Manager Commentary-Archive

Manager Commentary, 2nd Quarter 2016

THE START OF A NEW MICRO-CAP BULL MARKET?

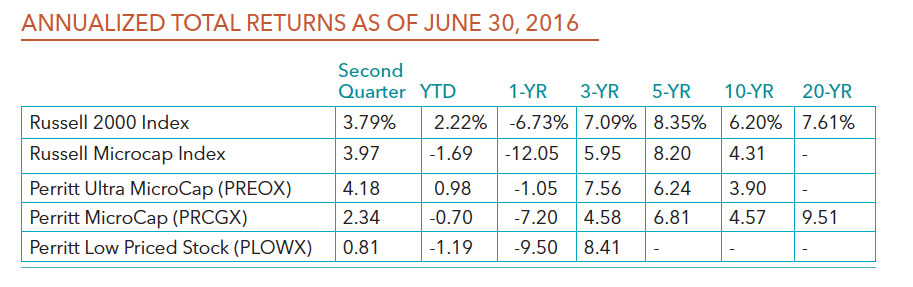

The extreme market swings within the small/micro-cap universe in the second quarter of 2016 sent investors a clear message. Volatility is here to stay in our opinion, but a new bull market for small stocks started earlier this year. As we discussed in our last quarterly commentary, small/micro-cap universe hit a bear market low on February 11, and stock prices rose dramatically in March and April. However, the poor May jobs report and the surprise Brexit news sent stocks lower quickly. To us, the real surprise was the resilience the market showed post-Brexit. Just days after the Brexit vote, small/micro-cap equities resumed their strength. When markets face big negative news as well as get hit by a big surprise, such as the Brexit news, and equities still trade higher, that is significant! The second quarter performance results are listed below, but what is not reported is the bull market performance. As of June 30, the Russell 2000 Index is up 20.78% from the February 11 low, which is a bull market to us, but the Russell Microcap Index was up 19.16% for that same period, just short of a 20% bull return. It only took one more day in the third quarter for the Russell Microcap Index to hit the official bull market definition of up more than 20%.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Click here for standardized performance. Performance data current to the most recent month end may be obtained by calling 800-331-8936. The funds impose a 2% exchange and redemption fee for shares held 90 days or less. Performance data quoted does not reflect the redemption or exchange fee. If reflected, total return would be reduced.

“We believe this is a bull market for small/micro-cap equities, and we are confident the markets will recognize the high quality companies within each of our portfolios.”

In our opinion, the obvious question now is how long and how far will the bull market take us. Unfortunately, my crystal ball does not lend itself well to those types of predictions, but I thought it would be useful to examine some of the quality investments we have made within our Funds.

Let’s start with how our Fund’s portfolios are different from the broader markets, such as the Russell 2000 Index and the Russell Microcap Index. Each of the Russell Indexes have investments of more than 25% in financial services. While our funds have a decent weight in financial services,** each of the indexes have significant exposure to banks. Our financial services weights include more niche insurance companies and asset managers. We believe our financial companies are more attractive investments. For example, one of our largest holdings that we own in all three Funds is Atlas Financial (AFH). Atlas is the largest independent provider of insurance for transportation companies, primarily taxi-cabs. The company has grown its business well in excess of 20% in the past three years, but yet trades only at 11.6x 2016 earnings.

Healthcare is another large weight within the Russell Indexes. The Russell Microcap Index has approximately 20% invested in healthcare companies. Nearly half of those healthcare companies are biotechnology companies. These biotechnology companies and many of the other healthcare companies don’t meet our strict quality measurements. As a result, our healthcare weights are well below than that of the Russell Indexes. To us, the opportunities lie in companies that have strong recurring business models and above average earnings power. We see a great deal of value in industrial and technology companies today. Each of our Funds have greater weights in these two industries than the two Russell Indexes. Some of these industrial companies are construction related, such as NCI Building (NSC) and USG Corporation (USG).

Within our Ultra MicroCap Fund, we feel there are numerous pockets of value. For example, U.S. Auto Part (PRTS) is a truly misunderstood story in our opinion. PRTS is a leader in the pure-play internet aftermarket auto part space. Investors are not giving management any credit for this pure-play and margins that are just starting to show drastic improvement. PRTS gross margins could improve from the low 20% to 30% level within the next few years. In addition, the company’s equity trades at less than half of revenue. Another example is MCFT Holdings (MCFT). MCFT designs, manufactures, and markets recreational sport boats primarily under the MasterCraft brand. Our analysis and due diligence shows that there is a great deal of pent-up demand in MCFT’s business. These are just a couple examples of some potential quality investments within the Ultra MicroCap Fund.

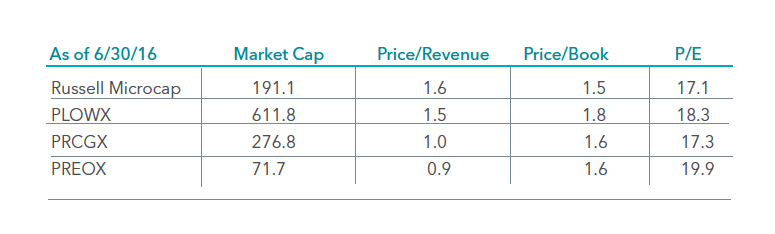

Overall valuations are very compelling in our Funds, too. The majority of the companies in the Low Priced Stock Fund are valued at a lower multiple of revenue, book value, and earnings versus that of the Russell 2000 Index.1 Our MicroCap Opportunities Fund and Ultra MicroCap Fund also have lower valuations relative the Russell Microcap Index.1 We often tell our investors that the MicroCap Opportunities Fund may offer higher quality and better valuations relative to that of the Russell Microcap Index. As an example of high quality, the average company in this fund has a return on invested capital of 12% versus only a slight positive for the average company within the Russell Microcap Index.2 Despite those attractive returns, companies in the MicroCap Opportunities trade at less than one times revenue versus 1.4 times revenue for the Russell Microcap Index. As said earlier, we believe this is a bull market for small/micro-cap equities, and we are confident the markets will recognize the high quality companies within each of our portfolios.