Manager Commentary-Archive

Manager Commentary, 1st Quarter 2020

A GLIMMER AMONGT THE DOOM AND GLOOM

To say these are unprecedented times would be an understatement. Fear and despair are at the forefront of all our news. Rather than recap all the COVID-19 news, we thought we would take the high road and remain optimistic. We believe the best time to find investments is when everyone else is turning away. To quote one of our favorite leaders, Winston Churchill, “Never give in – never, never, never, never in nothing great or small, large or petty, never give in except to convictions of honor and good sense. Never yield to force; never yield to apparently overwhelming might of the enemy.”

Part of our optimism is due to the belief that active management appears to be coming back in favor. We believe active management will beat index-tracking funds as the global meltdown has led to a dislocation between price and value. We are seeing it with the large cap stocks, where 60% of actively managed mutual funds that buy large cap stocks beat the Russell 1000 in February. They outperformed across core, value and growth investing styles. New actively managed ETFs debuted at the end of March, allowing managers to pursue their strategies without fear of being copied.

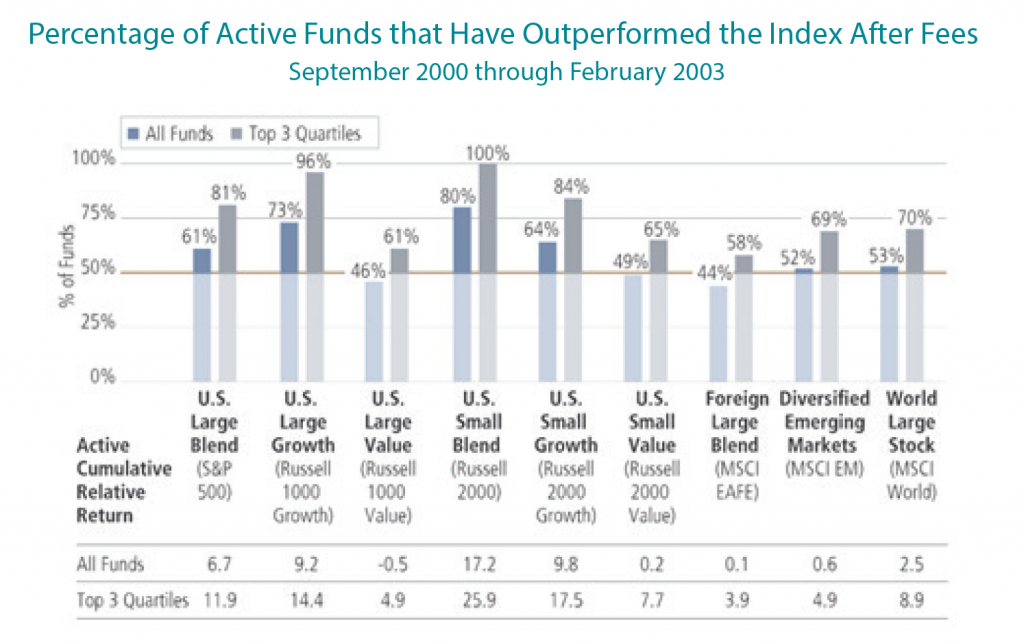

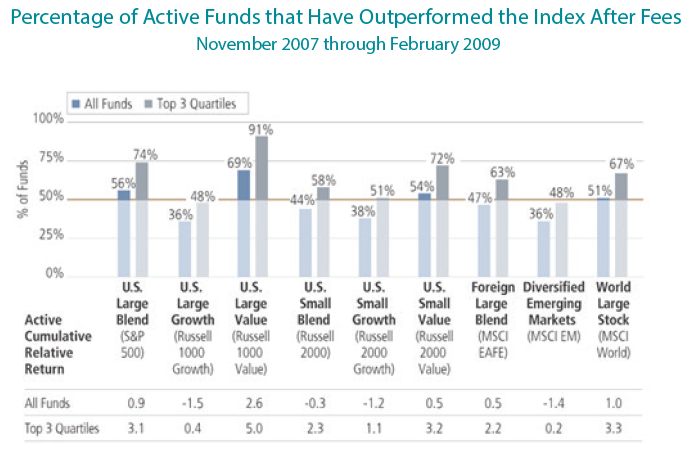

Active managers have historically outperformed their stated indices during selloffs and other periods of volatility when they identified outperformers and mitigated the downside. Passive investments have almost total exposure to the performance of a benchmark index – both when it is rising and when it is falling. The following two charts show the outperformance of active investing versus passive investing in both the Dot.Com Crash and the Global Financial Crisis.

We believe stock-picking is making a comeback. There is no substitute for evaluating a company and how it performs in extenuating circumstances. After the world calms down, there will be a new normal, and choosing the right stocks for that environment should be invaluable.

The past quarter was painful for both active and passive investors. The equity markets, particularly small stocks, had the worst quarter since the 2008 bear market and the great depression that started in 1929. As was said earlier, these are unprecedented times, mainly because the economy is shut down for the most part. While it is imperative for most us to stay home to save lives, the economic ramifications are enormous. To help the economy and most workers, the Federal Reserve and the Federal government launched the largest stimulus in our history, which we agree is justified. However, the long-term economic consequences will be very costly. As of quarter end, the Federal Reserve has not only reduced interest rates to zero but added more than $6 trillion of liquidity to the economy. The Federal government is in the process of adding more than $2 trillion to the economy and will likely add more soon. These two packages represent more than a third of the U.S. economy’s annual GDP (Gross Domestic Product). As our leaders and the POTUS (the President) prepare to evaluate and present a plan to return to work and life as we once knew, the future will likely be very different for both individuals and businesses. Because of those differences in the future, we have a different sense of optimism for active management and small stocks. We expect many differences in the years ahead. Here are a few that we think will benefit small stocks.

As investors in small companies, we have always been aware of the challenges of raising capital. Capital has been available for small companies, but we would argue the cost has been egregious for most in the past decade or so. A decent part of the capital the Federal Reserve and the Federal government are putting into the economy are low cost loans. A large part of these loans will be just enough for some companies to survive. However, there may be several small companies where these loans may help them thrive in the future. Another change we see is less stock buyback programs. It seems clear to us that future stock buyback programs may be frowned upon. While buybacks can be a useful tool for capital, it is hard to argue that they do not help economic growth or job growth. If the economy and stock market were so strong in the past ten years, why did our economy not grow much above 2% annually? We are in the camp that the past tax cuts mostly benefitted larger companies and those cuts were largely used for stock buybacks. The bottom line is that we believe capital will be used to grow the economy and create jobs, and less for stock buybacks.

There are other benefits for smaller companies, but we believe the biggest change will be in the change of attitude. Small companies employ the majority of our workforce. The number of people applying for and collecting unemployment is skyrocketing every week. Most unemployed worked for small companies. We expect, as a nation, we will encourage our leaders to help smaller companies and their workers. We expect future policies that will benefit smaller companies and not just large companies as we saw in the past. In the meantime, there will likely be more challenges for investors. Below are some updates on our micro-cap portfolios that make us believe these companies will survive and likely thrive in the future.

In the past few weeks, we have had discussions with management from all our portfolio companies. A small group of them have issued updates on their businesses and, for the most part, withdrew any guidance for 2020 results. It is likely that the rest of our companies and most public companies will withdraw 2020 guidance soon. It will be interesting to see how the markets react to these announcements, but we remain optimistic that investors will focus the potential results of 2021 and beyond. Our recent conversations with management were about not only long-term prospects, but the near-term challenges as well, particularly whether they can withstand an extended shutdown of the economy. We are happy to report that most are very confident that they will survive and thrive. While there were about a half dozen that still concerned us, those management teams assured us they will have the resources to survive.

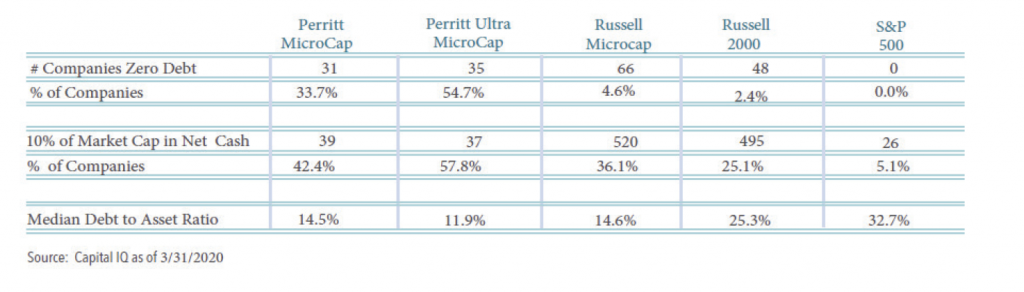

Below is a table that gives us confidence these companies will survive this shutdown and can thrive in the future. As you can see, on average, companies in our portfolios are less leveraged than companies in the Russell Microcap, Russell 2000 and the S&P 500 Indexes. We also have more companies with no debt on the balance sheet than these indexes. Between our two microcap strategies, we have a dozen that trade at or near net nets. This means that the company’s market capitalization is less than the company’s current assets less all liabilities. A great deal of these current assets are cash. Lastly, nearly a quarter of our companies paid quarterly cash dividends and all but two have dividend yields above the 10-year government yield. Thank you for reading our commentary. We hope you and your family are safe and healthy. While the last quarter and even the past few years has been challenging for micro-cap investors, we continue to have a glimmer of hope for micro-cap companies.