From the desk of...

Bear Market Internals

Michael Corbett

Michael Corbett

CEO, CIO, Portfolio Manager

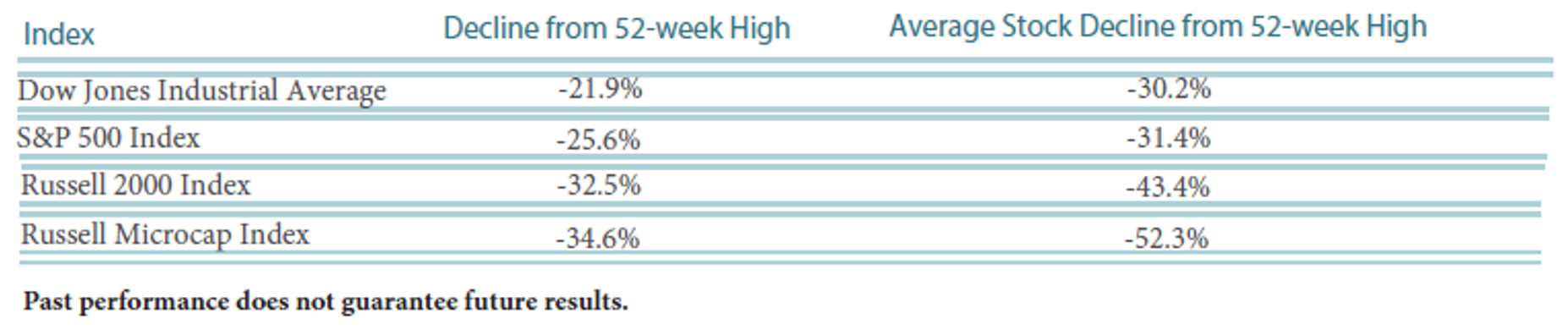

While each of the domestic indexes have clearly entered bear market territory, the average stock has experienced a far greater decline. Whether it is an individual stock or a broad index, bear markets are defined as declines of more than 20% from past their highs. As you can see in the table below, the bear market has reached each index with ranges of a 21.9% decline for the Dow Jones Industrial Average to the Russell Microcap Index decline of 34.6%. Each of these declines are as of September 30, 2022.

The average stock has experienced declines of 30.2% for Dow stocks to a whopping 52.3% for the average stock within the Russell Microcap index. The reason the declines are worse for the average stock versus the index is related to how stocks are weighted in each of these indexes. The Dow Industrial Average is weighted by a stock’s price. The other indexes are weighted by their market capitalization. For example, a stock like United Health Group (UNH) comprises more than 10% of the Dow due to its price more than $500 per share versus the average stock in the index is priced at only about $145. For the S&P 500 Index, the most heavily weighted stock is Apple (AAPL) at approximately 8% of the index due to its market capitalization of more than $2.3 trillion. Each of these stocks I mentioned have declined less than the average stock as well as less than their respective index.

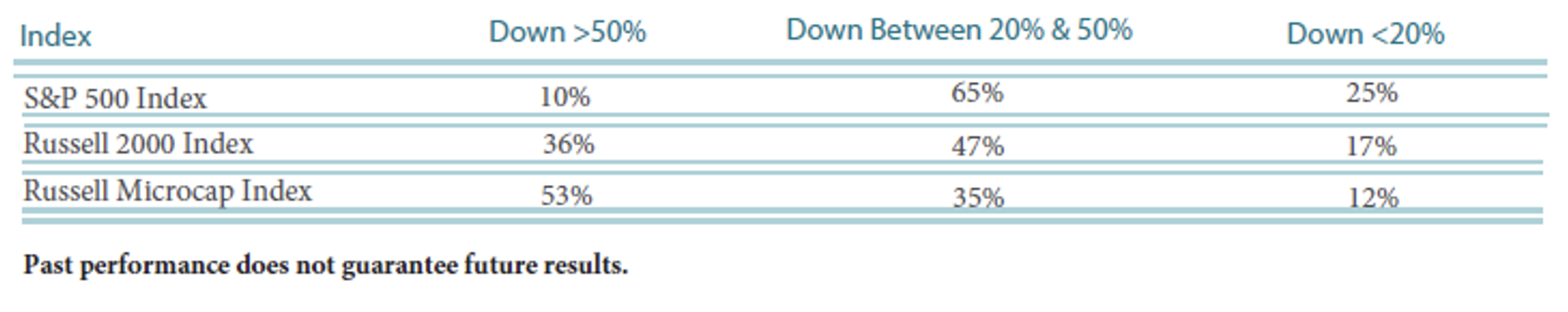

The table below shows the percentage of stocks that declined in ranges. As you can see, smaller companies have experienced greater declines in this bear market. While this is not a major surprise, we argue these declines give us confidence we are closer the end of the bear market than the beginning or the middle.

Here are a few other data points based on past bear markets. Since 1940, the average bear market during a recession lasts 13 months and declines 34%. The average bear market with no recession lasts 6 months and falls 24%. The current bear is now in its 10th month with a 25% decline. There have been eight previous times the S&P 500 has fallen 25% or more. The average returns following these declines have been 22% after one year, 37% after three, 83% after five, and 214% after ten. The Russell 2000 Index of small companies peaked in November of 2021 and is down 32.5% from its previous high. The Russell 2000 has fallen 30% or more in six previous periods, with the average 1-year, 3-year, 5-year and 10-year rebounds being 33%, 49%, 102%, and 228%.