers are service providers, utilities, public safety organizations, government agencies, energy companies, and more. Customers rely on CRNT’s wireless expertise and solutions for 5G and 4G broadband wireless connectivity. Their solutions include wireless networks for a city-wide surveillance network with video, bringing high-speed internet access to rural communities, and helping water and sewage providers minimize disruptions.

WHY WE OWN: THE PERRITT ADVANTAGE

Ceragon’s revenues are mainly in India and the U.S. They won a $150m order from a Tier 1 operator in India last year and has not even started to deliver on it. CRNT recently acquired Siklu, which gave them more exposure to the private networks segment thus increasing bookings and revenue growth opportunities. There is a growing need for high-bandwidth communication networks in education, utilities, and government sectors. CRNT aims for $80m+ in bookings from private networks this year – double that of 2023.

Wireless solutions have many benefits over the alternative of fiber. With wireless there is low deployment cost, rapid deployment, has application for 4G and 5G and is excellent for rural and suburban areas where fiber would be too expensive.

Their financial performance since 2020 has been good. Revenue has grown from $263m then to $347m in 2023. They have improved from an operating loss of $4m to operating profit of $29m. 2024 goals are to achieve non-GAAP (Generally Acceptable Accounting Practices) operating margin of at least 10%, expects revenue of $395m and will trade at 0.5x Enterprise Value/Sales.

Natural Gas Services Group, Inc. (NGS)

INTRO:

At Perritt Capital Management, we take focused positions in companies where we have a high conviction in their success; companies that are out of the mainstream of small cap investing. To highlight our process, we are pleased to present the newest installment in our ongoing series “Marvelous Microcaps – Big Ideas on Small Companies.” This series profiles companies that we believe have a niche in their existing markets or are launching a product that could disrupt their marketplace.

THE COMPANY:

Natural Gas Services Group, Inc. (NGS) is a provider of natural gas compression equipment and services to the energy industry in the continental United States. They engineer and fabricate, operate, rent, and maintain natural gas compressors for oil and natural gas production and plant facilities. They also design, manufacture, and sell a line of reciprocating natural gas compressor frames, cylinders, and parts. The company also provides flare tip burners, ignition systems, and components used to combust waste gases before entering the atmosphere. They market their products to exploration and production companies that utilize compressor units for artificial lift applications.

The company offers products and services to companies operating in Colorado, Michigan, New Mexico, Ohio, Oklahoma, Pennsylvania, Texas, West Virginia, and Wyoming. They operated a fleet of 1,995 small, medium, and large horsepower units totaling 561,000 horsepower. They were founded in 1998 and are headquartered in Midland, Texas.

WHY WE OWN: THE PERRITT ADVANTAGE

We were attracted to Natural Gas Services Group due to their service-oriented approach to serving the oil and gas industry. The advent of shale oil production necessitated the use of gas compression as an integral part of enhancing the production of oil wells through gas-lift operations. Essentially, pumping gas into an oil well to increase pressure and enhance the production profile of the well. In fact, compression equipment is often required to boost a well’s production profile to economically viable levels. Natural Gas Services Group is positioned well to meet the demand in the industry for these services by leasing out compression equipment.

Oil production is growing in the U.S. and is slated to continue to grow. It has increased dramatically in the past 10 years growing from roughly 8.5 million barrels per day to 13.2 million barrels per day. Much of this increase in production has come from wells drilled with unconventional methods like fracking and horizontal drilling. Most of these new wells require some form of artificial lift to enhance their production profiles and make them economically viable. At the same time, supply chain shortages and long lead times from Original Equipment Manufacturers (OEMs) have led to a shortage of compression equipment available in the marketplace. This has created an environment where Natural Gas Services Group can sign customers up for attractive lease terms.

Natural Gas Services Group signs up customers with initial rental terms of 6-60 months with many customers continuing to rent past the initial term. This is due to high switching costs born by the producers for switching out their equipment for a competitor’s. This leads to strong recurring revenues for the company with strong, stable cashflows. In addition to the compression equipment, Natural Gas Services Group provides leading, proprietary systems to enhance recovery in the form of their System Management and Recovery Technology. This technology platform helps to limit unplanned shutdowns and increases productivity by 5-8%. They also offer technologies that help to reduce emissions from wells by burning off waste gases prior to them entering the atmosphere.

In keeping with the adage regarding the gold rush that the way to make money was by selling picks and shovels, we believe that buying a company that provides essential services to oil and gas producers is an effective way to play the oil boom. Natural Gas Services Group does just that, providing essential services in an area that is experiencing scarcity due to supply chain issues and long lead times for new equipment. We believe these macro factors coupled with the long-term nature of their contracts makes for a steady, predictable cash flowing business that makes for a great investment.

PowerFleet, Inc. (AIOT)

INTRO:

At Perritt Capital Management, we take focused positions in companies where we have a high conviction in their success; companies that are out of the mainstream of small cap investing. To highlight our process, we are pleased to present the newest installment in our ongoing series “Marvelous Microcaps – Big Ideas on Small Companies.” This series profiles companies that we believe have a niche in their existing markets or are launching a product that could disrupt their marketplace.

THE COMPANY:

PowerFleet, Inc. (formerly PWFL) provides fleet management solutions for logistics, industrial, and vehicles. They are a leader in the artificial intelligence of things software-as-a-service mobile asset industry. Appropriately, as they joined the Russell 2000, they changed their symbol to AIOT. They unify business operations and help companies save lives, time, and money. PowerFleet serves 7500 customers worldwide with 1.9 million subscribers providing them with 75% of sales as recurring revenue. They recently merged with MiXT Telematics, making them capable of driving accelerated growth with a move towards a “Rule of 40” company based on sales growth and adjusted EBITDA margin expectations.

WHY WE OWN: THE PERRITT ADVANTAGE

PowerFleet adopted the Unity platform in 2022 as the lynchpin of their growth strategy. Unity is both a device and data agnostic. It enables rapid and deep integration with IoT devices and third-party business systems to a pipeline that powers AI-driven insights to help companies drive operational efficiencies. Unity has six applications: Safety & Security, Advanced Fuel Management, Maintenance and Performance, Regulatory Management and Compliance, Visibility and Resource Management, and Sustainability.

PowerFleet’s potential market is 236 million vehicles with a $100 billion connected vehicle total addressable market. Estimated sales growth is 15-20% from revenue synergies, geographic expansion, and expanded revenue streams. They have a pathway to 70% services gross margin and can double their adjusted EBITDA margin from 15% to 30% by 2026.

Management has a private equity pedigree and a core competency of extracting cost synergies while making acquisitions. A perfect example is the MiXT acquisition. MiXT has a clean balance sheet with $28 million cash and no debt. The combined company becomes the #5 or #6 global provider of Fleet Telematics services. The Unity platform will now be available to 4,000+ MiXT customers and the installed base is ripe for upselling opportunities.

BK Technologies Corporation (BKTI)

INTRO:

At Perritt Capital Management, we take focused positions in companies where we have a high conviction in their success; companies that are out of the mainstream of small cap investing. To highlight our process, we are pleased to present the newest installment in our ongoing series “Marvelous Microcaps – Big Ideas on Small Companies.” This series profiles companies that we believe have a niche in their existing markets or are launching a product that could disrupt their marketplace.

THE COMPANY:

BK Technologies Corporation (BKTI) is a communication equipment company based in West Melbourne, Florida. The company engages in the design, manufacturing, and marketing of two-way land mobile radios that are either handheld or installed in vehicles. Its primary product line is BKR series of radios which are available in two production lines known as their 5000 and 9000 series. They also manufacture a legacy product line called their KNG series. These radios operate in what is known as P25 digital and analog modes which are used primarily in government, public safety, and military applications.

The company’s products primarily serve government markets, including emergency response, public safety, homeland security, and military customers of federal, state, and municipal agencies as well as some industrial and commercial enterprises. Their primary end markets to date have been in sales into the wildfire management space, where they have carved out a niche market. Within these markets, BK Technologies has become a trusted brand in the critical communications industry.

They also offer a product called InteropONE. InteropONE is a push-to-talk-over-cellular software-as-a-solution, or SaaS, service that provides emergency incident commanders with the ability to establish group communications networks between smartphone users directly from their smartphone. This allows disparate departments that may be coordinating on an emergency response the ability to coordinate their efforts even if their primary communications equipment is not compatible.

WHY WE OWN: THE PERRITT ADVANTAGE

We were originally drawn to BK Technologies following their successful launch of their BKR 5000 series single band radios back in June of 2020. At the time, we were excited about the prospect of them expanding beyond their wildfire vertical and the BKR series seemed like the platform for them to do so. They met with some success in these endeavors, though COVID shutdowns and the subsequent supply chain shortages did have an impact on their ability to ship radios and in some cases the necessitated redesigning of certain products. Unfortunately, while they were successful in dealing with their COVID related issues and getting the 5000 series launched, the company was still losing money.

Their initial success was followed by the launch of their BKR 9000 series multiband radios in April of 2023. These higher priced, higher margin radios feature all band capabilities that enhance their market opportunity across several market verticals expanding their total addressable market for radio sales from $200 million to $2.3 billion. It has been well received by customers from state and federal agencies. These radios were designed to operate on all P25 radio systems in any frequency band including those used in wildfire operations. The multiband capabilities allow agencies to standardize their radios on a single platform using the BKR 9000 because its capabilities can manage all their mission critical needs and it saves money versus having several platforms addressing unique needs. Most importantly, in the three full quarters on record since the 9000 series was launched, the company has been profitable.

More recently, the company announced it has partnered with a contract manufacturer named East West Manufacturing to transition all of their in-house manufacturing to East West. This transition to an asset-light model allows the company to pull a lot of working capital out of their business and cut operating expenses. They believe that transition along with the pickup in sales following the launch of their 9000 series can push their earnings power to $1.50 per share.

We are encouraged by BK Technologies’ efforts in building out their business and believe that the success they have demonstrated thus far is just an introduction to what is to come for the company. They have yet to realize most of the benefits from their transition to using a contract manufacturer, they are investing in new product development to enhance their BKR 9000 product line and they are laser focused on creating shareholder value. We believe they will be able to build upon their success thus far to achieve even greater levels of success for many quarters to come.

Sensus Healthcare, Inc. (SRTS)

INTRO:

At Perritt Capital Management, we take focused positions in companies where we have a high conviction in their success; companies that are out of the mainstream of small cap investing. To highlight our process, we are pleased to present the newest installment in our ongoing series “Marvelous Microcaps – Big Ideas on Small Companies.” This series profiles companies that we believe have a niche in their existing markets or are launching a product that could disrupt their marketplace.

THE COMPANY:

Sensus Healthcare, Inc. (SRTS) is a non-invasive treatment for non-melanoma skin cancer and keloids. Superficial Radiotherapy (SRT) provides a non-surgical treatment. SRT involves low-energy radiation to destroy cancer cells and prevent them from growing. It delivers a precise dose of radiation to an affected area while not damaging the surrounding healthy cells. There is no need for surgery or incisions. The success rate is over 95%, there is little pain and less downtime.

WHY WE OWN: THE PERRITT ADVANTAGE

SRTS’ most recent quarter was driven by a large spike in SRT-100 system sales. This resulted from educating their clientele on the clinical advantages of SRT and favorable reimbursement policies aided by an aging population. SRTS recently implemented a new recurring revenue model which will be beneficial for clients who do not want substantial capital expenditures on equipment. The company is also waiting for FDA approval of the TDI system in the first half of this year. Sensus announced a new collaboration with CureRays, a radiation oncology specialist organization providing SRTS customers with oversight and supervision and conducting clinical trials for potential new indications for SRT. The company has a $62M market cap, virtually no debt, and trades at 1.3x tangible book value.

Modular Medical, Inc. (MODD)

INTRO:

At Perritt Capital Management, we take focused positions in companies where we have a high conviction in their success; companies that are out of the mainstream of small cap investing. To highlight our process, we are pleased to present the newest installment in our ongoing series “Marvelous Microcaps – Big Ideas on Small Companies.” This series profiles companies that we believe have a niche in their existing markets or are launching a product that could disrupt their marketplace.

THE COMPANY:

Modular Medical, Inc. (MODD) is a developmental stage medical device company operating in the insulin pump space serving patients with diabetes. Modular’s efforts have been in designing and prototyping a cheaper, easy to learn and use portable insulin pump that delivers better results than the more expensive, cumbersome, and restrictive entrants that are currently in the market. The company was founded by Paul DiPerna, an industry veteran with over 30 years of experience including having founded Tandem Diabetes, where he developed one of the popular insulin pumps available in the market today.

Their product consists of a small pod that contains a pump, a cartridge that contains a battery and three days’ worth of insulin, and a connected patch that delivers the insulin to the patient. This device can be attached safely to the patient where it will deliver a consistent flow of insulin for three days, at which time the cartridge will be switched out for another. The pump itself is designed to last for 90 days. The company has eight family patents underway to help sustain their competitive advantage if they meet FDA approval and are able to go to market. They have currently submitted their final application for FDA approval and expect to enter a six-month review period shortly. After that review period, should everything go well they will be able to launch commercially at the end of this year.

WHY WE OWN: THE PERRITT ADVANTAGE

We like Modular Medical because we believe they are bringing a product to market that is sufficiently differentiated from the existing competition. The addressable market for their product in the U.S. is $3 billion dollars, with approximately 3.1 million people requiring daily insulin injections and only 20% currently using a pump. The lack of pump adoption is due to several factors including inadequate and difficult reimbursements rendering them too expensive for patients, as well as the complexity of using the devices themselves. Modular’s new insulin pump is designed to be lighter, more mobile, and easier for both the doctors to teach and patients to use. This competitive advantage over the existing competition should open up additional market opportunities for them with patients that are currently not using pumps at all. Per the company’s market research, 45% of patients would use a pump if they could, which indicates a large, untapped market. They have additional market opportunities overseas as well.

The company has a key manufacturing and design relationship with Philips-Medi size ensuring they will be able to meet demand should they be able to go to market. They also have a relationship with Glooko, an industry leader in handling uploads and downloads onto their device. We believe that these relationships are beneficial in that they will be able to go to market without building out a software platform or a manufacturing base. This should allow for faster growth, and faster returns for shareholders if and when they are able to go to market. The only internal buildout necessary will be in their sales force.

The company is targeting revenues of $688 for a three-month treatment protocol, or $2,752 annually per patient. That means that every 3,634 patients that they get to use their product equates to $10 million in revenue. If there are currently 620,000 patients using an insulin pump (20% of a patient population of 3.1 million), Modular needs to convert less than 1% to reach $10 million. They are targeting gross margins for a treatment protocol of 70% plus. As long as they effectively manage their corporate costs, they should be able to achieve profitability. It is quite easy looking at these broad strokes to envision the market potential for their product should they get FDA approval.

We believe based on the strength of their industry relationships and the deep knowledge base of the management team that it is likely they get approval, however that process represents the single biggest risk to the investment and we caution readers to treat that risk with gravity as an adverse decision could set the company back years or even drive it out of business. We compensate for this risk by keeping the position at a modest weight in the portfolio to both obtain upside exposure and limit downside risk. Modular Medical represents one of our more speculative investments, we are extremely excited about what the future may bring for them while being aware of and positioning around the risks involved.

Cantaloupe, Inc. (CTLP)

INTRO:

At Perritt Capital Management, we take focused positions in companies where we have a high conviction in their success; companies that are out of the mainstream of small cap investing. To highlight our process, we are pleased to present the newest installment in our ongoing series “Marvelous Microcaps – Big Ideas on Small Companies.” This series profiles companies that we believe have a niche in their existing markets or are launching a product that could disrupt their marketplace.

THE COMPANY:

Cantaloupe, Inc. (CTLP) is a digital payment and software service company that provides payment processing and related services to the unattended retail market. The unattended retail market includes retail locations such as vending machines, retail kiosks, amusement & arcade entertainment, and other micro-markets where transaction sizes are small but frequent. In addition to payment processing services, the company provides software and support services including logistical support through inventory and account management, dynamic scheduling for restocking, sales optimization support, and assistance in administering loyalty and reward programs.

With their recent acquisition of Cheq Lifestyle Technologies, the company has also expanded into the sports, festival, and entertainment venue space where they will also offer a comprehensive suite of services like what they do in unattended retail. This is a rapidly growing market and Cantaloupe hopes to leverage their expertise to expand their market penetration in this space. Prior to the acquisition, Cheq already had relationships with several prominent venues including the stadiums for the Washington Commanders NFL team, the Florida Panthers NHL team, the Miami Marlins MLB team, and the Philadelphia Union MLS team.

WHY WE OWN: THE PERRITT ADVANTAGE

We own Cantaloupe because we believe they offer a compelling suite of products to a niche segment of the retail market and demonstrably improve the bottom line for their customers. Based on customer feedback, the addition of a cashless option increases revenues at that machine by 25-35% and using Cantaloupe’s suite of support products can drive operating expenses down by 30-40%. We believe that this dramatic improvement in operating results at the customer level makes for a sticky relationship. Customers that depend on Cantaloupe for their service and support are unlikely to switch to another vendor if that means losing that increased operating leverage.

Their customers are not the only ones realizing better operating leverage. When we first purchased the stock in 2011, the company was generating $23 million a year in revenues and losing money on an annual basis. Today, the company is projecting revenues of $275-285 million and net income of $9-15 million for their fiscal year 2024 ending in June. This would make 2024 the company’s most profitable year on record, and we believe it is a testament to the successes they have had in growing their business and maintaining stable customer relationships.

While it is too early to tell how the addition of Cheq will change the profile of the company, we are excited by this move into an adjacent market and believe it creates an exciting new opportunity for the company to leverage their expertise in the payments space and their experience growing the business on the vending side into a market where they have ample opportunities for growth. In the last decade, Cantaloupe has managed to grow their presence in the vending space to over 1.2 million active connections and has captured much of the low hanging fruit. Having captured almost 30% of their addressable market in that segment, we believe it makes sense for the company to expand into adjacent market verticals where they are less penetrated to open additional revenue streams.

CECO Environmental Corp. (CECO)

INTRO:

At Perritt Capital Management, we take focused positions in companies where we have a high conviction in their success; companies that are out of the mainstream of small cap investing. To highlight our process, we are pleased to present the newest installment in our ongoing series “Marvelous Microcaps – Big Ideas on Small Companies.” This series profiles companies that we believe have a niche in their existing markets or are launching a product that could disrupt their marketplace.

THE COMPANY:

CECO Environmental Corp. (CECO) is a supplier of air and water quality solutions to a wide range of industrial end markets. They boast that they have an installed base of air pollution control systems that have the capability to eliminate more than 4.4 billion pounds of pollutants per year. CECO sells to rapidly growing sectors including power generation, petrochemical, industrial process, water and wastewater treatment and construction. Management raised its FY23 outlook three times since its first forecast in November 2022. CECO has focused on diversifying away from cyclical industries and has made numerous acquisitions. They expect at least four of the acquisitions to double in size over the first 18 to 24 months under CECO.

WHY WE OWN: THE PERRITT ADVANTAGE

EBITDA margins are expected to rise in 2024 driven by pricing and leverage of gross profit dollars. Management has once again lifted guidance and introduced 2024 targets, underscoring their confidence in the company’s position. Their addressable pipeline has doubled to nearly $3.0B from $1.5B mainly due to reshoring of manufacturing, energy transition and water solutions. They are diverse enough now that if an end market slows for a particular solution, sales can shift to a different area where growth is improving or there is a better opportunity. Organic growth is anticipated to be 10% in 2024 and this may be conservative. CECO continues to seek accretive acquisitions to boost their growth as well.

Decisionpoint Systems, Inc (DPSI)

INTRO:

At Perritt Capital Management, we take focused positions in companies where we have a high conviction in their success; companies that are out of the mainstream of small cap investing. To highlight our process, we are pleased to present the newest installment in our ongoing series “Marvelous Microcaps – Big Ideas on Small Companies.” This series profiles companies that we believe have a niche in their existing markets or are launching a product that could disrupt their marketplace.

THE COMPANY:

Decisionpoint Systems, Inc. (DPSI) is a provider of enterprise level technology solutions primarily to the logistics, distribution & warehousing industries. The company’s core focus is offering mobility solutions for customer needs in moving & tracking both products and assets. They offer hardware solutions including full mobile computing solutions, data capture equipment, barcode and RFID scanners along with a full suite of service and support functions to engage customers and meet their needs throughout product life cycles. They offer asset tracking applications for customers to monitor their assets, inventory control applications for warehousing and distribution and reverse lifecycle/end of life product disposal support. Their emphasis on service as a key component of their business plan. By engaging with customers as their ongoing support specialists and having their software installed in system critical functions within their customer’s operations, Decisionpoint is able to earn higher margins on revenues throughout the lifecycle for their products. These sticky relationships also help them retain customers due to the high level of integration they strive for with their customer relationships.

Decisionpoint is led by CEO Steve Smith, who joined the firm in 2018 when the company was generating $35 million a year in revenue and was modestly profitable with EBITDA of $1.2 million. Steve and his team have since grown the company by almost 4x in revenue and will exit 2023 with revenues of around $112 million. Profitability has grown even more, with project EBITDA to be around $9.1 mil for 2023, an increase of 7.5x from when Steve joined the company.

Decisionpoint is a growth stage company and as such is acquisitive. Under their current management regime, the company has completed three acquisitions with the most recent one being in April of 2023. These acquisitions have helped build out the product and service offerings that Decisionpoint brings to their customers, and it is expected that these types of transactions will continue at the pace of 1-2 a year depending on the size.

WHY WE OWN: THE PERRITT ADVANTAGE

We first found Decisionpoint through our internal screening process in the fall of 2021 and were interested in their growth profile. While their revenue growth was impressive over the course of 2018-2020, where they grew revenues by 80% from $35mil to $63.3, even more impressive was their improvement in EBITDA, which quadrupled to $4.9mil from $1.1mil during that same time period. We believed that this demonstrated significant leverage in their business model. At this time, the stock was not well known by the investing public and was trading at a solid base of around $4.00 per share without much reaction to their recent results. To emphasize the unknown nature of the company, we were one of the first institutional investors to reach out to the company. We spoke with management and they confirmed our thesis that there was continued leverage to be unlocked in their business model and began to take a position.

Since then, the company has met most of our expectations. Revenue has grown to over $100 mil with the company recently guiding for $111-113 mil in revenue for 2023 and EBITDA of $8.9-9.2mil. They have completed a successful acquisition and are using their cashflow to pay down the related debt while making necessary investments in their own business. We believe that much of the leverage is obscured by their continued spend in the business and will materialize over the next couple of years as they continue to grow the topline. In their last quarterly earnings report from Q3 of 2023, they reported that software and service revenue was a record 45% of total revenue. This revenue comes with higher margins and we contend that this is a prelude to higher bottom line margin expansion in the future relative to top line.

We believe that Decisionpoint is selling the necessary tools and support services to an area of the economy that is experiencing a secular growth trend in e-commerce as it relates to distribution and logistics. Their ongoing investment in their business both internally and through acquisitions should allow for continued topline growth while their high level of integration with their customers and ongoing service commitments should help retain current business and enable the company to capture revenue from the full customer lifecycle.

The Lovesac Company (LOVE)

INTRO:

At Perritt Capital Management, we take focused positions in companies where we have a high conviction in their success; companies that are out of the mainstream of small cap investing. To highlight our process, we are pleased to present the newest installment in our ongoing series “Marvelous Microcaps – Big Ideas on Small Companies.” This series profiles companies that we believe have a niche in their existing markets or are launching a product that could disrupt their marketplace.

THE COMPANY:

The Lovesac Company (LOVE) designs, manufactures, and sells furniture. Lovesac’s tagline is “We intend to become one of the biggest, the most innovative and the most beloved furniture brands in the world.” LOVE designed-for-life philosophy is to make well made, adaptable, aesthetically pleasing, and functional furniture. They are technologically driven with its StealthTech brand which embeds speakers and sound properties allowing sound to pass through the fabric and upholstery. The company started with Sacs, or oversized beanbags. They then progressed to Sactionals which is a platform, not simply a product. The patented modular system makes it easy to assemble and change over time and incorporates washable covers, drink holders, power hubs, and various accessories designed for comfort. They recently launched the “Angled Side” to add to both aesthetics and comfort. LOVE’s products are sold in their own stores, online, Best-Buy shop-in locations as well as a Costco partnership.

WHY WE OWN: THE PERRITT ADVANTAGE

WHY WE OWN: THE PERRITT ADVANTAGE

The furniture sector has been hit by recession worries, but LOVE continues to take market share, increase revenue, and gross margins. Their most recent quarter showed revenue up 4%, showroom sales up 6%, internet sales up 16% and gross margins increasing from 53% to 60%. They have $55 million in cash and no debt. There is a bit of an overhang in the stock regarding an accounting issue. It was found that they incorrectly recorded shipping expenses. The company plans to fix their internal controls and has hired a new CFO. This is an issue that should be resolved after restating the financials which have been completed.

LOVE is a company intent on being a disruptive force in the furniture sector. They are taking market share and delivering impressive results while their competitors struggle with stagnant or negative revenue growth.

VirTra, Inc. (VTSI)

INTRO:

At Perritt Capital Management, we take focused positions in companies where we have a high conviction in their success; companies that are out of the mainstream of small cap investing. To highlight our process, we are pleased to present the newest installment in our ongoing series “Marvelous Microcaps – Big Ideas on Small Companies.” This series profiles companies that we believe have a niche in their existing markets or are launching a product that could disrupt their marketplace.

THE COMPANY:

VirTra, Inc. (VTSI) is a global provider of firearms and use of force simulators for the law enforcement, military, educational, and commercial markets. In this capacity, the company assembles, provides software, and manufactures some components of simulators, ranging from single screen devices to full, room sized multi-screen 300-degree systems. Supporting these systems is a broad offering of software offerings for training programs and support tools for use with their systems. The training software consists of programs in firearms both their use and accuracy as well as scenario training, including use of force simulations that allow interaction with both firearms and less-than-lethal devices such as TASER©s. They offer a library of off-the-shelf training solutions as well as customizable programs unique to their client’s needs. Their support tools include simulated recoil kits and a patented return fire device that can be used to apply real-world stress on trainees during use. This eco-system is protected by several existing and pending patents.

The company has recently experienced a management transition with a new CEO, John Givens, taking over the role earlier in 2023 after having shared the role for a year with the previous CEO Bob Ferriss, who took the position of Executive Chairman of the Board as part of the transition. The presence of both John and Bob at the company is important to note as Bob’s industry experience is concentrated in the law-enforcement markets while John has experience in the military markets, allowing them each to focus on business development within their respective verticals. Prior to joining VirTra, John Givens founded, led, and eventually sold a firm called Bohemia Interactive Simulations, Inc. to BAE Systems plc.

WHY WE OWN: THE PERRITT ADVANTAGE

WHY WE OWN: THE PERRITT ADVANTAGE

We first purchased VirTra in early 2021, believing that their product offerings around use of force training software served a critical need in the marketplace, which coupled with the valuations of the company at the time, made for an interesting investment opportunity. Our primary thesis is that the continued focus on the use of force by police should lead to an increased and continued focus on training and funding by federal, state, and local programs centered around law enforcement. VirTra is well positioned to benefit from this funding. They offer a depth in training offerings that is second to none in the industry and several standardized system set-ups that make VR training accessible to law enforcement departments that may not be able to afford a large-scale customized system.

The law enforcement markets have been the historical focus for the company, and this is where they have the existing base to grow revenues the quickest. They continue to invest in product Research and Development (R&D) and training program development, including a new generation of programs using a type of video capture technology that produces superior graphics relative to a computer simulation. We believe this continued investment in their product, superior depth and quality in training offerings, and an existing market presence that gives them credibility with new customers leave them well positioned to increase their market share.

The secondary thesis behind the investment is that VirTra can penetrate and grow their business in the military markets. The company has historically had limited sales into the defense markets, primarily to those segments responsible for law enforcement duties within military establishments. With the appointment of John Givens as CEO as his background in selling into the defense space, the board has made a clear statement to the markets that this is the next growth vertical for the company. He brings an established network through which the company can cultivate connections and sales opportunities within the vertical. While this is still an early-stage opportunity for the company, we are encouraged that they have appointed the right team to execute.

We are excited for what is to come with VirTra. It is our belief that they can continue to grow their base of business in the law enforcement space and use that success to support their sales initiatives in the defense space. These efforts will be supported by their continued investment in R&D centered around better training programs and methods for use of force programs, as well as emerging VR platforms that may provide better experiences for end users. We look forward to future developments with the company and are happy to introduce them to our shareholders!

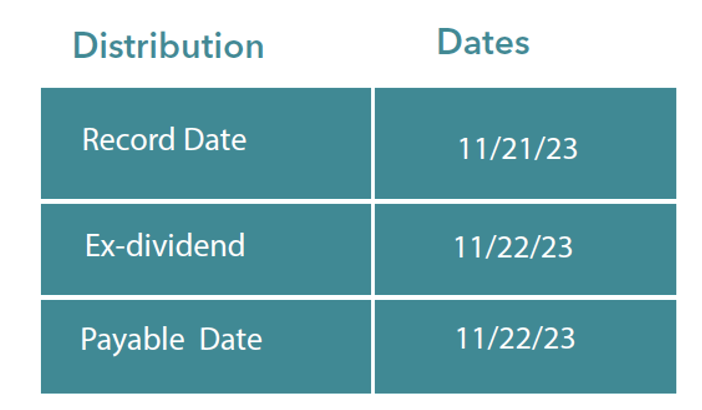

2023 Perritt Funds Tax Distribution Update

The Perritt MicroCap Opportunities Fund paid a long-term capital gains distribution on 11/22/23 to shareholders.

-

The long-term capital gains distribution in the Perritt MicroCap Opportunities Fund (PRCGX) was $1.52985 per share and $0.29435 in the Perritt Ultra MicroCap Fund (PREOX).

-

Any income or short-term gains in our Funds will be paid on 12/22/23 to shareholders of record on 12/21/23. However, the Perritt Ultra MicroCap Fund is not expected to have a short-term capital gain or income distribution, but the Perritt MicroCap Fund will pay an income distribution of about 1%.

Distribution figures and distribution dates are estimates only and are subject to change. Actual distributions may be substantially different (higher or lower) or may not be distributed at all.

Actual distributions on a dollar per share basis will be available on or after 11/22/2023.

Please visit our website at www.perrittcap.com/index.php or call 1-800-331-8936 for more information. Thank you for your investment and trust in the Perritt Team.

Click here for research and insights regarding small company investing.

Click here for a prospectus.

Usio, Inc. (USIO)

INTRO:

At Perritt Capital Management, we take focused positions in companies where we have a high conviction in their success; companies that are out of the mainstream of small cap investing. To highlight our process, we are pleased to present the newest installment in our ongoing series “Marvelous Microcaps – Big Ideas on Small Companies.” This series profiles companies that we believe have a niche in their existing markets or are launching a product that could disrupt their marketplace.

THE COMPANY:

Usio, Inc. (USIO) is an electronic payments processor and FinTech company with a full stack of proprietary and integrated cloud-based payment and financial solutions for merchants, banks, governments, service bureaus, and credit card issuers. They operate in four divisions: ACH payments, credit card processing/payment facilitation, pre-paid card services, and output solutions.

Their ACH (Automated Clearing House) business accounts for 19% of their revenues as of the last quarter. The company had previously been the ACH processor for the failed cryptocurrency broker Voyageur Digital, which saw revenues from that segment jump significantly during the boom in interest in the currency only to disappear entirely when Voyageur went bankrupt in June of 2022. This sudden loss of their largest customer led to a period of readjustment from the company as the ACH segment experienced double digit percentage declines in revenue for the next few quarters. They recently eclipsed the one-year anniversary of this loss, and we believe year-over-year comps should be sustainably positive going forward.

Credit card processing recently accounted for 33.4% of their revenues. Usio’s processing services are used by customers through third party relationships with vendors that sell payment systems. Usio works to sign up these vendors, targeting those with strong customer relationships and long-term contracts. For example, they recently signed up a vendor that provides credit card payment systems to various toll roads across several governmental entities.

Prepaid cards recently accounted for 24.5% of revenues. Prepaid’s share of revenues was higher than usual during the previous quarter, as they receive a portion of unused card balances that expire as the related stimulus programs end. Due to this timing, some of this bump in revenue is temporary, however, their success in running these programs has helped Usio to sign up additional government programs and they are establishing themselves as one of the go-to providers of pre-paid cards for guaranteed income programs. They also are managing the prepaid, reloadable cards for the new iteration of MoviePass which is just getting off the ground. As part of this program, Usio will earn a processing fee of 4-8% for every transaction that membership card is used for.

Output solutions accounted for 22.8% of their revenues. They manage print and mailing services for various government entities both directly and through third party vendors. Their largest relationship is with Los Angeles County, CA where they manage all check processing services for fees, fines, and overpayments. During the last quarter’s report, they highlighted that they had processed over 9,000 checks in one day for LA County, demonstrating their ability to meet the needs of their largest customers.

WHY WE OWN: THE PERRITT ADVANTAGE