Manager Commentary-Archive

Manager Commentary, 2nd Quarter 2012

Opportunity Now: Reasons For Small Company Optimism

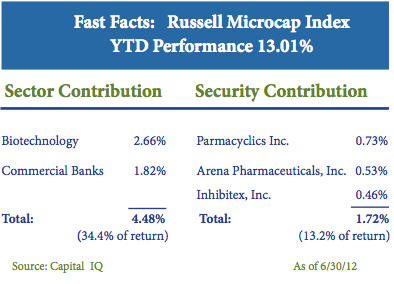

Our clients understand that micro-cap equity is an asset class where active managers can provide great value. The lack of traditional Wall Street Analyst coverage leads to price inefficiencies and potential trading advantages that don’t always exist in the more closely-followed sectors. Yet as of the end of June, from what we have seen, active management in the micro-cap space appears to have lagged. As seen, micro-cap benchmark returns have been concentrated in a small number of Biotech and Regional Banking firms where many active managers (including ourselves) don’t observe compelling tradeoff between risk and reward.

In times like today, it is sometimes too easy to become swallowed by negative news and prevailing pessimism about the economy. Yet we consider ourselves fortunate to have the ability to meet with 3-5 management teams of small companies every week inside our offices. The perspectives we have gained from these on-the-ground entrepreneurs is often much different from what you read in the headlines. Here we pass along some of the opportunities we are uncovering during our analysis and meetings with company management. If you read closely you will find that in the Small/Micro-cap universe the facts counter many common misperceptions. ”

Micro-cap benchmark returns have been concentrated in a small number of Biotech and Regional Banking firms where many active managers (including ourselves) don’t observe a compelling trade-off between risk and reward”

High Margin Levels Unsustainable

Opportunity: Pricing Power Lets Many Small Companies Continue Margin Expansion

It seems to be a common belief that margin expansion is at its peak. However, this is not always true in the types of small, niche businesses that possess more nimble pricing power than their larger, more diversified peers. The decline of input costs related to falling commodity prices is another often overlooked part of the peak margin story. For example, John B. San Filippo & Son (JBSS) (maker of Fisher Nuts) consistently raised prices during a recent cycle where raw nut prices were steadily increasing. Roughly speaking, in a typical period where JBSS’s revenue was growing at 5%, prices were increasing by 10% while sales were down 5%. Knowing that this is a cyclical business, we were pleased when our investment thesis was proven correct and positive sales growth returned. Today, JBSS’s business is growing and nut prices are beginning to come down. Yet those higher prices the company set will be sticky, helping to potentially increase margins. Despite increasing over 100% this year, we continue to believe JBSS has upside potential; even after the substantial increase in share price JBSS is still trading below book value*.

“We applaud the many companies in our portfolio who are driving capital allocation in the right direction.”

Attribution Analysis

As discussed earlier, much of the micro-cap Index performance this year has been driven by concentrated returns in a small number of Biotech and Regional Banking firms. In our MicroCap Opportunities Fund, Healthcare (which includes Biotechnology) was the largest sector detractor from performance, contributing -1.50% to relative performance. In addition, our portfolios are currently invested with a cyclical bias in energy, technology, and industrial companies. This is wholly a result of our bottom-up analysis and our conviction that the greatest upside opportunity in micro-cap space can currently be found in cyclical companies. However, more cyclical investments have suffered due to a general flight to liquidity most of this year. Along with the aforementioned Healthcare sector, three of the top four sector detractors to performance were in fact Energy, Technology, and Industrials.

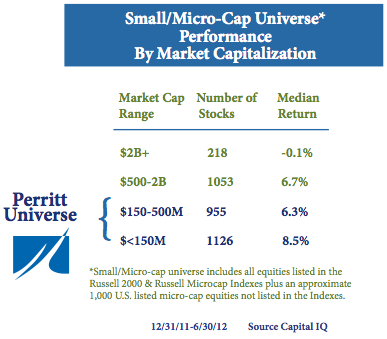

Stock selection has had a greater positive impact on the Ultra MicroCap Funds’ performance than seen in the MicroCap Opportunities Fund this year. This is not surprisingly considering we are investing in companies which are so far off the traditional radar; the current median market capitalization is approximately $50 million. One of our top performing holdings, U.S. Home Systems (USHS), provides customized kitchen and bathroom remodeling for Home Depot customers. USHS increased nearly threefold in a matter of two months on what was essentially market speculation about the recovery in U.S. housing. This type of “irrational buying” demonstrates the potential upside of investing in less liquid securities that many investors may overlook when focusing only on the risk to the downside of investing in micro-cap companies. Having experienced this type of short- term investor behavior many times before, we reduced our position by half before the stock returned to more normalized prices. USHS’s business is still growing and at today’s more modest price we believe that future earnings could equal a P/E in the mid single-digits.