Manager Commentary-Archive

Manager Commentary, 1st Quarter 2013

Celebrating 25 Years

On April 11th, the Perritt MicroCap Opportunities Fund attained a 25-year track record. We are proud to be among a limited group of mutual fund managers – not to mention one of the only micro-cap managers – to have achieved such an established record of experience. We believe that we can keep improving if we make sure to always learn from our past experience. Departing from our typical commentary format, below is a look at select quotes over past three years and several outcomes which we can study to understand the strengths of our own analysis.

“I have not seen this degree of opportunities in both their range and depth over my twenty year career. Because of the damage to the confidence in our markets and in our economy, we believe that the recovery could last for many years and the rewards could be very impressive.”

—Manager Commentary, 3/31/2009

Results speak for themselves*, and we believe shareholders of the Perritt Funds have been rewarded considerably since the market bottom in March 2009. Equally impressive is the level of passion we witnessed from certain entrepreneurs and business owners who never seemed in doubt of their companies’ potential even during dire economic times. We may have learned more about human and investor psychology during this period than at any other time in our 25 years.

“We believe that the conditions facing the management teams of acquiring companies and those of companies targeted for pur-chase have created an environment for acquisition activity in the microcap universe where ‘the stars are aligned.”

—Manager Commentary, 3/31/2010

Merger & Acquisition (M&A) activity continues to be a major characteristic of micro-cap investing. Our outlook was initially accurate before M&A activity declined overall in 2011. Buy-out activity returned in 2012 due in part to anticipated changes in the tax code. Today we believe that we are in an environment where private equity firms and shareholder activists are hungry to get deals done.

“While short term periods where our investment style may be out of favor can be difficult, these periods have often provided us with the greatest opportunities”

—Manager Commentary, 6/30/2011

We added to our positions in a select group of securities during the summer of 2011 including Sanfilippo John B & Sons (JBSS), Midas (MDS), Global Cash Access (GCA) and Ruldolph Technologies (RTEC). Each of these companies were trading at very attractive valuations due partly to indiscriminate selling during the period. Our conviction was rewarded as each of the positions at least doubled since the investment.

The number one difference that we detect in the management teams between now and 2008-09 is what we describe as their ‘Cash Attitude.’ Simply put, management teams are no longer trying to survive, they are creating new ways to thrive.”

—Manager Commentary, 12/31/2010

A great example of Cash Attitude is Landec (LNDC), which used their excess cash and even new debt to make several strong accretive acquisitions. Landec, which has a legacy business of food packaging and distribution to grocery stores on the West Coast, has now partnered with food growers to build an expansive new greenhouse which produces many of the very foods the company packages. We recently visited the new Santa Monica, CA facility and were blown away by its size and scope; the site includes 64 acres of greenhouses, or 3 million sq. feet, equivalent to the size of fifty football fields. The market has loved Landec’s transactions as the stock has more than doubled since management’s announcement that they were using cash to invest in the business. You can hear more about our opinion of Landec in our interview with TheStreet.com on 2/1/13 (thestreet.com/video/11829793/bet-big-on-century-casinos landec.html – copy and paste link in your web browser to view).

“Investors who wish to participate in improvements in the U.S. economy may wish to look to small/micro-caps with more domestically-driven revenue sources as they seek to take advantage of U.S. improvements.”

—Manager Commentary, 3/31/2012

We are of the opinion there is no better way to get domestic revenue exposure than through a small, regional bank. Bank of the Internet (BOFI) is a distinct, niche company in that it provides banking and financial services online and without any brick and mortar locations. BOFI was a strong contributor to the performance both Funds, climbing 92% last year and another 29% in the first quarter of 2013. While it is true that the world is getting “flat” or more global, a significant portionof micro-cap revenue has continued to be domestically-based, which has been a benefit for investors in the current environment.

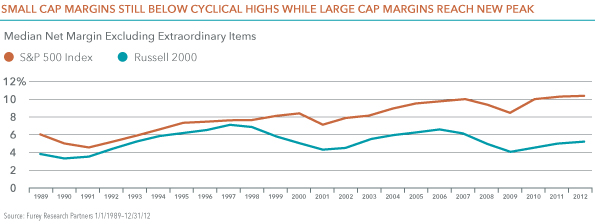

“It seems to be a common belief that margin expansion is at its peak. However, this is not always true in the types of small, niche businesses that possess more nimble pricing power than their larger, more diversified peers .”

—Manager Commentary, 6/30/2012

Corporate profits have been at record highs*, prompting many investors to wonder if decreasing margins pose an imminent risk to equity inventors. While this might be true for The S&P 500, we caution investors to realize that margin levels for small companies are nowhere near as elevated as what is seen in large cap companies, as seen in the chart on page one. Small companies are more likely to invest into growing their businesses, which has the potential to keep margins low. If a “margin-bubble” does in fact exist, we don’t see this risk among small cap companies.

Attribution Analysis

Click here for standardized fund performance.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-800-331-8936. The funds impose a 2% redemption fee for shares held less than 90 days. Performance data quoted does not reflect the redemption fee. If reflected, total return would be reduced.

MicroCap Opportunities Fund (PRCGX)

- The MicroCap Opportunities Fund gained 14.15% in the first quarter, outperforming both the Russell 2000 Index (12.39%) and the Russell MicroCap Index (12.58%)

- Stock selection contributed to all of the positive returns relative to the indexes. Stock selection added 4.97% verses the Russell 2000 Index and 6.90% versus the Russell MicroCap Index. Stock selection in six of the Fund’s eight equity sectors added to relative outperformance.

- Continuing last ear’s trends, stock selection was most pronounced in the Health Care and Financials sectors. Strong selection in these sectors more than made up for a relative underweight versus the index, which detracted from performance.

- In aggregate, investments in the Health Care sector returned 39.60% in large part due to a strong performance oftop-10 holding Addus HomeCare (ADUS), which was up 84.53% during the quarter.

- We continkue to stress that our investors monitor the high level of exposure to Financials in the Indexes. Financials now account for nearly 30% of the Russell MicroCap Index, a level that we don’t believe is sustainable over the long term.

Ultra MicroCap Fund (PREOX)

- The Ultra MicroCap Fund gained 12.16% in the first quarter, versus 12.58% for the Russell MicroCap Index.

- We always stress the difficulty of comparing this fund to a benchmark as it invests in companies far below the traditional radar, as demonstrated by its median market capitalization of just $57 Million (the lowest of all 8,130 equity Funds, according to Morningstar as of 4/18/13).

- Overall stock selection was strong, contributing 4.64% to relative performance. Stock selection by industry was mixed, as selection in four equity sectors added to relative performance while selection in four sectors detracted.

- In the sectors where we did experience dpositive stock selection, the magnitude was significant.Our selection in the Financials and Health Care industries accounted for 6.03% of relative out performeance, due to strong returns in several individual names.

- The primary reason why our positive stock selection did not translate into outperformance was a bombination of a large underweight in Financials, which continued its strong run, and poor returns in the Consumer Discretionary sector.